Over the past decade, Chinese brands have rapidly risen in the global e-commerce wave, shifting from manufacturing exports to brand exports. Now, with structural adjustments in global e-commerce, a new regional opportunity is emerging.

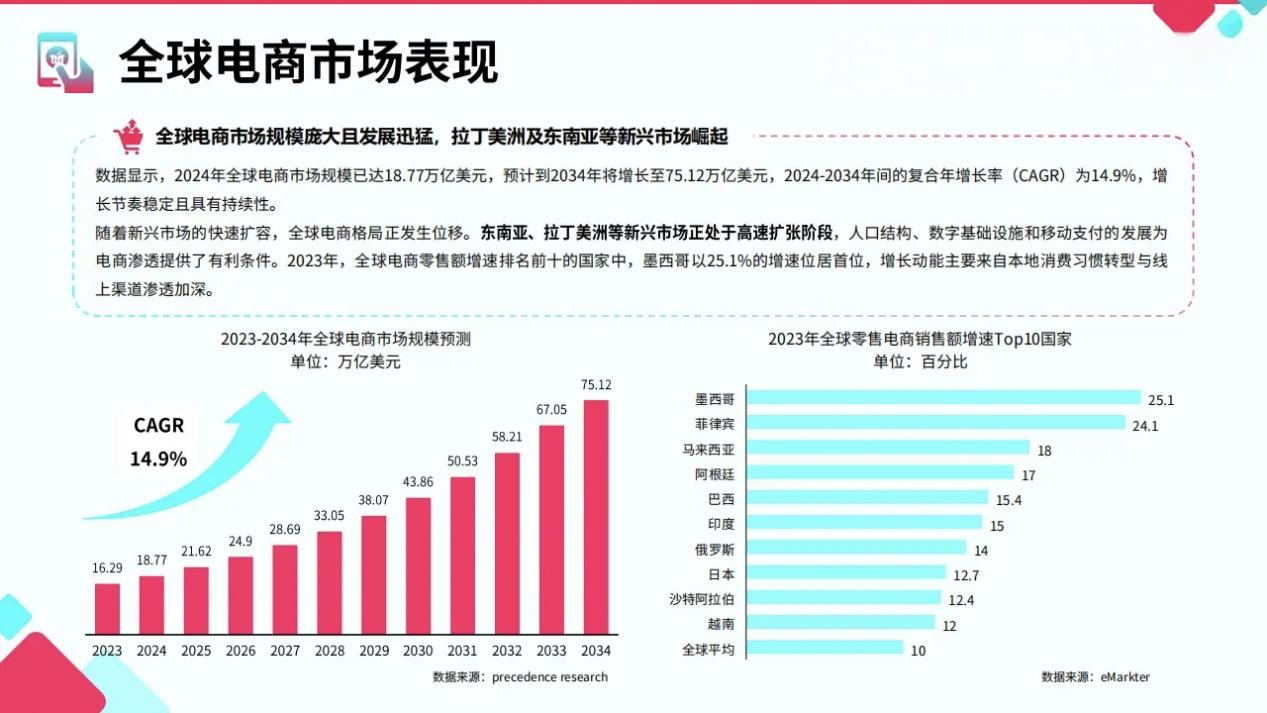

According to data from Precedence Research, the global e-commerce market size will reach $18.77 trillion in 2024, and is expected to grow to $75.12 trillion by 2034, with a compound annual growth rate (CAGR) of 14.9% over the next decade. Compared to the slowing growth in North America and Europe, the new round of growth is more concentrated in emerging markets such as Latin America and Southeast Asia.

These markets are currently in a phase of demographic dividend release and accelerated improvement of digital infrastructure, becoming key directions for Chinese brands to expand overseas.

Image source: Dashu Cross-border x ProBoost

"2025 TikTok Shop New Market Insights Report"

Latin America and Southeast Asia Become the Fastest Growing Regions, E-commerce Infrastructure Continues to Improve

Among the top ten countries in global e-commerce retail sales growth in 2023, Mexico ranked first with a growth rate of 25.1%, followed by the Philippines (24.1%), Malaysia (18%), India (17%), and several other Asian and Latin American countries.

This set of data sends a clear signal: the incremental logic of global e-commerce is shifting from stock competition to structural migration.

Feedback from multiple Chinese overseas enterprises shows that although the overall online penetration rate in emerging markets is relatively low, there is ample room for growth, and users have a high acceptance of e-commerce platforms and new brands.

In markets such as Mexico and the Philippines, the localization capabilities of leading e-commerce platforms are continuously strengthening, and the infrastructure for logistics and payment is gradually maturing, providing favorable conditions for cross-border brands to establish themselves.

Image source: Internet

TikTok Is Becoming an Important Entry Point for Content-driven Consumption

In terms of content channels, the evolution of social platforms is reshaping users' consumption paths.

