01

Tuke Tipping Revenue Surpasses $10 Billion

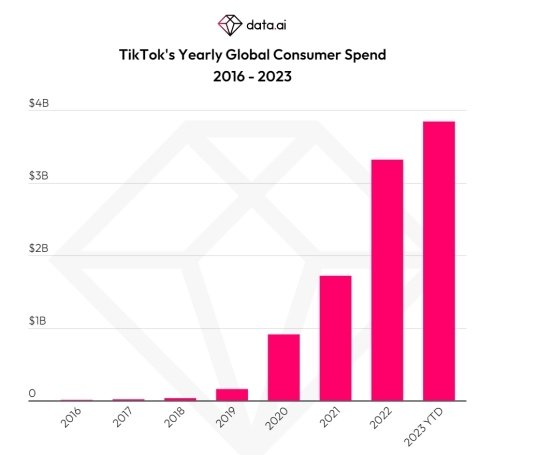

Recently, according to the latest data from Data.ai, Tuke has become the first non-gaming mobile application to generate $10 billion in consumer spending. Behind this achievement, is Tuke's powerful content creativity and user stickiness.

As a leading global short video platform, Tuke has attracted hundreds of millions of users worldwide with its unique algorithm and creative content. These users not only browse a variety of interesting and creative content on the platform, but are also willing to tip their favorite content creators, thus forming a huge tipping revenue.

It is understood that Tuke's tipping revenue mainly comes from virtual gifts on the platform. Users can purchase virtual gifts to give to their favorite content creators, and these virtual gifts can be converted into actual income. Tuke takes a certain share from this.

According to Data.ai, Tuke's consumer spending in 2023 increased by 61% compared to 2022, far surpassing other non-gaming mobile applications. This growth is mainly attributed to Tuke's continuous efforts in globalization strategy, user experience optimization, and content innovation.

