The global economy in 2025 remains shrouded in the shadow of inflation, and British consumers, under the pressure of soaring living costs, are forced to adopt a "tightening the belt" mode.

From offline discount stores to online low-price platforms, from stockpiling discounted goods to turning to private labels, a consumption revolution centered on "cost-effectiveness" is sweeping the UK market and profoundly influencing the competitive strategies of global cross-border e-commerce.

Image source: Internet

I. British Consumers: A Comprehensive Shift from "Buying Brands" to "Buying Practicality"

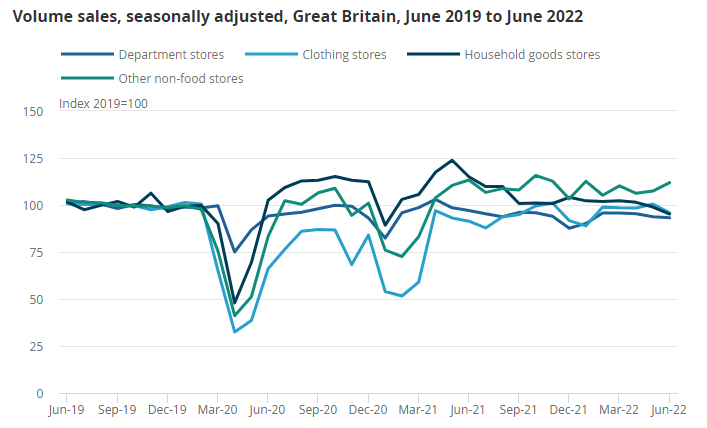

According to data from the UK Office for National Statistics, as early as 2022, 62% of British adults had reduced spending on non-essential items due to the cost-of-living crisis, and this trend further intensified in 2025. Kantar Consumer Index shows that British consumers are coping with inflation in various ways: buying "imperfect" fruits and vegetables to save money, turning to discount stores and private labels (as shown by the significant growth in UK supermarket private label market share in 2022).

Image source: Internet

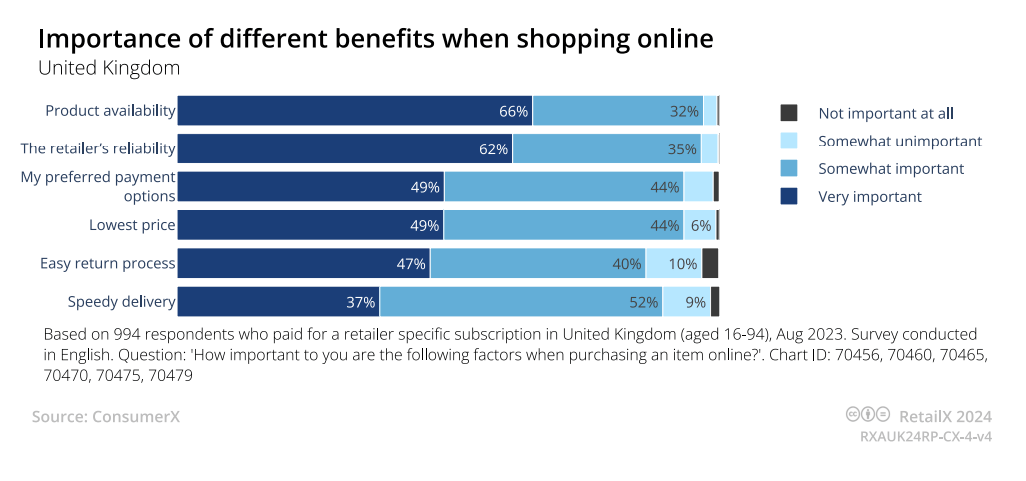

It is worth noting that consumption downgrading is not simply about pursuing low prices. This "calculative" consumption logic forces brands to reassess product positioning—low prices must be tied to practical value, not just simple price cuts.

Nevertheless, the shadow of economic downturn has long hung over the UK market, making consumption downgrading an inevitable trend. Recently, the Confederation of British Industry (CBI) released its February retail sales assessment, showing that retail sales performance remains weak and has not shaken off its sluggish state. Meanwhile, pessimism among retailers about market prospects continues to spread, with most expecting sales to decline further in March. This situation not only reflects the severity of the current economic environment but also indicates that the road to recovery for the consumer market remains long.

