For more than a month, the China-US trade war has felt like riding a roller coaster.

As soon as Trump wielded the tariff stick, China immediately responded with a list of counter-tariffs.

The scene is like two masters dueling: you stab me, I must return the blow.

Image source: Internet

Trump’s “triple strike”, Chinese companies crunch numbers at midnight

It all started on February 1. Trump signed an executive order announcing a 10% tariff on Chinese goods. Many sellers breathed a sigh of relief at the time: “At least it’s not the rumored 60%.”

Mexico and Canada didn’t escape either; the 25% tariff was reinstated just like that.

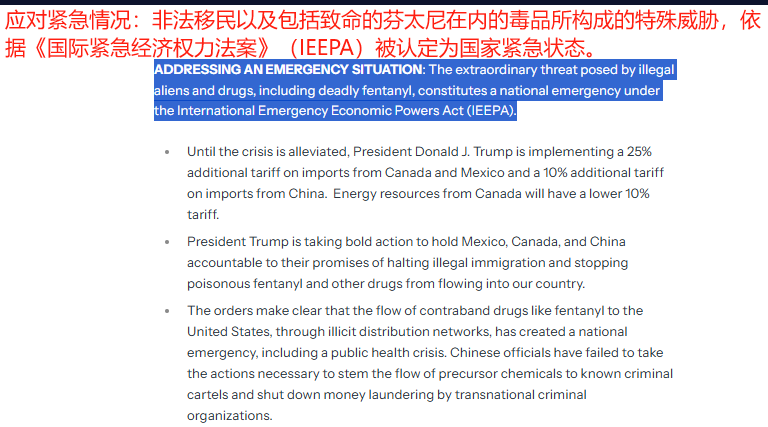

The White House officially announced the tariff increase

But just 26 days later, Trump issued a new notice: starting March 4, another 10% would be added, bringing the total tariff rate directly to 20%.

Image source: BBC

The White House’s justification sounded righteous: “To stop fentanyl from flowing into the US.” But anyone can see this is just window dressing for the trade war. Some analysts pointed out: On April 2, the US will also implement “reciprocal tariffs”—this move is pure setup.

The ones suffering most are cross-border e-commerce sellers. Originally, a $100 product now requires an extra $20 just for tariffs. Some small business owners stayed up late with calculators, only to find that even if they grit their teeth and raise prices by 10%, they’ll still lose 30% of their orders.

White House official release (excerpt)

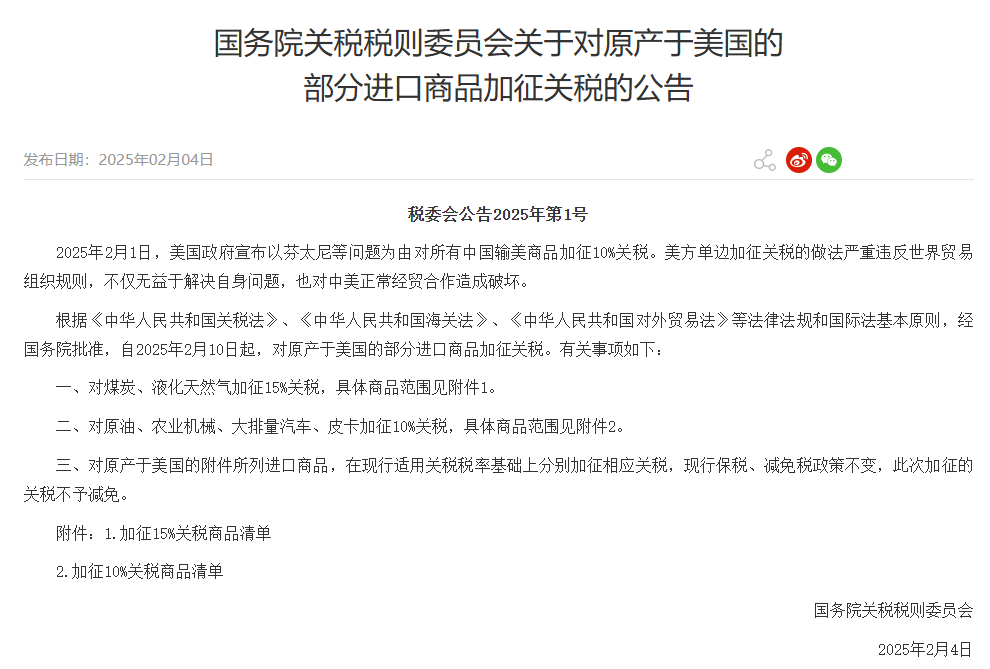

China’s countermeasure list revealed, targeting the “arteries” of the US economy

China also released a “precision strike” list, directly targeting the lifeblood of the US economy. Coal and liquefied natural gas were hit with a 15% tariff, while crude oil, agricultural machinery, large-displacement SUVs, and pickup trucks were hammered with a 10% increase.

Anyone can see these are aimed at America’s core industries. For example, pickup trucks: last year, the US sold nearly 3 million, making them the “national car.” Now, every imported Dodge Ram to China will cost nearly $5,000 more in tariffs.

Even harsher is the energy sector. Last year, the US exported $12 billion worth of liquefied natural gas to China. This tariff hike has turned long-term contracts into hot potatoes for traders.

This round of countermeasures wasn’t decided on a whim. Laws like the “Tariff Law” and “Foreign Trade Law” are clearly written, and the tariff list is precise down to the ten-digit customs code.

Announcement from the State Council Tariff Commission

The long-term battle begins—these signals are deadlier than tariffs

Don’t be fooled by the current excitement; the truly deadly trends are these two:

First, Trump clearly intends to use tariffs as a “long-term weapon.” There may be new moves on April 2, forcing China to make concessions on issues like fentanyl control. This “death by a thousand cuts” approach is far more torturous than a one-time tariff hike.

Second, the global supply chain is undergoing a major reshuffle. After the RCEP agreement took effect, tariff incentives in ASEAN, Japan, and South Korea became too attractive. Some business owners have calculated: moving part of the production line to Vietnam and then exporting to Japan and South Korea via RCEP actually costs less than stubbornly bearing US tariffs.

Image source: Internet

In conclusion

At this stage, the tariff war is no longer a simple “you raise tariffs, I retaliate.”

Behind it lies America’s $1.8 trillion fiscal hole, and a chokehold on China’s manufacturing upgrade.

For ordinary businesses, complaining about policy is useless—changing routes overnight is the real business. After all, in the crossfire of a trade war, the survivor may not be the biggest ship, but it will definitely be the one that turns the fastest.

(Note: The information in this article is compiled from various public news reports. For policy details, please refer to official releases.)