Recently, several major events have occurred one after another in the cross-border e-commerce industry. One is that the US T86 tax exemption policy is about to be canceled, and the other is that the TikTok US acquisition case has encountered new variables. Both events have brought considerable impact and challenges to the industry.

The cancellation of the T86 tax exemption policy has logistics providers on edge

The US T86 tax exemption policy will be officially canceled starting May 2, 2025, which means that goods with a single ticket value ≤ $800 will no longer enjoy tax-free fast entry treatment.

As the "lifeline" of cross-border e-commerce, the cancellation of this policy directly leads to increased logistics costs and more complicated customs clearance processes. In response,leading logistics providers such as Cainiao, Yanwen, and Orange Union have all adjusted their strategies.

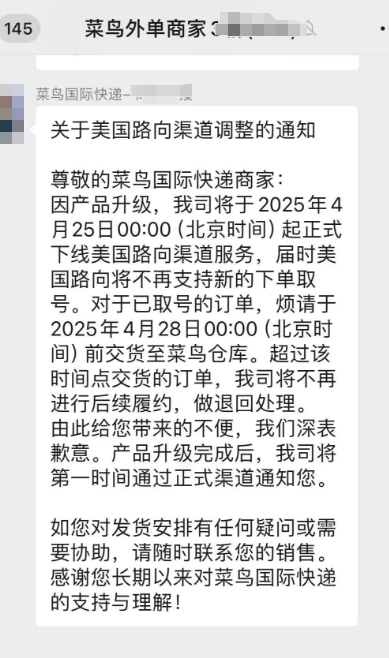

Cainiao made early arrangements, directly taking down US-bound services on April 25, and returning undelivered orders after the 28th;

