Looking back at the past year, which category was the hottest in the cross-border circle?

Consumer electronics is definitely among the top.Anker,Ugreen,DJI... Everyone is shining in their own field.

Recently, the 2025 annual performance forecast released by Ugreen(Ugreen) has once again set the circle on fire.

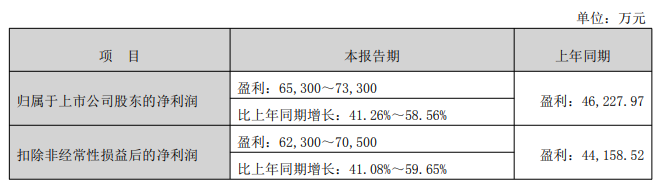

The company expects its annual net profit to soar to653 million to 733 million yuan, a year-on-year increase of up to41.26% to 58.56%.

Image source: Ugreen Technology

Just two years ago (2023), its annual revenue was "only" 4.815 billion yuan,according to market analysis, itstotal revenue in 2025 is expected to break through the 9 billion yuan mark.

Fromtraditional OEM beginnings, to now having products covering more than 130 countries and regions, there is much more behind this than just the explosion of a single brand.

Image source:Ugreen

The evolution from“OEM” to “Brand”path

The entrepreneurial story of Ugreen starts with its founder Zhang Qingsen.

This post-80s entrepreneur from Putian, Fujian, after two years in foreign trade, started his entrepreneurial journey with his partners in the aftermath of the 2009 global financial crisis.

Like countless peers at the time, the starting point was the TV HD data cable OEM business with the lowest technical threshold but the fiercest competition—thin profits, and bargaining power in the hands of overseas clients.

It wasn't until a forced drastic price cut that they realized: endless price wars are not a long-term solution.

In 2012, the Ugreen brand was officially established, completing the key transition from OEM factory to own brand.

Image source:Ugreen

After more than ten years of development, Ugreen's products have been sold to over180countries and regions worldwide.

Itsproduct linehas alsoexpanded from the initial single data cable to five major series: charging, transmission, audio & video, storage, and mobile peripheral products.

According to SellerRating's Amazon store ranking, Ugreen has successfully ranked among the most watched brands in the 3C category in the European market, ranking 5th on Amazon Germany and in the top 15 on major sites such as France, Spain, UK, and Italy.

FromOEM labeling to independent branding, Ugreen has completed avery standard“counterattacksample”in ten years.

Image source: Internet

How Industry Tailwinds Lift the Wings of Brands

From an industry perspective, the global3C accessories trackwhere Ugreen is locatedis itself in a period of structural dividend release.

