Recently, a "boycott of Chinese sellers" campaign initiated by US domestic sellers has continued to escalate, causing a shock in the cross-border e-commerce industry. According to Amazon platform data at the end of 2024, Chinese sellers have accounted for over 50% of the top 10,000 core sellers, and soared to 62% in the fourth quarter, reaching a record high.

Meanwhile, 41% of new sellers added to the Walmart platform last year came from China, with active sellers contributing 28%. This growth trend has directly triggered collective anxiety among US sellers. Some leading merchants have formed alliances and submitted five targeted reform proposals to the US government, attempting to use policy pressure to curb the competitive advantage of Chinese sellers.

Image source: Yahoo Finance

The Focal Points of Conflict Behind the "Boycott Incident"

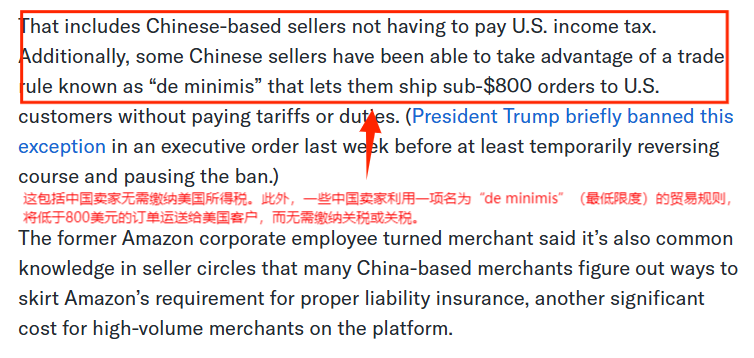

US sellers' dissatisfaction centers on three aspects: cost differences, supply chain efficiency, and competition rules.

On the tax front, the tax-free policy for small packages under $800 (i.e., T86 policy) gives Chinese sellers a pricing advantage. According to US sellers’ statistics, for similar products, Chinese sellers can reduce costs by 15%–25% due to the tax exemption, while US domestic companies must bear a 21% corporate income tax and high insurance costs. In addition, Chinese sellers rely on manufacturing clusters in the Yangtze River Delta and Pearl River Delta, forming a "design-production-logistics" rapid response system within 7 days, while US sellers rely on cross-border procurement, with new product launch cycles generally exceeding 30 days. Some aggressive competitive tactics (such as malicious negative reviews, exploiting rule loopholes) have further intensified the conflict. Although such behavior is rare, it has become the trigger for the boycott.

Image source: Yahoo Finance

The "Five Proposals" of US Sellers and Policy Game

Facing competitive pressure, the US sellers' alliance submitted five reform proposals to the Trump administration, attempting to restrict Chinese sellers through policy means:

- Abolish the tax-free policy for packages under $800 (T86 policy): Block Chinese sellers from evading taxes through direct mail of small parcels;

- Mandatory registration of US entities and tax payment: Eliminate the cost advantage of offshore operations;

- Unified liability insurance standards: Require overseas sellers to provide million-dollar insurance, equal to US domestic sellers;

- Disclosure of seller nationality and tariff information: Guide consumers to make "informed choices";

- Set a 90-day patent review period: Strictly investigate the risk of infringement of Chinese goods.

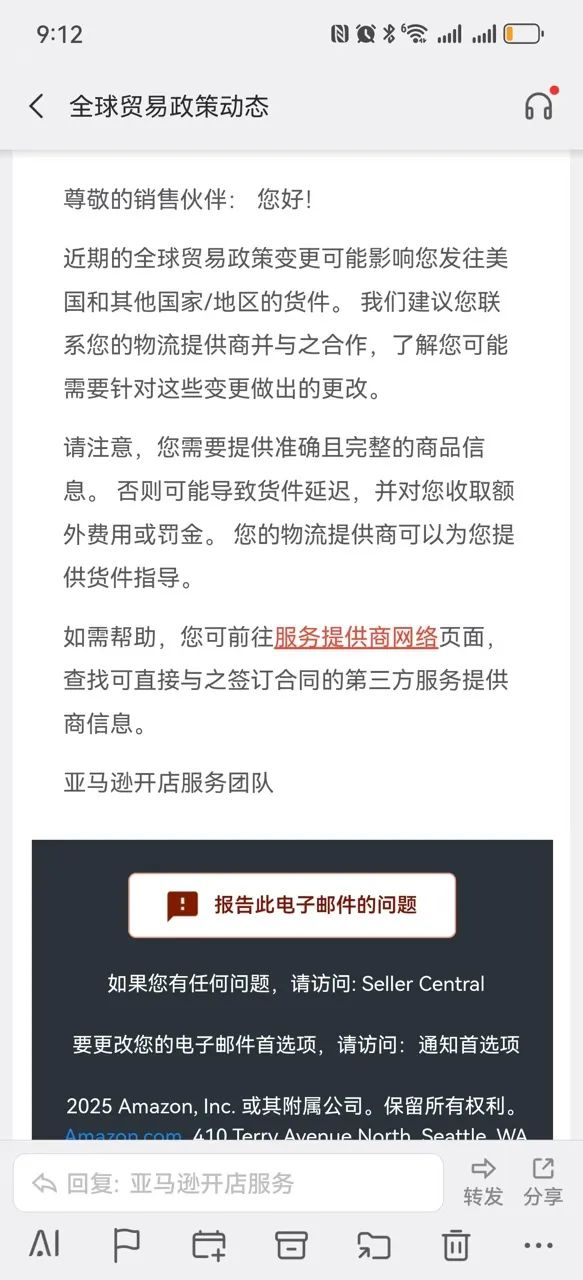

At present, the industry generally believes that the abolition of the T86 policy is almost a foregone conclusion. Amazon has officially warned sellers to pay attention to policy changes. Federal agencies will submit a review report on April 1, and the Trump administration may sign an executive order on April 2. If the policy is implemented, Chinese sellers may face an additional 10%–60% tariff, superimposed on the existing 20% tariff, and the comprehensive cost of some products may increase by 30%–40%.

Image source: Hugo Cross-border

Breakthrough Paths and Future Trends for Cross-border Sellers

Facing the dual pressure of policy and competition, Chinese sellers need to build resilience in three aspects:

1. Compliance Upgrade: Register US companies in advance, purchase liability insurance, and adapt to tax and regulatory requirements. For example, some leading companies have reduced the impact of tariffs by stocking goods in overseas warehouses, with logistics costs dropping by 15% compared to direct mail models;

2. Supply Chain Restructuring: Shift production capacity to Southeast Asia or cooperate with local suppliers to shorten supply cycles. Walmart platform data shows that sellers using "overseas warehouse + local delivery" have reduced order fulfillment times from 15 days to 3 days, and the return rate has dropped by 12%;

3. Value Competition Replaces Price War: Strengthen brand building and technological innovation. Brand sellers represented by Anker and SHEIN have increased product premiums by 30%–50% through R&D investment and patent layout, offsetting policy costs.

Image source: Internet

Conclusion

Trade protectionism may win US sellers a breathing space, but the underlying logic of the global e-commerce market is still "consumers pursue high cost performance." For Chinese sellers, crisis is also an opportunity. Only by relying on supply chain resilience and accelerating brand upgrading can they remain invincible in turbulent times.

(Note: All data in this article comes from public reports and industry research. Please refer to official releases for specific policy changes.)