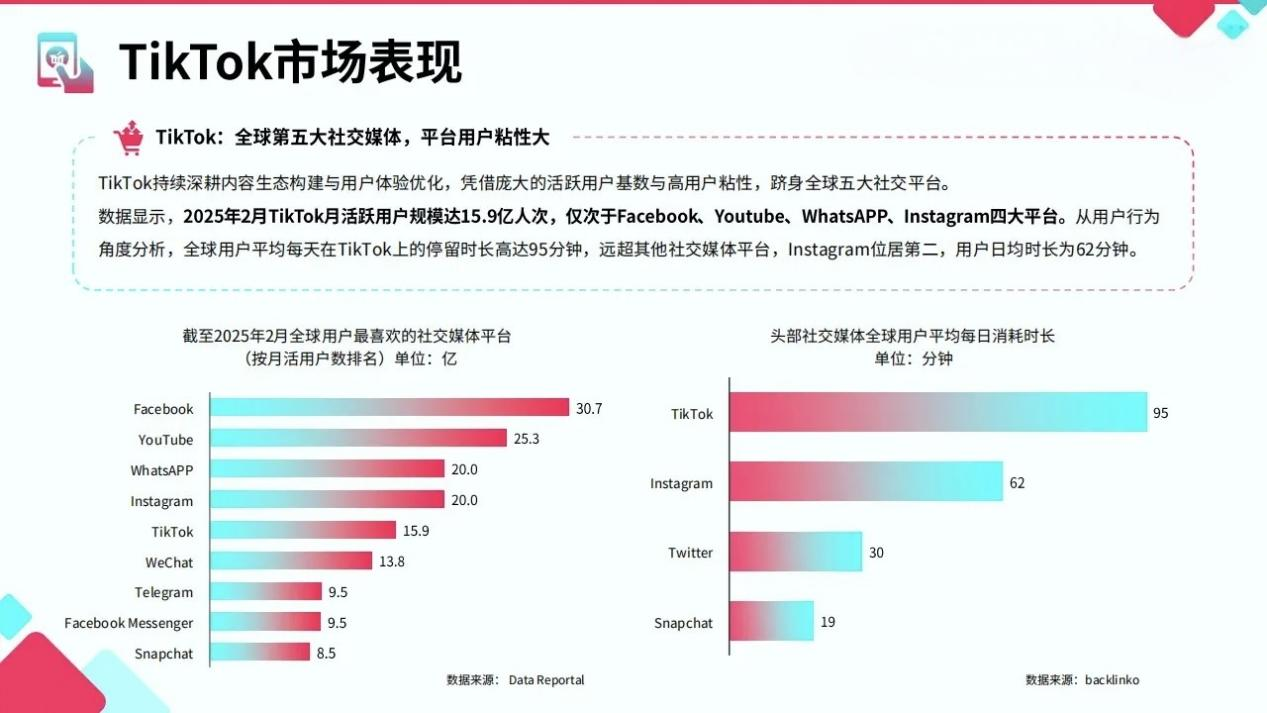

According to Data Reportal and Backlinko, as of February 2025, TikTok's global monthly active users have reached 1.59 billion, ranking as the fifth largest social platform in the world; users spend an average of 95 minutes per day on TikTok, far exceeding Instagram (62 minutes) and Twitter (30 minutes).

TikTok's high stickiness means it is no longer just a content distribution channel, but also a new entry point for e-commerce conversion. In many emerging markets, brands complete the "seeding—interaction—purchase" closed loop through TikTok, significantly shortening the user decision-making process.

Some Chinese brands in Latin America and Southeast Asia have achieved low-cost cold start conversions by collaborating with local KOLs, launching short video content and live streaming events. This content-driven approach is also becoming the core pillar of the new generation of overseas strategies.

Image source: Dashu Cross-border x ProBoost

"2025 TikTok Shop New Market Insights Report"

Localized Operations Become a Key Capability for Brand Expansion Overseas

Although emerging markets are experiencing significant growth, there are still high differences among countries in terms of culture, payment, logistics, and regulations. Overseas enterprises should avoid simply copying domestic experience, and instead build refined localization strategies around their target markets. For example:

In Mexico, cash on delivery (COD) remains the mainstream payment method, so brands need to integrate local payment and fulfillment systems to reduce return and default rates;

In the Philippines, social media platforms are used extremely frequently, so brands need to strengthen localized content production and user community operations;

In Malaysia, with its multilingual environment and diverse religious backgrounds, product packaging and communication content must comply with local regulations and cultural sensitivities.

As user decision-making processes increasingly rely on content information and social evaluations, the ability of overseas enterprises to produce localized content, integrate channels, and build service systems will become core barriers.

Image source: Internet

Conclusion:A new round of structural shift in the e-commerce industry is taking shape

Emerging countries represented by Mexico, the Philippines, and Malaysia are undertaking the next growth cycle of the global e-commerce market. New social platforms represented by TikTok are also becoming new entry points for brands to connect with users.

For Chinese overseas enterprises, going global is no longer just about operating a single platform or distributing low-priced goods, but a comprehensive upgrade centered on localization capabilities, content system construction, and full-chain efficiency coordination.

The next three to five years will be a critical window for brands to capture the minds and market share of emerging markets. Whether brands can take the lead in regional layout and deepen operations during the structural adjustment will directly determine their globalization process and long-term competitiveness.