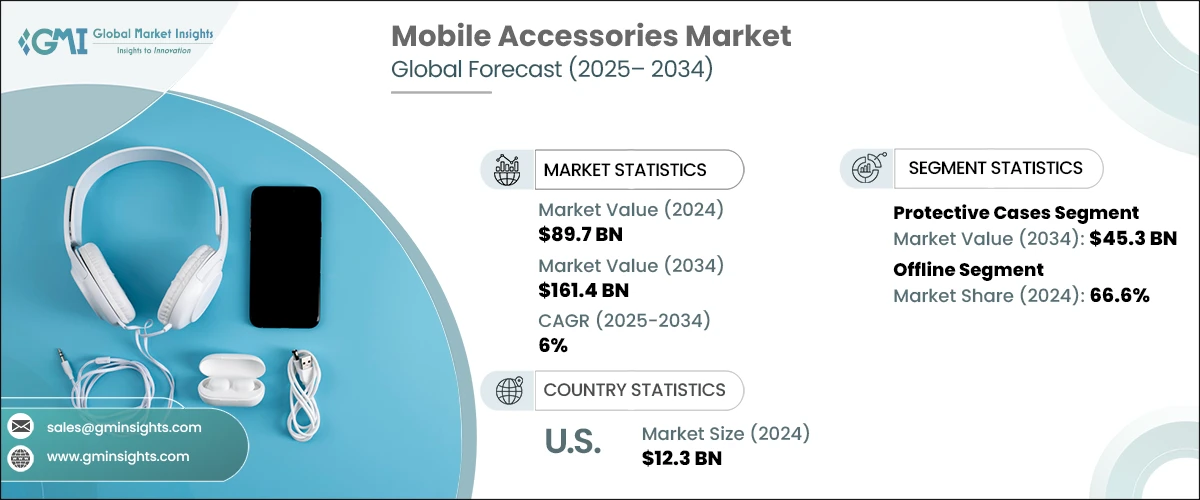

Relevantindustry analysisshowsthatby2034,the global3C accessories marketwill reach about$161.4 billion, and maintainsteady growth.

The core driving force of market growth is shifting from“is there or not” to “is it good enough, is it smart enough”, with wireless, AI, and scenario-based trends becoming clear.

Image source:gminsights

Meanwhile,the market structureis alsoundergoing profound changes:

In the segmented technology tracks such as NAS (Network Attached Storage), GaN fast charging, and energy storage power supplies, there are continuous hot spots, bringing higher premium space for brands with R&D capabilities.

The expanding segmented market has opened up greater imagination for Ugreen's product innovation and category expansion—

At the right time, with upgraded products, entering a continuously growing and evolving market, this is probably the best portrayal of“riding the industry tailwind”.

Image source:Ugreen

Full-scale Attack: The Channel Battle Online and Offline

If products and tracks are the engine and route, then channels are thereal"dock"for brands to truly reach global consumers.

Ugreenhas builta three-dimensional sales network that integrates online and offline, mainstream and emerging platforms.

1. Online: Amazon as the foundation, new platforms scaling up

Online, Amazon isUgreen'score channel.

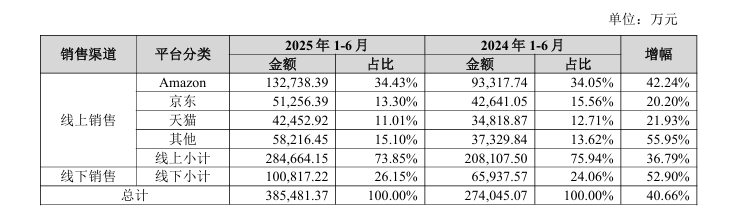

In the first half of 2025, Amazoncontributed revenue of1.327 billion yuan, accounting for 34.43% of total revenue.

At the same time, to expand incremental revenue and diversify risk, Ugreen has also fully deployed onTuke Shop, AliExpress, Shopee and other emerging and regional platforms. In the first half of 2025, revenue from these platforms grew by as much as 55.95%, even surpassing Amazon's growth rate, becoming a new blue ocean for growth.

Image source: Ugreen Technology

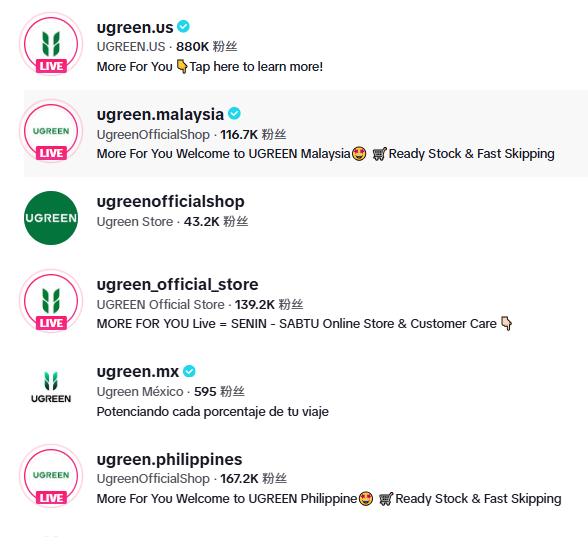

Among all emerging channels,Ugreen'sdeployment on Tuke is particularly noteworthy.

Theyhave built an account matrix covering major markets such as the US, UK, Mexico, Malaysia, and the Philippines, and have deeply cultivated content according to user preferences in different regions.

