In recent years, TikTok Shop has rapidly become a popular platform in the cross-border e-commerce sector, thanks to its massive traffic pool and unique model that integrates short video content with e-commerce.

However, as its global expansion deepens, the platform has recently made significant adjustments to the entry rules for cross-border sellers in the US and UK markets. It will completely close the channel for individual sellers to join and raise the qualification threshold for enterprises.

This policy change not only marks a shift in TikTok Shop's operational strategy but also reflects a profound transformation in the cross-border e-commerce industry from "scale expansion" to "quality first".

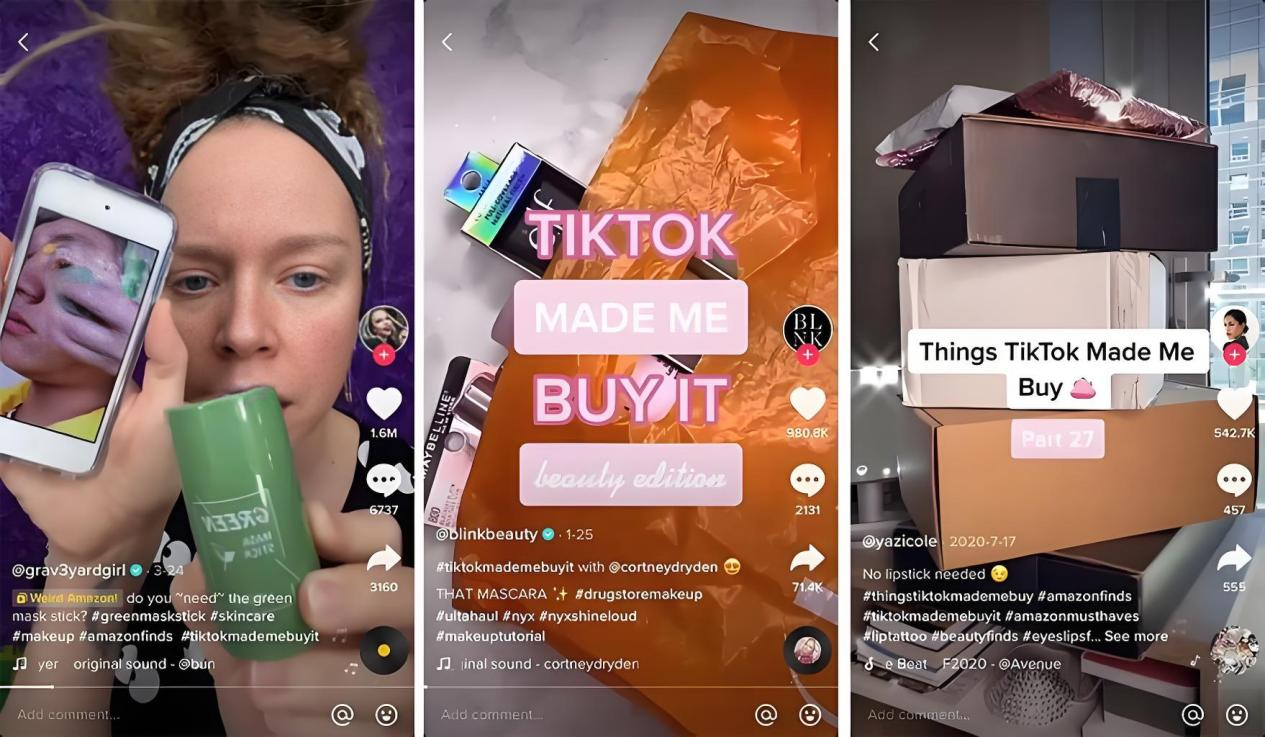

Image source: Internet

From "Open" to "Selective"

The core of this adjustment is to reshape the platform's merchant structure through qualification review and subject restrictions, specifically manifested in three major tightening dimensions:

1. Strengthening Qualification Thresholds

The platform requires all cross-border sellers to be enterprise entities registered in Mainland China or Hong Kong (excluding sole proprietorships and individual businesses), and the company must have been established for more than 60 days, with more than 90 days remaining before the registration expires. This means the platform has completely abandoned the "individual seller" group and instead focuses resources on enterprises with stable operational capabilities and compliance foundations.

2. Dynamic Risk Control Mechanism

In addition to hard qualifications, the platform has added dynamic reviews of applicants. Applicants who are under investigation for trade or consumer protection, or who already have relevant penalty records, will be prohibited from joining. This rule shifts risk interception from "post-event accountability" to "entry screening," reducing platform operational risks at the source.

3. Binding of Region and Business Entity

The platform clearly requires that the company's headquarters must be located in Mainland China or Hong Kong, further strengthening the "substantiality" of cross-border trade. This regulation not only avoids the possibility of shell companies or cross-border gray industries but also lays the foundation for compliant supervision in subsequent tax, logistics, and other aspects.

Image source: Internet

What Impact Does This Have on the Entire Industry?

1. For Seller Enterprises: A Polarized Situation

For small and medium-sized individual sellers, this means the end of the era of low-cost trial and error. Taking the UK market as an example, many individual sellers previously operated through 1688 procurement and third-party logistics delivery models, but due to lack of company qualifications and compliance capabilities, they will be forced to exit or transform into service providers.

For compliant enterprises, it means the release of competitive dividends. The raised entry threshold reduces the impact of low-priced and inferior products, and companies with supply chain advantages and branding capabilities will receive more traffic support. For example, a domestic home furnishing brand operating through a TikTok Shop enterprise account has a customer unit price 40% higher than individual sellers, and the repurchase rate has increased to 25%.

Image source: Internet

2. For Service Providers: From Peripheral Support to Core Track

The policy adjustment has created new business opportunities, with a surge in demand for enterprise compliance services. Service providers such as agency registration, cross-border tax planning, and EU CE certification are ushering in a new window of business growth.

Some eliminated individual sellers may transform into enterprise service providers, using their previous operational experience to provide light-asset services such as short video content production and live streaming hosting for enterprises.

Image source: Internet

3. For Industry Trends: From Traffic is King to Intensive Cultivation

This adjustment also signals that cross-border e-commerce has entered a new stage of compliance-driven growth. The market structure will continue to optimize, with industry resources concentrating on leading enterprises, while small and medium-sized sellers seek survival through mergers, transformation, or focusing on niche markets.

Future competition will no longer be limited to traffic acquisition, but will encompass comprehensive capabilities such as supply chain response speed (such as the "7-day delivery" project being tested by TikTok Shop), building multi-country compliance systems, and localized content operations.

Image source: Internet

Conclusion

This rule adjustment by TikTok Shop may mean short-term pain for the industry, but in the long run, it is a necessary path toward healthy development.

After all, the sustainable development of any business ecosystem ultimately depends not on the quantity of unchecked growth, but on trustworthy quality. Only those enterprises that can adapt to the rules and focus on compliance and quality can continue to develop and grow.