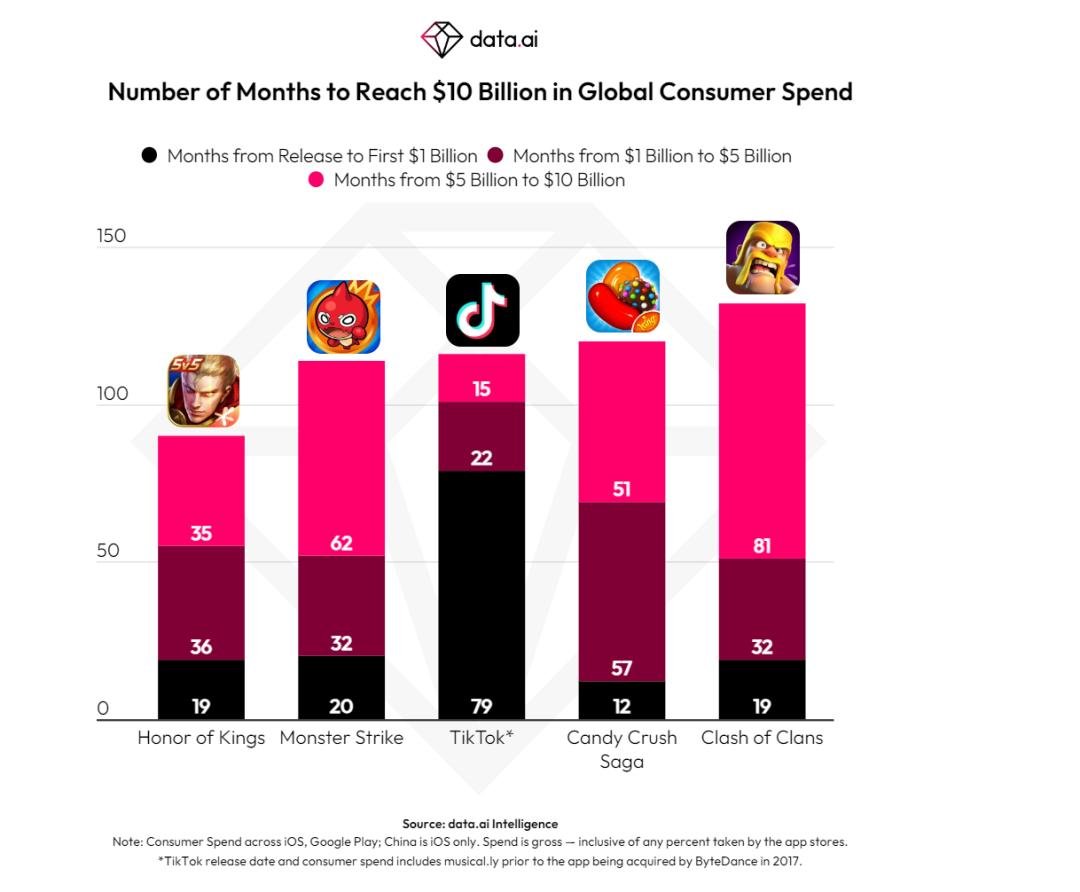

By the end of 2023, Tuke stood at the top of the market alongside mobile classics such as King/Activision Blizzard's "Candy Crush Saga" (over $12 billion in revenue), Tencent's "Honor of Kings" ($11 billion), XFLAG/Mixi's "Monster Strike" ($10.6 billion), and Supercell's "Clash of Clans" ($10.2 billion).

02

Tuke Experiences Traffic Explosion in South Africa

South African consumers' love for Tuke continues to rise, resulting in a traffic explosion for Tuke in South Africa, making it the preferred online shopping platform for South African consumers.

According to research by Redseer Strategy Consultants, Tuke has the greatest influence on users' purchasing decisions. This finding indicates that Tuke occupies an important position in South Africa's e-commerce market.

The study found that many South African consumers explore and purchase new products on Tuke. Shockingly, 71% of the adult internet population uses Tuke to explore and buy new products.

Tuke is not only an entertainment platform, but also a platform for discovering and purchasing new products. Users can easily discover new products here, share advice and opinions, and participate in conversations about products and shopping.

The study also found that over 40% of South African consumers use Tuke for product searches, nearly half of South African consumers discover products through popular videos on Tuke, and 44% interact with videos posted by creators on Tuke when deciding to purchase a product.

In addition, more than 60% of shoppers make immediate purchases after discovering products on Tuke. With the surge in retail, domestic travel, gifting, and outdoor activities during the year-end holiday season, Tuke has also become one of the essential marketing tools for brands.

03

Tuke May Pose a Greater Threat to Shopee

According to foreign media reports, the partnership between Tuke and GoTo may pose a significant threat to Southeast Asian e-commerce giant Shopee. This is not only an attempt at business cooperation, but also symbolizes the deep integration of digital content and e-commerce platforms, heralding a new trend in the future of the e-commerce industry.

Kai Wang, a senior equity analyst at Morningstar, pointed out in a report: "We foresee that this cooperation may put greater pressure on Shopee as it struggles to maintain profitability." His remarks reflect the widespread attention and concern in the market regarding this partnership.

Shopee analysts have also expressed similar views, believing that Shopee may face strong competitive pressure from GoTo's Tokopedia and Tuke. The combination of these two companies will undoubtedly pose a serious threat to Shopee's market position.

Data shows that Shopee's parent company Sea closed at $37.87 per share on December 11. Previously, Sea's financial report showed a net loss of $143.9 million in the third quarter, a reversal from a net profit of $331 million in the previous quarter. This indicates that Sea is focusing on growth rather than profitability to maintain its market share.

Professionals believe that with only e-commerce products, operations, and revenue, it is difficult for Shopee to directly defeat Tuke Shop. To win in this competition, Shopee needs to formulate a very clear strategy. And the key may not lie in e-commerce itself.

Information sourced from the internet