In recent years, the global e-commerce industry has begun to experience strong growth, especially in Brazil. As the leader of e-commerce growth in Latin America, its market expansion speed is remarkable. According to the latest survey by Akamai Technologies, 20% of Brazilian consumers shop online at least once a week, while the proportion of those who shop at least once a month reaches 31%. These numbers are expected to continue rising during the upcoming "Black Friday" promotional period.

Image source: Google

In terms of shopping preferences, Brazilian consumers tend to purchase clothing and electronic products on international platforms, with 32% of consumers choosing these platforms mainly because they offer a wider selection of products and competitive prices. This not only makes the shopping process more convenient but also enhances shopping security, greatly improving the consumer shopping experience.

Image source: marcasemercados

Brazilian consumers also demonstrate great flexibility when choosing shopping channels, and their choices often depend on the specific type of product being purchased. For example, in the field of electronics, many consumers make a balanced choice between international markets such as Amazon and Mercado Livre and local Brazilian sites like Magazine Luiza and Casas Bahia. When it comes to purchasing home appliances, about 45% of consumers prefer to use local Brazilian websites.

However, in general, smartphone apps remain the most popular shopping method among Brazilian consumers, especially in the categories of food and clothing, where their convenience and intuitiveness take the shopping experience to the next level.

In addition, the Brazilian market has a very high acceptance of imported goods and cross-border e-commerce. According to a joint study by the Brazilian Retail Managers Association, SPC Brasil, and Offerwise Pesquisas, in the middle of 2023, 77% of Brazilians had shopped on cross-border e-commerce platforms at least once.

Image source: ecommerce Brasil

Chinese products, in particular, are highly favored by Brazilian consumers. According to relevant data, 7 out of every 10 Brazilian consumers have purchased Chinese products. This trend not only reflects the popularity of Chinese goods in the Brazilian market but also highlights the important role of cross-border e-commerce in global trade.

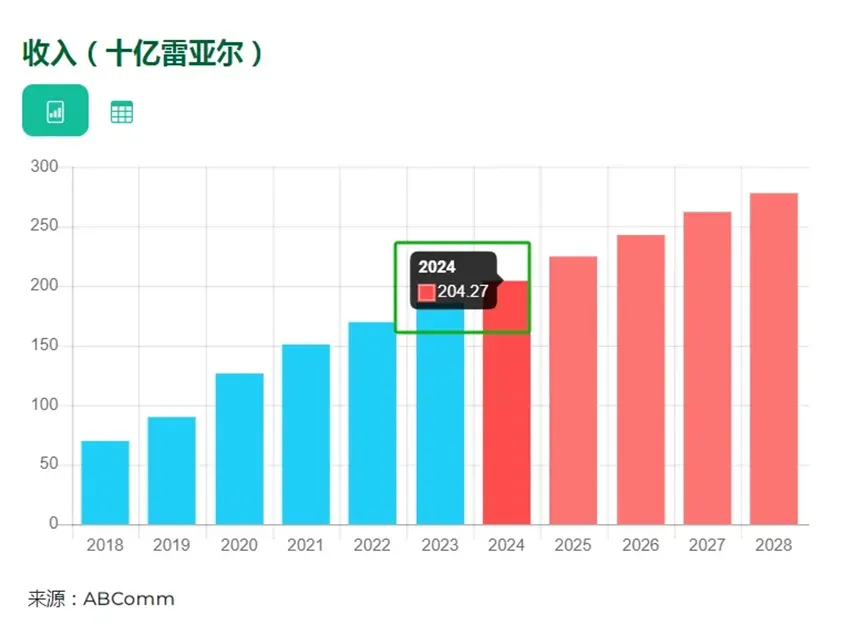

As the largest economy in Latin America, Brazil has always been regarded by many sellers as an emerging blue ocean market. According to data from the Brazilian E-commerce Association, in 2023, the size of Brazil's retail e-commerce market reached 185 billion reais, a significant increase from 70 billion reais in 2018. Looking ahead, it is expected that by 2024, Brazil's e-commerce sales will increase to 204.3 billion reais, with an annual growth rate of about 10%. This continued growth trend highlights the huge potential and attractiveness of the Brazilian e-commerce market.

Image source: ABComm

With the development of internet technology and the widespread popularity of smartphones, shopping on e-commerce platforms has become a daily habit, bringing huge growth opportunities for cross-border e-commerce. However, the rapid development of the Brazilian e-commerce market has also brought some challenges, especially in terms of consumer trust and security.

According to surveys, 58% of consumers tend to shop only on official websites or apps, and 54% are concerned about transaction security issues. Security incidents such as data breaches may cause about 40% of users to refuse to make another purchase.

Image source: telesintese

Although Brazil's cross-border e-commerce market contains huge growth potential, competition in this field is becoming increasingly fierce, and consumers' expectations for service quality and products are also continuously rising. In order to establish a market position, merchants must continuously optimize their services and refine product quality management. In this constantly evolving market, only by continuously learning and adapting can one truly achieve lasting success and growth.