Image source: Fashion

II. The "Low-Price Strategy" of Cross-Border E-Commerce and Localization Challenges

Low-price platforms accelerate penetration, but localization barriers rise

Faced with British consumers' price sensitivity, cross-border e-commerce giants are adjusting their strategies. Amazon launched its low-price mall Amazon Haul in 2024; although the response in the US market was lukewarm, it quickly expanded to Europe and invested $2.4 billion to expand its logistics network to support fast delivery of low-priced goods. AliExpress, through sponsoring London Comic Con and subway advertising blitzes, topped the UK shopping app download charts during the 2024 "Double 11" period, with high cost-performance products such as figurines and festive supplies becoming bestsellers. Temu, under Pinduoduo, continues to erode traditional platform shares with its "ultra-low price + social viral" model.

Image source: Amazon

Consumer demand forces supply chain upgrades

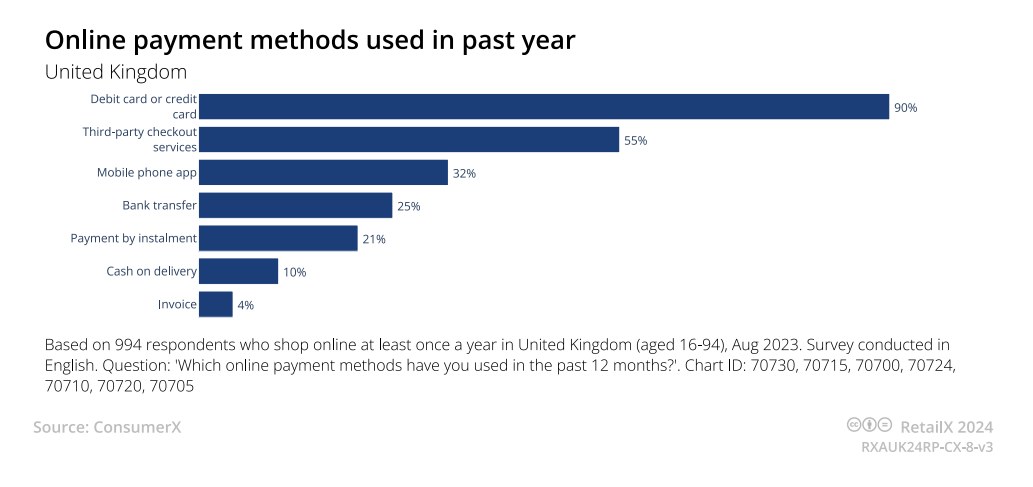

British consumers have almost harsh requirements for logistics efficiency: 84% hope parcels arrive within 3–5 days, and 32% expect delivery within 1–2 days. However, cross-border sellers face the challenge of more complex supply chains after Brexit; 39% of European consumers have reduced cross-border shopping due to VAT rule changes, UK imports from the EU have dropped by 28.8%, and exports have plummeted by 407%. In addition, localized services have become key to competition: 43% of consumers say "flexible returns" is their top choice, and 56% list "free shipping" as the primary factor in choosing a platform.

Image source: ConsumerX

Hidden costs behind the price war

The low-price strategy is not a panacea. Data from the 2024 holiday season shows that although overall UK retail sales grew by 2.3%, clothing categories fell by 2%, and electronics only increased by 1.3%, indicating that non-essential categories are more impacted by price wars. At the same time, consumers' demand for product transparency has increased: 62% pay attention to ingredient labels and sustainability certifications, and 93% value flexible payment methods. Relying solely on low prices may lead to loss of brand loyalty, especially in emotionally driven categories such as beauty and apparel, where differentiated value remains the core barrier.

Image source: ConsumerX

Conclusion

The consumption downgrading in the UK market is both a challenge and an opportunity to reshape the competitive landscape. Cross-border sellers need to break out of the "low-price competition" by precise product selection, supply chain optimization, and value marketing, finding a balance between cost-effectiveness and brand identity. As the RetailX report points out: "The winners in 2025 will be those who can control costs while also moving consumers with localized services and emotional connections." Only by adapting to trends and deeply rooting themselves can sellers stand firm in the wave of low prices.

(Note: All data and events in this article are based on public reports and research; specific strategies should be based on actual business needs.)