While domestic netizens are still happily scrolling through TikTok short videos, this global social media giant has quietly started "big moves" in Europe. Recently, news has emerged that TikTok is planning to launch its logistics service "Fulfilled by TikTok" (FBT) in Germany, while accelerating its e-commerce business in multiple European countries. From the UK to the US, and now to Germany, TikTok's logistics and e-commerce footprint is expanding step by step. In this "European e-commerce war," can TikTok stir things up?

Image source: ecommercebridge.com

1. Logistics Expansion in Germany: TikTok Wants to Be Sellers' Backbone

For cross-border sellers, logistics has always been a major headache—expensive warehousing, slow delivery, troublesome returns, and a slight misstep can mean losing money for exposure. TikTok's FBT service launch in Germany is aimed precisely at these pain points.

Reportedly, TikTok has already formed a logistics team in Munich, Germany, planning to provide local sellers with one-stop services including warehousing, picking, packing, and shipping. Simply put, sellers only need to deliver goods to TikTok's warehouse, and the platform will handle the rest, from packing to shipping. This model is similar to Amazon's FBA (Fulfillment by Amazon), but TikTok's ambitions clearly go beyond that.

Image source: tiktokglobalshop

Previously, TikTok's FBT service has already been piloted in the UK and US. For example, during last year's Black Friday, TikTok extended order fulfillment times and return periods, helping sellers withstand the pressure of surging orders. In the US, TikTok also partnered with logistics provider ShipBob to further optimize delivery efficiency. These experiences are now being "replicated" in Germany, with a clear goal: to attract more sellers with logistics advantages while enhancing consumer experience.

Image source: TikTok Shop Academy

Why Germany?

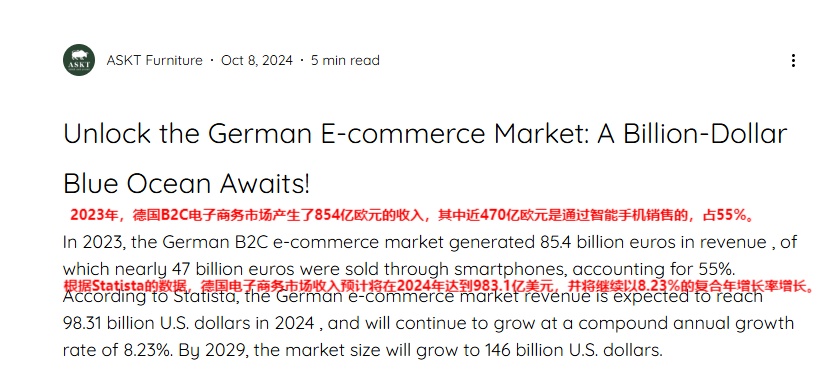

Germany is one of the largest e-commerce markets in Europe, with an e-commerce scale exceeding 85.4 billion euros in 2023. However, high logistics costs and unstable delivery times have long troubled sellers. TikTok's entry at this time can fill market gaps and also compete with local giants. For example, German fashion e-commerce Zalando is likely to become TikTok's partner—the former has already tried live streaming sales on TikTok's UK site with impressive results. If the two join forces, TikTok's logistics and e-commerce business in Germany will be greatly strengthened.

Image source: ASKT Furniture

2. E-commerce Flourishes Across Europe: From Live Streaming Sales to "Yellow Cart"

Logistics is just one part of TikTok's European plan; the real highlight is e-commerce.

