The recently concluded year-end shopping frenzy saw American e-commerce deliver another astonishing report card.

According to reports, duringthe two-month holiday season from November 1 to December 31, 2025, online sales in the US broke historical records, reaching as high as$257.8 billion (about RMB 1.8 trillion), far exceeding previous market expectations.

Image source:forbes

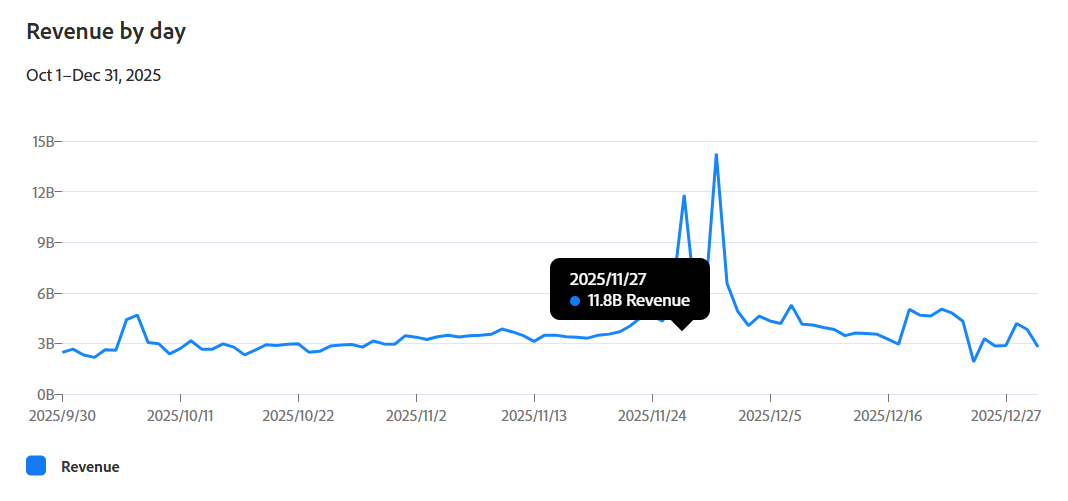

Several key dates stood out in this consumer feast.

The highest single-day e-commerce transaction volume of the year appeared on“Cyber Monday”, with a single-day revenue of$14.25 billion, a year-on-year increase of7%. Following closely, “Black Friday” sales reached$11.8 billion, an increase of9%.

Even on Thanksgiving Day, online sales reached$6.4 billion. Throughout the holiday season,there were as many as 25 days with daily sales exceeding$4 billion, 7 days more than the previous year, showing the continued high enthusiasm for consumption.

Image source:adobe for business

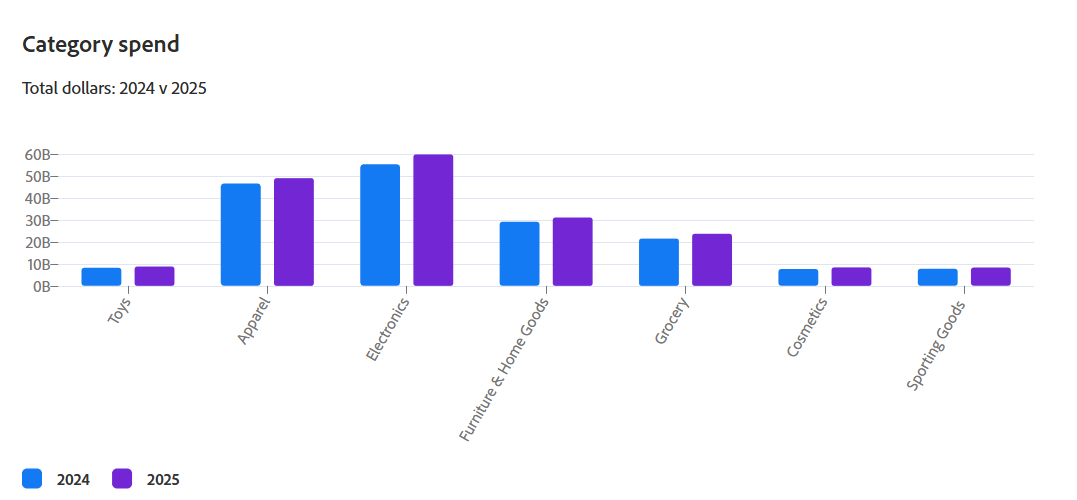

Which products were the hottest?

Data shows that electronics, apparel, and home furniture became the “three driving forces” of growth, with these three categories contributing over 54% of total sales.

Among them,electronics sales were about$59.8 billion, apparel about $49 billion, and furniture about $31.1 billion. During the holiday season, the strong discounts in these categories were undoubtedly the core driving force attracting consumers.

Additionally,convenient payment methods, especially “Buy Now, Pay Later” (BNPL) services, became an important engine driving consumption. Transactions completed through this method reached $20 billion, a year-on-year increase of nearly 10%, significantly easing consumers’ immediate payment pressure and stimulating purchasing power.