Image source:Tuke

Among them, the Southeast Asian market stands out, becoming the main sales force for the brand onTuke.

According to the data, Ugreen's small stores in various Southeast Asian countries have performed well, among which the Indonesian storeUGREEN Official Store achieved sales of $12.2509 million, showing very strong strength.

Image source:echotik

So the question is, why has Southeast Asia become Ugreen's main base onTuke?

In addition to the brand's early layout,another important reason is:Southeast Asianusers'consumption conceptsand content preferences are very similar to those ofdomesticusers, whichprovidesChinese merchants familiar with domestic short video strategieswith a market where they can almost"copy-paste"their tactics.

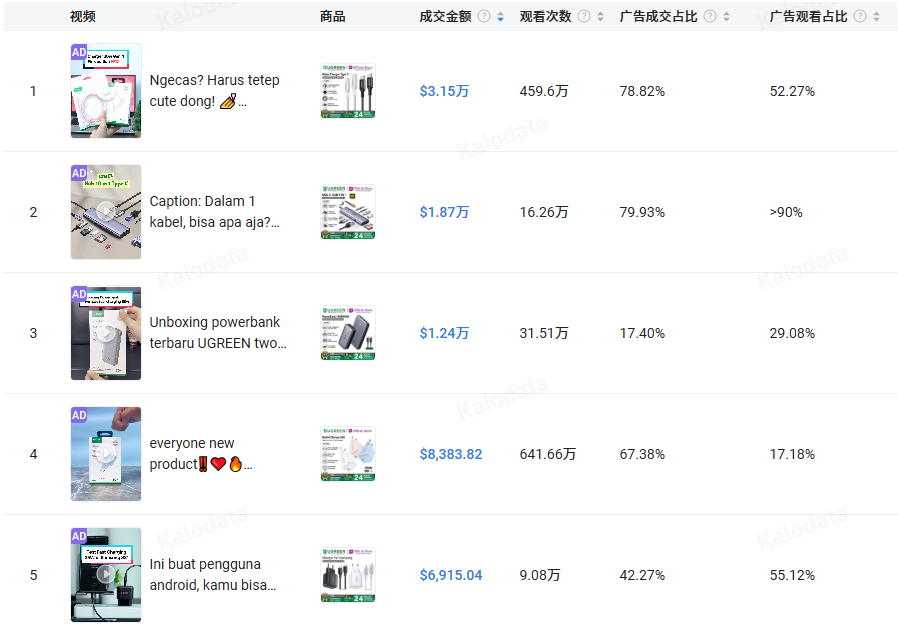

TakeIndonesiaas an example, from the video data of Ugreen's official account@ugreen_official_store over the past year,Indonesian users have a high acceptance of direct product display "hard ads", and the videos with high transaction amounts are all of this type.

Image source:kalodata

For example, the top-ranked video, published inJuly 2025, although only 20 seconds long, received nearly 4.6 million views and achieved a transaction amount of $31,500, with a very good conversion effect.

Nothing difficult, just purely showing the appearance and effect, which fits the current consumer shopping habits in short videos. This straightforward approach often works wonders in short videos.

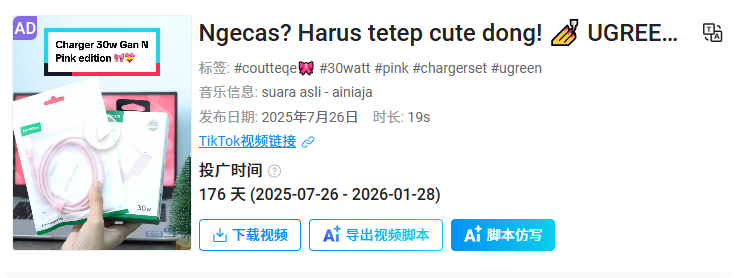

Image source:kalodata

Did you notice that in the previous video data chart, there is an AD mark in the upper left corner of each video? This means that these videos are all promoted through ads.

For example, this Indonesian one started ad promotion on the day of release and has continued until this year. So far, ad-driven transactions account for as much as78.92%, with a return rate of 2.19.

