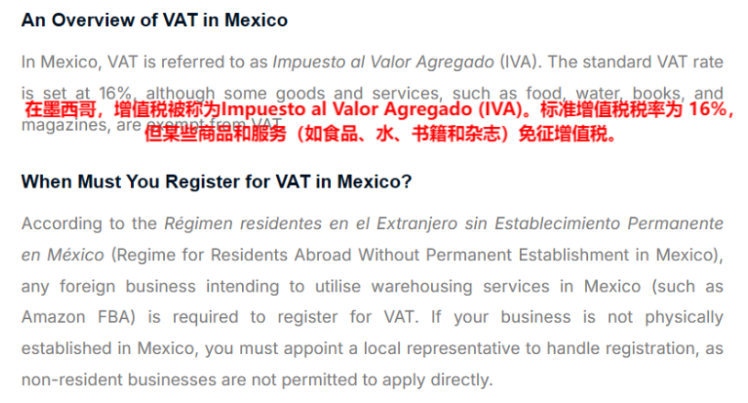

The Mexican Tax Administration Service (SAT) recently announced a new tax policy, deciding to impose a 16% Value Added Tax (VAT) on all foreign companies selling goods through e-commerce platforms starting from January 1 next year.

Mexico imposes additional VAT on imported goods. Image source: tbaglobal

The introduction of this policy means that a large number of cross-border e-commerce sellers will face new tax compliance requirements. For many sellers who rely on local warehousing services such as Amazon FBA, this is undoubtedly a significant challenge.

Additional Tax Burden: Compliance Pressure for Cross-Border E-Commerce Sellers

According to the new policy, all foreign sellers using warehousing services within Mexico must register for VAT with the Mexican Tax Administration Service. This includes sellers on platforms such as Amazon FBA and Temu, especially those cross-border sellers who have not established a physical company in Mexico. Whether choosing to ship through Amazon warehouses or using local warehousing services of other platforms, sellers must comply with this new regulation.

To be compliant, cross-border sellers need to register for VAT in Mexico and obtain a tax identification number (RFC). If the seller has not set up a company in Mexico, they must complete this registration through a local agent. After registration, sellers can obtain a VAT number and are required to submit monthly VAT returns to the Mexican tax authorities to ensure compliance.

The implementation of this policy not only increases the tax burden on sellers but also brings higher compliance costs. Especially for smaller, less mature sellers, this new regulation may significantly increase their operational difficulty and costs. Moreover, the tax compliance process is more cumbersome, requiring sellers to submit returns regularly and bear corresponding legal responsibilities.

Cross-Border Platforms’ Response: Providing Support but with Strict Requirements

In response to changes in Mexico’s new tax policy, several cross-border e-commerce platforms have introduced corresponding measures to help sellers adapt to the new requirements.Amazon, Shein, and Temu, among other major e-commerce platforms, have made clear regulations regarding sellers’ tax compliance issues and provided various support measures.

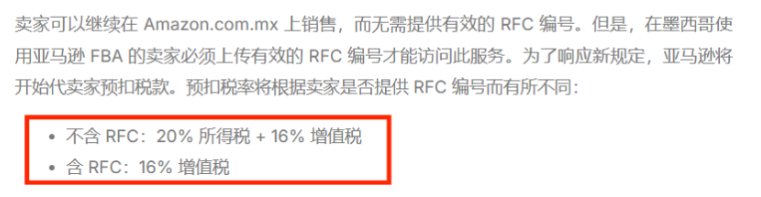

TakingAmazon as an example, the platform requires all sellers using FBA warehousing services to provide a valid VAT number (RFC). If the seller does not provide a valid RFC number, Amazon will withhold 20% income tax and 16% VAT. Sellers who provide an RFC number only need to bear the 16% VAT. To ensure compliance, sellers must upload their tax identification number in a timely manner and comply with monthly tax filing requirements.

Amazon’s tax withholding policy. Image source: tbaglobal

Shein offers relatively flexible rules. The platform decides whether to withhold taxes based on whether the seller provides an RFC number. For sellers who do not provide an RFC number, the platform will withhold the corresponding taxes. For sellers who provide an RFC number, taxes will be paid directly by the seller to the Mexican tax authorities, and the platform will no longer withhold them.

Temu has relatively strict requirements. Any seller targeting the Mexican market must provide a valid RFC number, otherwise the platform will stop shipping and will regularly verify the seller’s tax registration status. If the seller fails verification, their inventory will be suspended until their tax registration issue is resolved.

Image source: from the Internet

Although these platforms provide services such as tax withholding to ease part of the burden for sellers, sellers still need to submit VAT returns to the Mexican tax authorities regularly. This means that sellers not only rely on the platform’s withholding services but also need to closely monitor their own tax compliance status to ensure timely filing.

Facing the New Policy, Sellers Need to Plan Ahead

For cross-border sellers, the future tax environment may become even more complex. In addition to Mexico, other markets may also introduce similar tax policies, so sellers should closely monitor tax developments around the world and be prepared to respond.

Only with tax compliance can sellers maintain long-term stable operations and avoid operational risks caused by policy changes.