Recently, JD.com's self-operated retail platform Joybuy announced that it will officially launch in the UK in March this year, marking the official start of its third strategic entry into the European market.

Unlike the previous two explorations and trials, this launch is accompanied by the signing of a strategic cooperation agreement with the China-Britain Business Council (CBBC), as well as a "heavy asset" localization strategy refined and adjusted over ten years.

The determination of founder Liu Qiangdong towards the European market is being clearly conveyed through this brand-new platform.

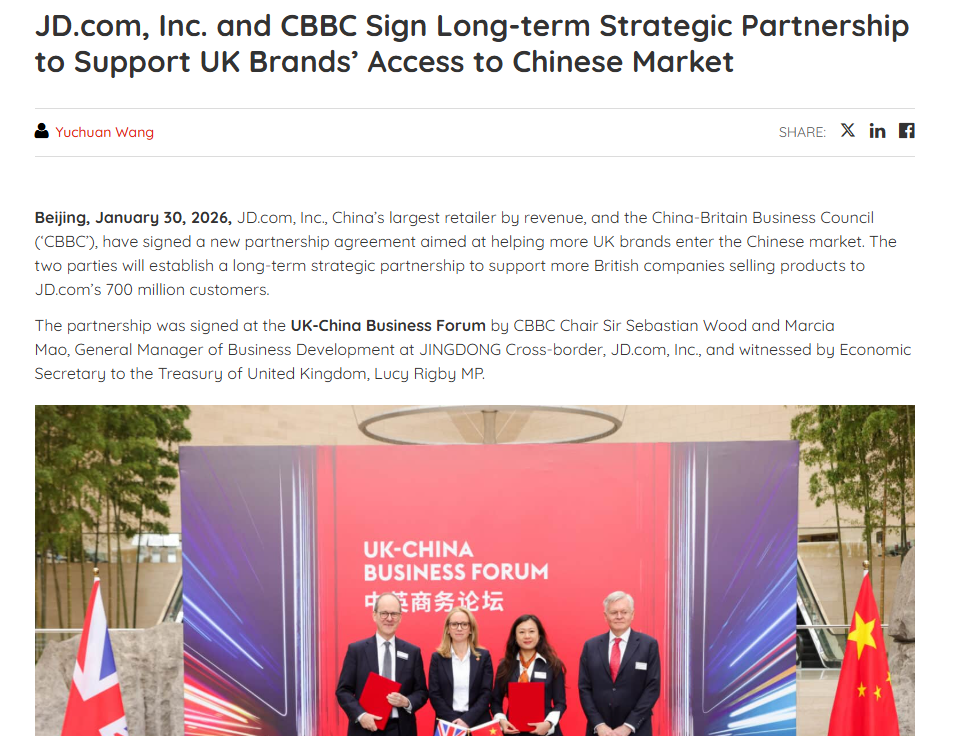

Image source:jdcorporateblog

A Decade, Three Battles: The Twists and Turns of JD.com's European Dream

JD.com's journey in Europe has not been smooth sailing. This is JD.com's third attempt to break into the European market, with each attempt representing a different strategic approach and market understanding.

In 2015, JD.com launched Joybuy 1.0, attempting to replicate China's e-commerce model in Europe. The main problem at the time was a mismatch in the model—JD.com's main 3C digital products could not replicate the low-price advantage that peers built through factory direct sales and tax-free direct mail channels.

Subsequently, due to company strategy adjustments and the impact of the COVID-19 pandemic,JD.com's first attempt in Europe ended in 2021.

In 2022, JD.com adjusted its strategy and launched the new retail brand Ochama in the Netherlands, positioning itself as an omni-channel retail brand both online and offline. The product strategy also shifted from "China export" to "global selection, local operation".

Image source: Internet

Brand Cycle Battle

In August 2025, JD.com carried out a key strategic integration, deciding to cease operations of the Ochama brand and merge all its business and user resources into the Joybuy platform, which had already been relaunched in April of the same year.

Internally, the company positioned this adjustment as an important"strategic upgrade", with the core aim of concentrating advantageous resources and strengthening the market competitiveness of the core brand.

This brand switch is a key decision made by JD.com after deepening its understanding of the European market through early exploration.

Ochama completed its phased mission of market exploration, while Joybuy, with stronger brand assets and operational experience, will take over as the core vehicle for long-term localized operations in the European market.

JD.com's three attempts in Europe have shown distinctly different characteristics:

A Logistics Moat Built with Heavy Investment

JD.com dares to take this "slow and heavy" path in Europe because of the infrastructure it has quietly built over the past few years.

In Europe, one of JD.com's core advantages is its deeply deployed logistics system.

As a key achievement of the "Global Network Weaving Plan", JD Logistics has established a warehousing network of more than 130 overseas warehouses in 23 countries and regions in Europe, with a total managed area of over 1.3 million square meters, providing solid support for front-end business.

JD.com's grand strategy for Europe is being accelerated through a key acquisition. The company has targeted Ceconomy, a leading European consumer electronics retail group (which operates the MediaMarkt and Saturn chain brands), as a strategic acquisition target.

These stores are expected to be transformed into front-end service points for online ordering, offline pickup, or returns and exchanges, thus achieving a true online-offline integrated (O2O) retail closed loop. This acquisition is seen by outsiders as a key move by JD.com to build omni-channel capabilities for Joybuy.

Image source:reuters

After ten years of sharpening its sword, JD.com's third charge into Europe has sounded the horn.The official launch in March will be a practical test of its "heavy asset + deep localization" model.

The outcome of this battle concerns not only the success or failure of a platform, but will also test whether China's "heavy" e-commerce business model can be successfully transplanted into mature global markets.

The battle for the European e-commerce market is becoming more suspenseful with the full entry of this heavyweight player.