Recently, Sea's performance in the stock market has been nothing short of spectacular, with its share price soaring by more than 200% over the past 12 months. This surge has not only excited investors but also prompted many to reassess the potential of this Southeast Asian e-commerce giant.

The reason behind this is inseparable from the strong performance of Shopee, its e-commerce platform. As Sea's core business, Shopee has become the key to the group's continued growth, leading the company to a rebound in its results.

Image source: Internet

Share Price Surge Supported by “Shopee”

For a listed company, the performance of its share price is often a direct reflection of the market's view of its future potential. Sea's recent share price surge is based on its strong recovery in performance. Over the past year, Sea's share price rose from $37.48 to $113.24, an increase of 202.13%. In the capital market, analysts at JPMorgan have also given Sea's stock an "overweight" rating, believing its prospects are promising.

However, looking back at last year, Sea's share price experienced an inglorious low. In the second quarter of 2023, Sea released its financial report, announcing that due to fierce market competition, the company would increase spending and was expected to turn to a loss. This news triggered panic among investors, causing the share price to drop by more than 30%. However, as this year's performance gradually recovered, Sea's share price began to rebound, especially after the third quarter financial report, in which Sea successfully returned to profitability.

Shopee Q3 performance shows significant growth. Image source: Sea

E-commerce Business Shopee: Sea’s “Cash Cow”

To talk about Sea's share price surge, one must mention its core business—Shopee. The robust growth of this e-commerce platform is the fundamental reason for Sea's rebound in performance.

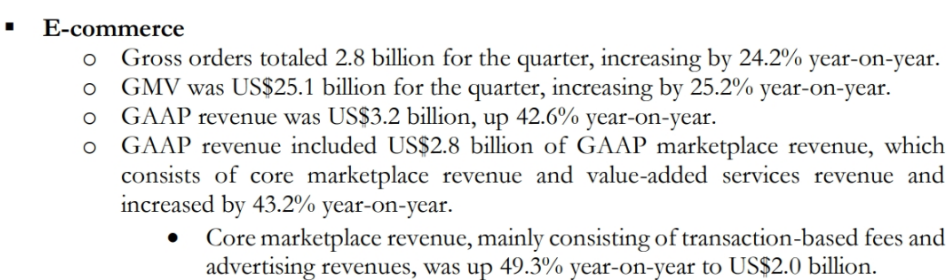

According to the latest financial data, Shopee's performance is quite impressive. In the third quarter of this year, Shopee's total revenue reached $3.14 billion, making it Sea's largest source of revenue. Meanwhile, Shopee's GMV (Gross Merchandise Value) grew by 25.2% year-on-year to $25.1 billion, and its adjusted core profit was $34.4 million, compared to a loss of $347 million in the same period last year, showing exceptionally strong growth momentum.

In fact, Shopee's contribution has long surpassed Sea's other businesses. In fiscal year 2023, Sea's total revenue was $13.1 billion, of which $9 billion came from Shopee, accounting for almost two-thirds of the group's income. With the support of its e-commerce business, Sea achieved its first full-year profit since going public.

Sea Q3 2024 performance. Image source: Sea

How Does Shopee Maintain Its Growth?

In the Southeast Asian market, Shopee faces fierce competition. Platforms like Lazada, TikTok Shop, and Temu are quickly catching up, yet Shopee has managed to hold its ground and continue growing, mainly thanks to its flexible market strategies.

1. Shopee actively caters to consumer trends by expanding its live shopping business.

Live shopping has become an important shopping method in the Southeast Asian market, and Shopee has seized this opportunity to attract a large number of consumers and increase platform activity. By collaborating with many influencers and bloggers, Shopee closely integrates e-commerce with entertainment and social interaction, making shopping not only a consumption behavior but also a social activity.

2. Shopee's support for small and medium-sized sellers is also one of its key strategies for maintaining growth.

As the platform's user base continues to grow, small and medium-sized sellers are increasingly dependent on Shopee. Shopee helps these sellers increase product exposure and boost sales by lowering entry barriers, providing financial support, and optimizing operational tools.

3. Shopee also attracts users through large-scale promotional activities.

For example, in the upcoming 12.12 mega sale, Shopee has prepared a large number of coupons and discounts to stimulate consumer desire, especially in Southeast Asia and Latin America, where shopping enthusiasm is running high.

Shopee 12.12 Mega Sale. Image source: Shopee

Future Outlook: Still a Long Way to Go

Sea's founder Forrest Li mentioned in a public speech that although the company has achieved considerable success in its e-commerce business, there is still a long way to go in the future. Market competition, economic fluctuations, and other factors may affect the company's future development. Therefore, Sea and Shopee still need to continue innovating and enhancing their competitiveness to ensure they stand out in the future market environment.

Nevertheless, Sea's current performance has undoubtedly laid a solid foundation for its future development. With the strong growth of its e-commerce business Shopee, Sea has emerged from its previous slump and ushered in a spring of performance rebound. In the future, how Sea leverages Shopee to further expand market share and maintain profit growth will be the focus of investors and the market.