This document is the "2025 EY White Paper on Overseas Expansion of Consumer Goods," published by Ernst & Young. It mainly discusses the overseas expansion of Chinese consumer goods enterprises, including the current situation, characteristics of different stages, hot issues, and the assistance EY can provide, offering reference for companies seeking to go global.

1. Current Situation of Overseas Expansion

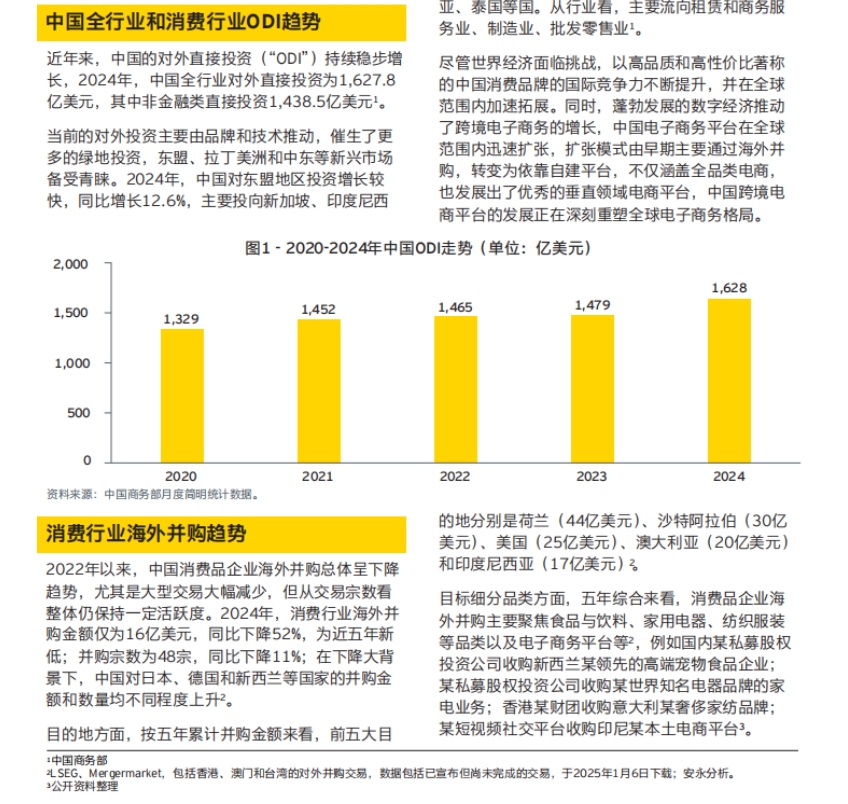

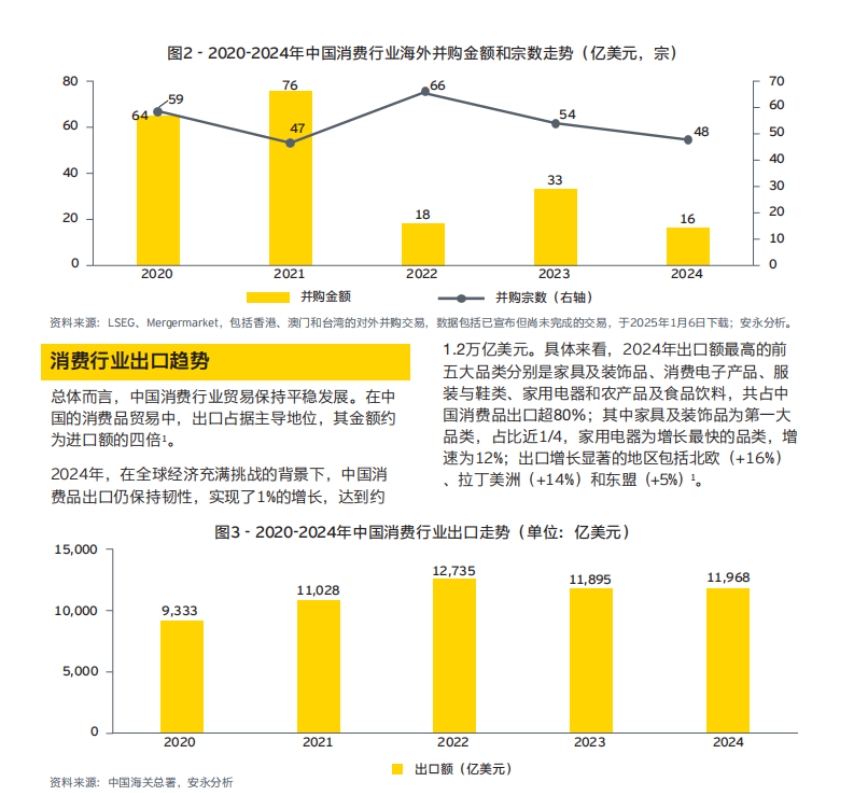

- Investment and M&A: China's overall outbound direct investment continued to grow in 2024. The overseas M&A amount in the consumer sector declined in 2024, but the number of transactions remained active, mainly involving categories such as food & beverage and home appliances. Investment destinations were concentrated in countries like the Netherlands and Saudi Arabia.