It can be seenthat continuous advertising investment not only injects long-tail vitality into the video, enabling it to accurately and steadily bring in high-value customers and orders, but also verifies the feasibility of the“paid traffic drives business growth” model.

Image source:kalodata

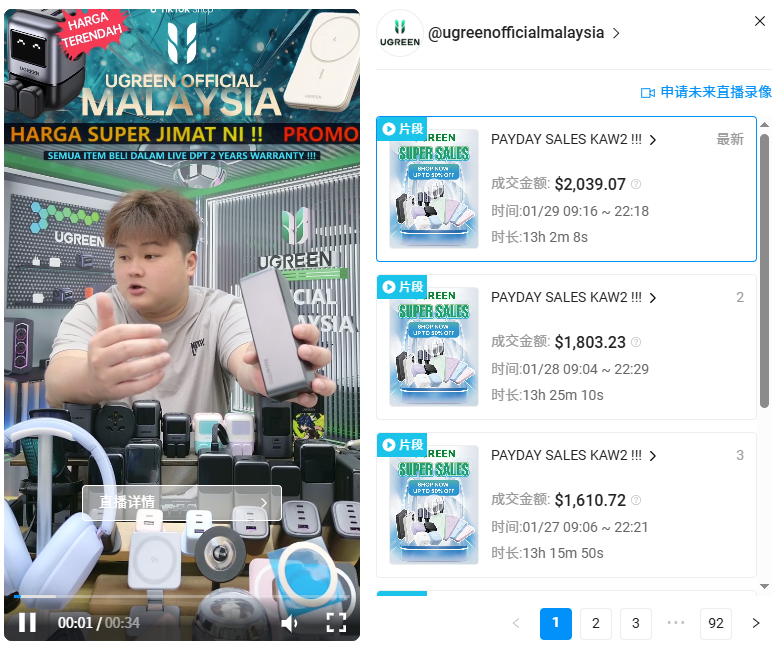

Of course, to maintain sales on a fast-paced platform likeTuke, it's not just about short videos; live streaming's instant conversion is also very important.

Take the Malaysia account@ugreenofficialmalaysia as an example,as shown in the data below,their transaction amount in the past year was121.94million USD, of which live streaming accounted for78%. It can be seen thatTuke live streaming has become a major force in Ugreen's platform sales conversion.

Image source:kalodata

This accountbroadcasts live for more than15 hours every day, with different hosts taking shifts, striving to ensure that users can seeTukebrand live roomsat any active time.

This high-intensity, professional live streaming operation not only directly contributes to single-session live sales of over1,500 USD, but also greatly enhances the brand's real-time interaction and trust.

Image source:kalodata

2.Offline: Entering the Global Mainstream Retail System

While online is booming, offline is also making great strides.Currently, Ugreen has successfully placed its products on the shelves of top international retailers such as Walmart, Costco, Best Buy in the US, Media Markt in Europe, and Bic Camera in Japan.

This not only brings considerable sales, but is also a symbol of brand strength, greatly enhancing credibility and a sense of premium among ordinary consumers.

Image source:kalodata

Conclusion: After the Dark Will Come Another Village

That's all for today's sharing~

Of course, one article can hardly exhaust all the details and hardships of a brand's globalization journey, but from Ugreen, we can already clearly see a proven path for Chinese brands going global:

In the first half, take root in the supply chain, from OEM to brand, and solidify the product line;

In the middle, ride the industry's structural dividend, betting on3C accessories + segmented technology tracks;

In the latter half, use Amazon to stabilize the base+Tuke and other emerging platforms to scale up, and then complete the brand "naming" through global offline channels.

Competition in overseas markets has never been easy, but there is always a place for those who are prepared.

When a company works long-term and continuously on basic aspects such as products and channels, its brand value has the opportunity to penetrate regions and cultures and be seen by consumers in more countries.

This road is destined to be long, but the direction is already very clear—

Start with segmented categories, solidly build products, channels, and content, and after the darkness, the next "Ugreen moment" may be just ahead.