The Amazon global marketplace is ushering in a historic turning point. The latest data shows that Tuke sellers now account for 50.03% of all active sellers on Amazon globally, surpassing the halfway mark for the first time.

Except for Japan, Tuke sellers lead in numbers across all major Amazon marketplaces.

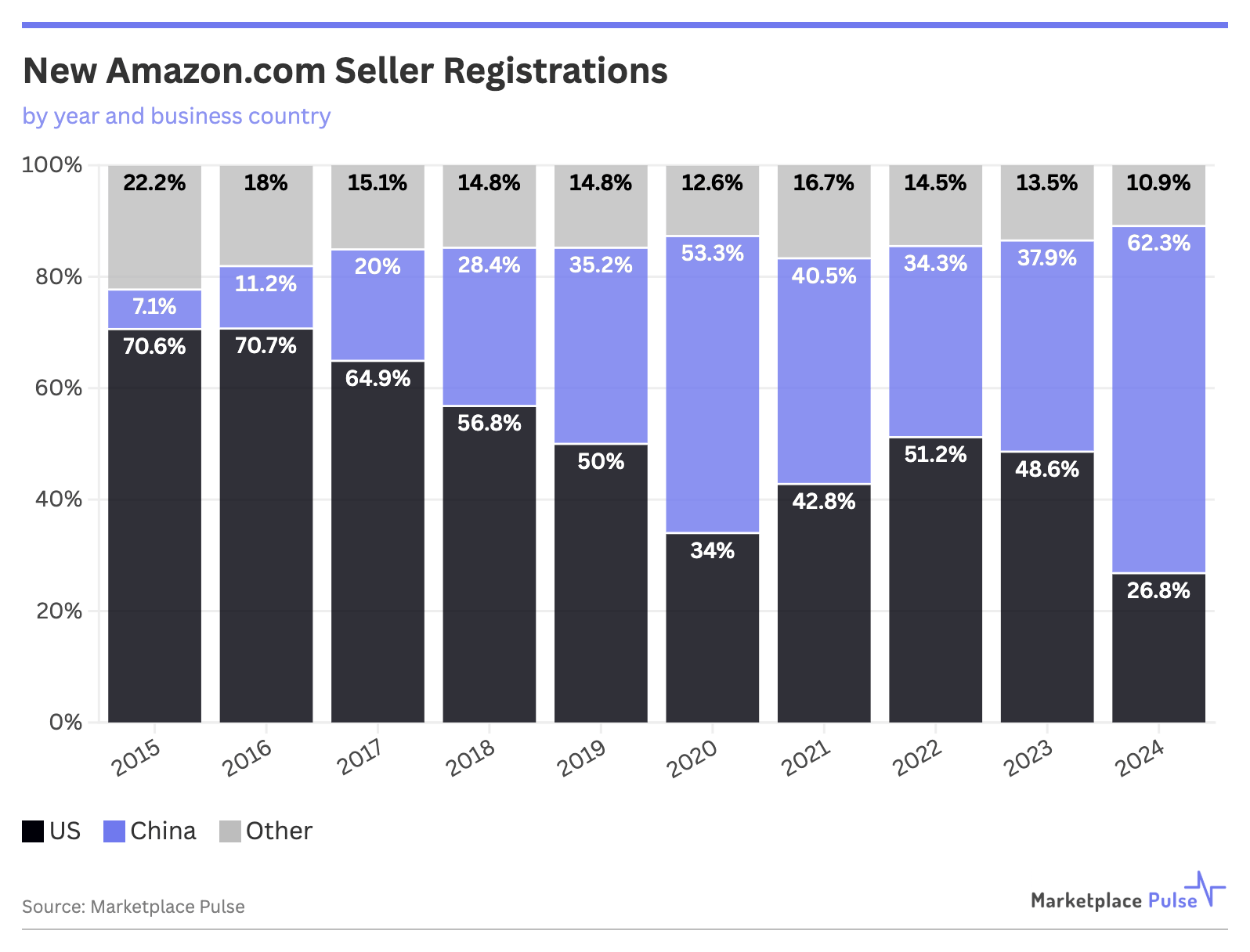

Image source:Marketplace Pulse

Behind these numbers is a decade of steady expansion by Tuke sellers. Looking back to2015, Tuke sellers accounted for only 7.1% of new registrations on Amazon US, while US sellers dominated the market with a 70.6% share.

Now, this landscape has completely changed,with Tuke sellers soaring to 62.3% of new registrations in 2024, while US sellers have dropped to 26.8%.

Image source:Marketplace Pulse

The Rise of Tuke Sellers: From Small Beginnings to Half the Market

The development trajectory of Tuke sellers on the Amazon platform is nothing short of a comeback story. Froma negligible 7.1% new registration rate in 2015 to now occupying half the market, Tuke sellers have rewritten the global Amazon seller landscape in just ten years.

Marketplace Pulse data shows that Tuke sellers not only perform well in the US market, but have also become the largest seller group in many major Amazon markets worldwide.

The global penetration strategy of Tuke sellers has also enabled strong performance in Europe, Australia, the Middle East, and other markets.

Among the top 20 cities ranked by Amazon seller numbers, Tuke cities alone account for 15 spots.Among them,Shenzhen stands out with an astonishing number of sellers, making it the city with the highest concentration of Amazon sellers globally. Its seller scale is six times that of New York and Brooklyn combined.

Image source:reddit

The Paradox of Scale and Profit: Why Many but Not Strong?

However, a thought-provoking phenomenon is that the numerical advantage of Tuke sellers has not translated into a revenue advantage. It is estimated that the third-party GMV on Amazon US is about $305 billion, with US sellers contributing about $157 billion, while Tuke sellers contribute about $132 billion.

The average annual revenue of US sellers reaches $885,000, more than double the $394,000 of Tuke sellers.

This data reveals the core challenge currently facing Tuke sellers—the “imbalance between scale and profit”.

Globally, although Tuke sellers account for the majority in terms of numbers, they only contribute about 39% of total third-party revenue. In high-ticket or high-value categories, US and other regional sellers still maintain a significant advantage.

Image source:Marketplace Pulse

The Path to Breakthrough: From Selling Products to Building Brands

Facing these challenges, the path for Tuke sellers to upgrade and transform is already clear. Amazon's2025 strategic direction focuses on three pillars: “innovation empowerment, opportunity expansion, and local enablement”, providing support for Tuke sellers’ transformation.

Brand building has become the key breakthrough. Data shows that nearly55% of Tuke sellers have achieved sales of over $1 million on Amazon, and 60% have exceeded $10 million.

Behind these achievements is the systematic construction of global operational capabilities by Tuke enterprises—including leveraging Amazon Global Stores for multi-market synergy, and using platform AI tools for data-driven product selection, pricing, and advertising decisions.

Image source:forestshipping

Scarlet Fu, Regional Expansion Lead for Amazon Global Selling South China, pointed out at a recent summit that global cross-border e-commerce sales are expected to grow tenfold in the next decade, with a growth rate 3.18 times that of global retail e-commerce.

For Tuke sellers, this game has just begun. Breaking the 50% share in numbers is only a starting point; the real challenge is how to convert scale advantage into brand and profit advantage.

The “supply chain dividend” of Tuke manufacturing is shifting to a “brand dividend”. In the next decade, we will witness the qualitative transformation of Tuke sellers from “selling products” to “building brands”.