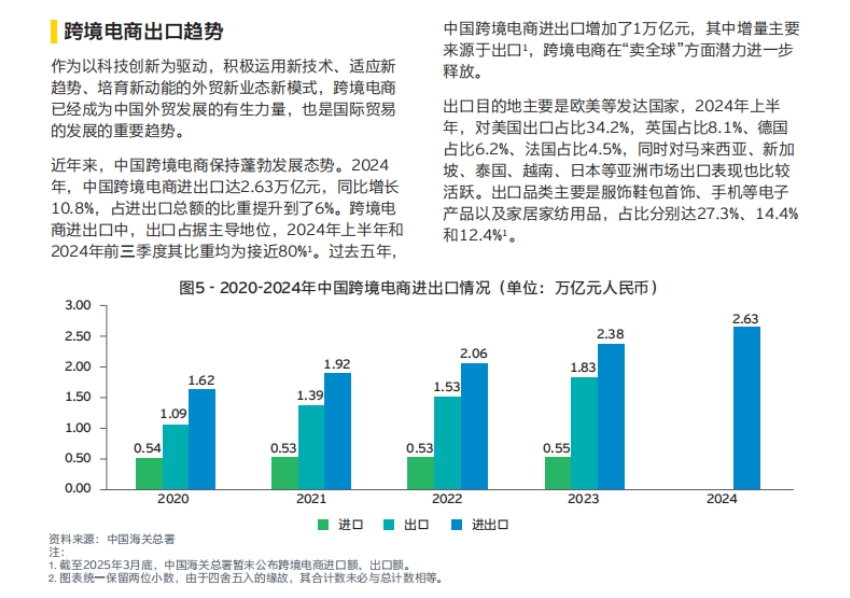

- Trade Export: China's consumer sector trade remained stable, with exports dominating. In 2024, consumer goods exports achieved growth, with categories such as furniture and decorative items having high export value. Exports to regions like Northern Europe and Latin America grew significantly; cross-border e-commerce import and export also maintained growth, with exports taking the lead, mainly to developed countries such as Europe and the US, and categories like apparel, shoes, and bags being exported in large quantities.

- Policy Support: Multiple government departments are working together to promote high-quality development of cross-border e-commerce, issuing various policies to support the construction of overseas warehouses. At the same time, China is engaging in bilateral/multilateral international cooperation, signing e-commerce cooperation memorandums with multiple countries and participating in the formulation of international standards.

- Supply Chain Going Global: Leading consumer goods companies such as Midea and COFCO are accelerating the globalization of their supply chains, enhancing global resource integration and risk resistance capabilities, but also facing challenges in digitalization, industry chain collaboration, and compliant operations.

2. Stages and Hotspots of Overseas Expansion

- Development Stages: The internationalization of Chinese enterprises can be divided into three stages: product export (1.0), cross-border operations (2.0), and global operations (3.0). Each stage has different characteristics in terms of market coverage, value chain, and brand influence.

- 1.0 Stage Hotspot - Export E-commerce: Export e-commerce is developing strongly, with common models including direct shipping and overseas warehouse models. Overseas warehouses are favored for their low cost and high efficiency, and leading service providers have significant advantages in operations. Export e-commerce needs to consider tax issues in different countries; export pre-tax rebate policies can activate funds, but companies need to choose the appropriate rebate method.

- 2.0 and 3.0 Stage Hotspot - Site Selection: In the 2.0 and 3.0 stages, supply chain globalization becomes an important strategy, and site selection is influenced by various factors such as market strength and energy costs. Chinese companies face high complexity and difficulty in coordinating stakeholder interests when choosing locations. EY provides site selection methodology and a three-step approach, and companies also need to consider matters such as equity structure.

3. EY Assists Enterprises in Going Global: EY provides end-to-end strategic, operational, and compliance solutions for consumer goods companies going global, covering strategic planning, market entry, and global development stages. EY's extensive global network and professional teams can provide high-quality tax services to help companies address the challenges of overseas expansion.