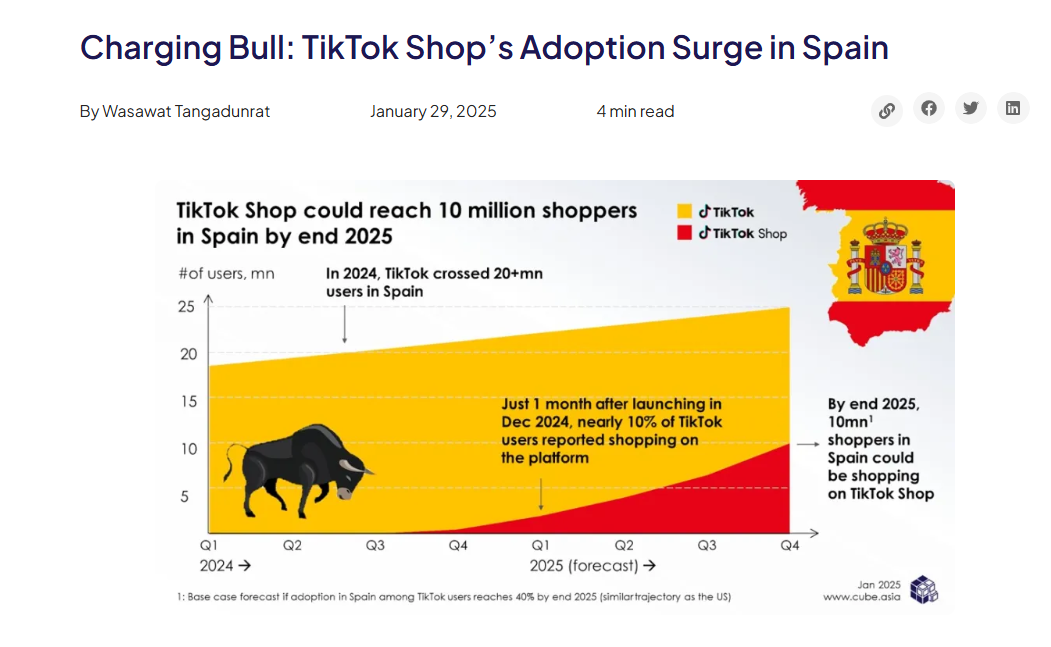

At the end of 2023, TikTok Shop (small shop feature) was launched in Spain and Ireland, focusing on "live shopping + yellow cart (product links) + affiliate marketing." Spanish users can place orders directly in TikTok live streams, and Irish consumers can shop while watching short videos. How effective is this strategy? In December 2024, just one month after launch, nearly 10% of Douyin users shopped on the platform. Some forecasts predict TikTok's usage rate in Spain will reach 40% by the end of 2025.

Image source: cube.asia

Bigger moves are yet to come.

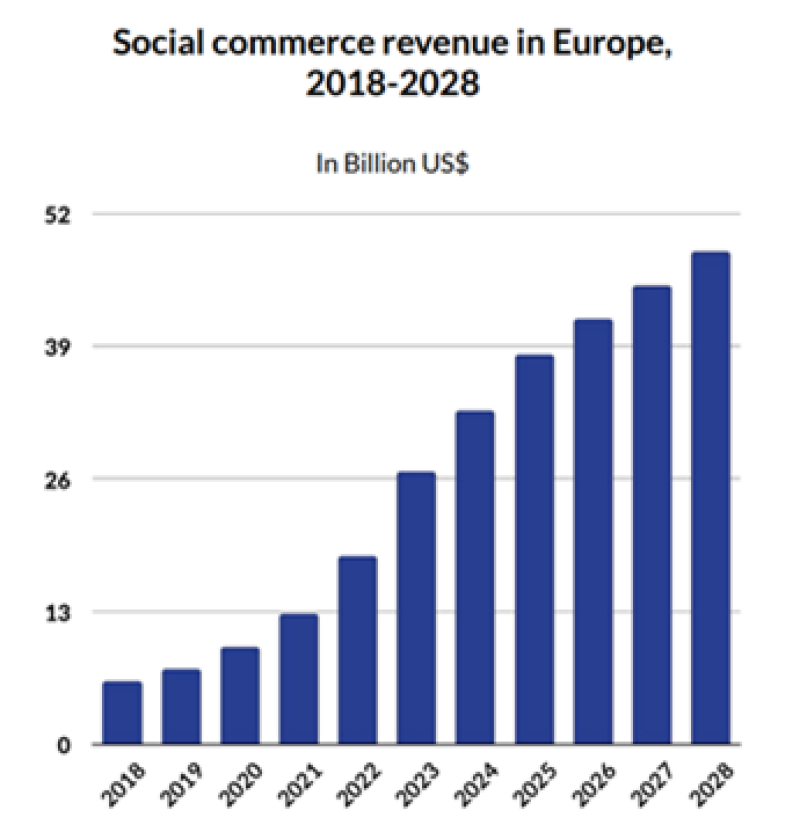

Currently, TikTok is intensively recruiting business and operations positions in European cities such as Amsterdam, Paris, and Milan. It is speculated that these regions may be the next batch of countries to launch TikTok Shop. After all, the potential of social e-commerce in Europe is too tempting—the market size was $26.7 billion in 2023 and is expected to soar to $48.3 billion by 2028. Among them, the UK is the "big brother," Spain has the fastest growth, while markets like Germany and France are on the verge of explosion.

Image source: MikMak

3. Can TikTok Replicate Douyin's Success in China?

The explosive growth of Douyin e-commerce in China has shown the industry the potential of "interest-based e-commerce." In 2023, Douyin e-commerce GMV exceeded 2 trillion yuan, with live streaming sales playing a crucial role. Now, TikTok clearly wants to replicate this model in Europe.

In the short term, TikTok's breakthrough lies in a dual approach of "logistics + localized content." By lowering the entry barrier for sellers through FBT services and stimulating consumer demand with short videos and live streaming, it ultimately forms a closed loop of "traffic-conversion-fulfillment."

In the long run, TikTok may need to ally with local companies. For example, partnering with Zalando for apparel, teaming up with MediaMarkt to expand electronics, or even investing in local logistics companies. After all, a strong outsider cannot easily overpower local players; cooperation is the key to unlocking the European market.

Image source: Internet

Conclusion: A War to Rewrite the European E-commerce Landscape

From logistics to e-commerce, TikTok's expansion in Europe is far from a whim; it is a key move in its global strategy. For sellers, this means new opportunities—low-cost entry, traffic dividends, and logistics support; for consumers, it may bring a more convenient and engaging shopping experience.

Of course, this war is destined to be tough. But regardless, TikTok's entry has already stirred up the European e-commerce market. Who will be the future winner? Time will tell.

(Note: The data and information in this article are based on public reports and industry analysis. Specific business developments are subject to TikTok's official announcements.)