Image source:adobe for business

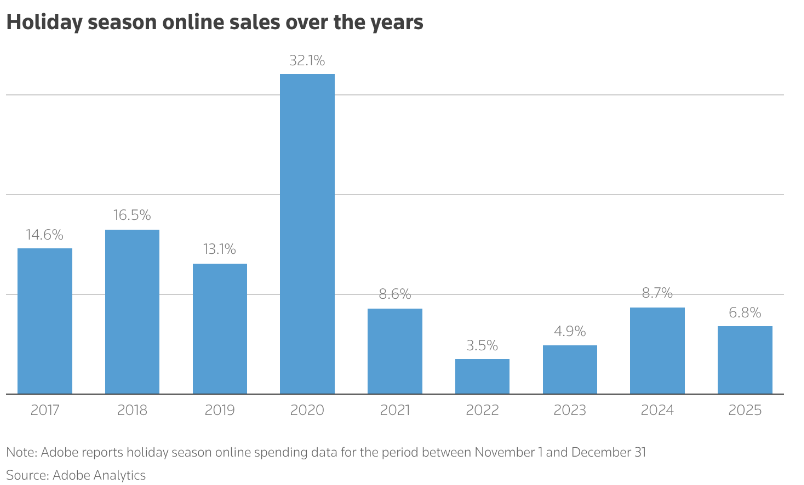

“Deceleration” signals amid high growth

Although the total amount set a record, one subtle change is worth noting,the year-on-year growth rate of online sales during the 2025 holiday season was 6.8%, slowing down compared to 8.7% in the same period in 2024.

Industry analysis points out that ongoing inflationary pressure and adjustments to US tariff policies are the main reasons for the slowdown in growth.

Rising prices have shrunk consumers’ wallets, making them more budget-conscious when shopping.

To cope with rising import costs, retail giants including Target, Amazon, and Walmart have all raised product prices to varying degrees, and the prices of some popular holiday gifts have also risen accordingly.

This“cost-driven price increase” coexists with strong promotions launched by retailers to attract traffic, forming the unique market landscape of the 2025 holiday season:Consumers remain cautious in anticipation, and the market shows resilience amid challenges.

Image source:rtr

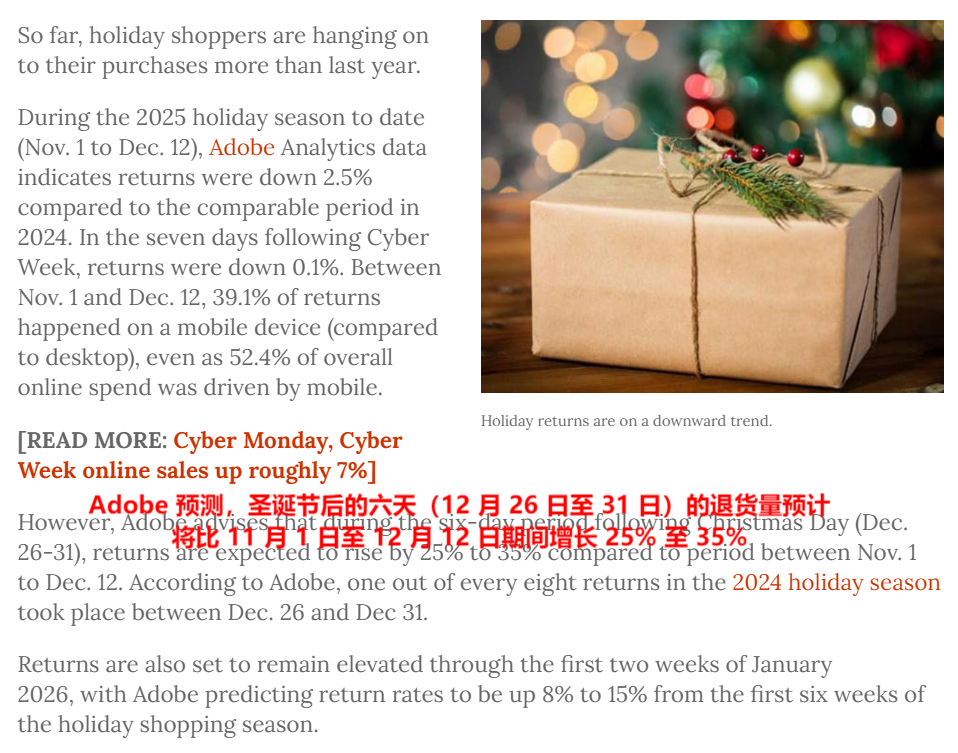

The carnival ends, the wave of returns arrives

However, the brilliance of the sales figures does not allow sellers to rest easy. As the shopping season ends, a more urgent problem is surfacing—a large-scale wave of returns.

Historical data shows thatthe last few days of December to January of the following year is the period with the most concentrated return requests. It is predicted that since the growth in holiday sales in 2025 is more driven by “price increases” rather than “volume growth”, consumers may choose to return goods after receiving them due to economic pressure or cooling off from impulse purchases. Especially for products given as gifts, after being given at Christmas, there is likely to be a peak in returns in January.

The convenient online shopping process and the tense atmosphere created by limited-time discounts, while stimulating consumption, also objectively shorten consumers’ decision-making time, leading to more unplanned purchases, which further raises the return rate.

How do retailers respond?

Facing the increasingly severe challenge of returns, major retailers have begun to prepare in advance and take targeted measures:

Some fashion e-commerce platforms charge higher return fees to customers with excessive return frequency.

Retailers with physical stores, while maintaining free return policies, have launched points reward programs to encourage customers to offset returns as member points, promoting repeat purchases.

Some e-commerce platforms choose to shorten the return window for promotional products to reduce operating costs and risks.

Image source:chainstoreage

In short, no matter how impressive the sales figures are during major promotions, the profit that actually ends up in the seller’s pocket is what matters most.

The surging wave of returns reminds the entire industry: promotional activities can only play a “icing on the cake” role, and consistently providing high-quality products and services is the true cornerstone for winning the market and customers.

Otherwise, even the most brilliant growth may be nothing more than a flash in the pan.