Image source: Cainiao International Group Chat

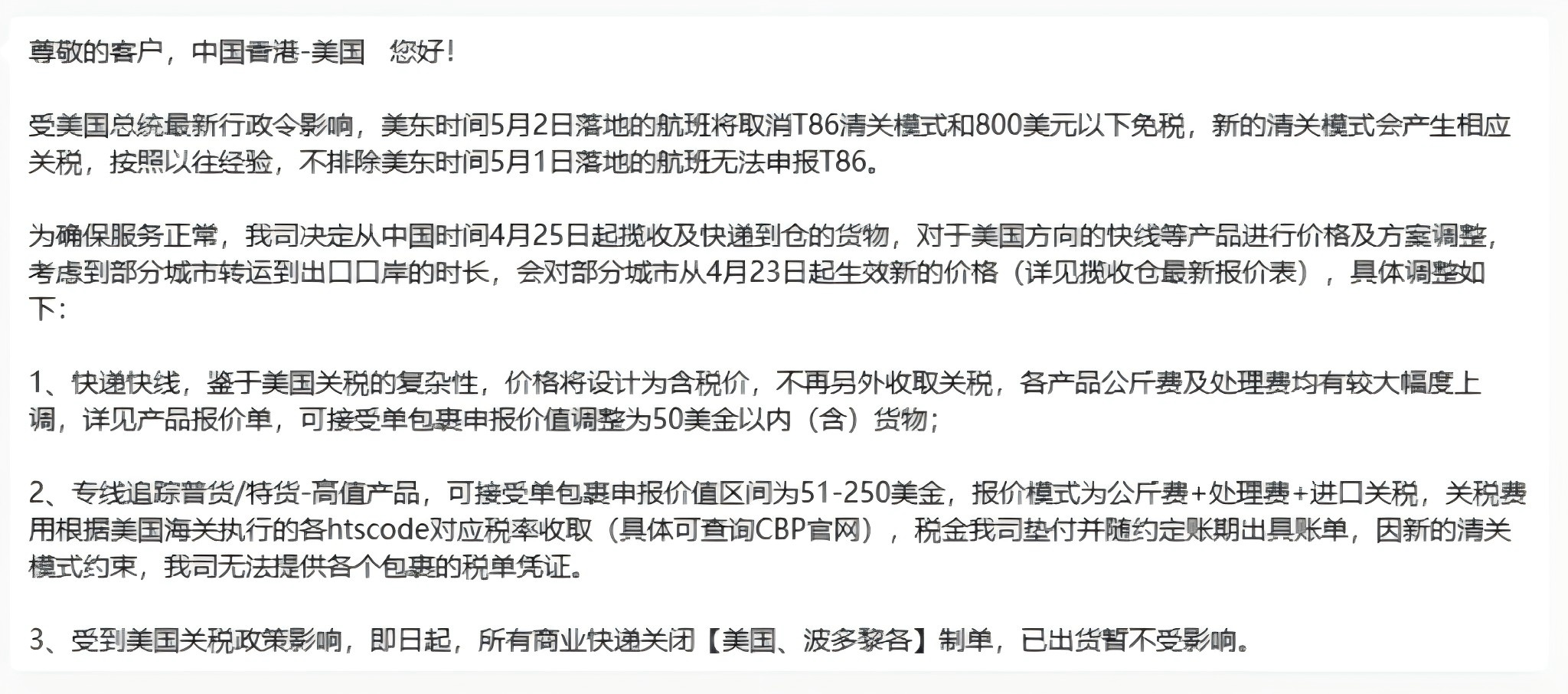

Yanwen has gradually adjusted since April 25, with express and fast line prices now tax-inclusive, dedicated line tracking taxed according to cargo value, and US line order creation in commercial express business suspended;

Image source: Yanwen Logistics

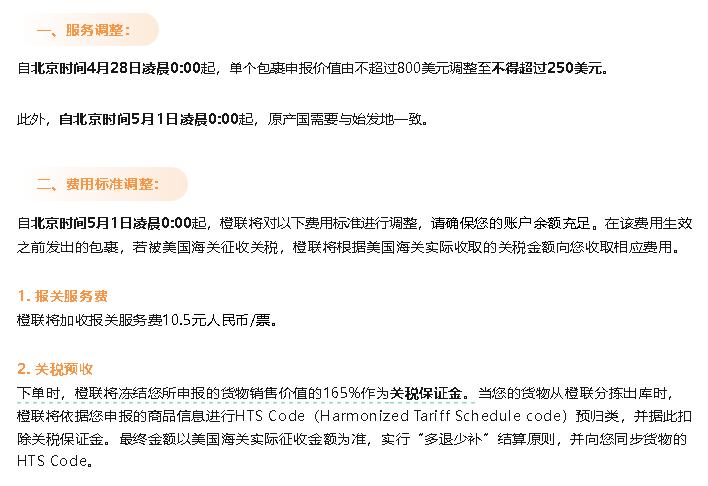

Orange Union, starting May 1, will charge an additional 10.5 yuan customs declaration fee per ticket, freeze 165% of the cargo value as a customs deposit, and the single package declaration limit is reduced to $250.

Image source: SpeedPAK (Orange Union)

At present, the industry has tried alternatives such as T01, T11, and transshipment through neighboring countries, but all have encountered problems such as high tariff costs and difficulty in providing certificates of origin. There is currently no particularly ideal alternative. Some freight forwarders have suspended receiving goods or require high deposits to hedge risks.

The TikTok US acquisition case changes again, sellers are left hanging

Now let's talk about the TikTok US acquisition case. This matter has always been on the minds of countless sellers. Previously, ByteDance had been working hard on the fate of TikTok's US business, and now the acquisition case has encountered new variables.

According to Fox News, due to escalating tensions in US-China trade relations and ByteDance's inability to reach agreement with the US on key terms such as data sovereignty and algorithm control,the TikTok US acquisition case has been officially removed from the government agenda, and may be permanently shelved.

This is another heavy blow for sellers on TikTok Shop US.

Previously, TikTok Shop US finally saw a rebound in performance in March 2025, with monthly GMV exceeding $1.044 billion. Now with new changes in the acquisition case, the future is once again full of uncertainties.

Global layout “blossoming everywhere”

However, there is also some good news recently.US tariffs are expected to drop significantly.

On April 22 local time, US President Trump stated at a White House press conference thatthe high tariffs imposed on Chinese goods will be “significantly reduced”, but not to zero, which means that US-China trade relations are expected to ease, and this is undoubtedly a positive signal for the cross-border e-commerce industry.

In the Southeast Asian market, TikTok announced an investment of over 300 billion baht (about $8.8 billion) in Thailand over the next five years to strengthen its technological infrastructure, build Thailand into the ASEAN digital hub, and help Southeast Asian SMEs master e-commerce skills by expanding the “SOAR Together Program.” Thailand’s market GMV growth rate in Q1 2025 reached 217%, ranking first in the world.

In the European market, on March 31, 2025,TikTok Shop entered core markets such as Germany, Italy, and France. Previously, sites in Spain and Ireland had also gone online, marking a new stage in its strategic layout in Europe.

In addition, in 2025,TikTok Shop’s Brazil site opened for local sellers to join, further consolidating its presence in the Latin American market after the Mexico site, andthe Japan site is also planned to open for entry in June.

TikTok Shop opens three major European sites. Image source: ecommercenews.eu

In the face of these changes, Tuke will also continue to keep a close eye and bring you the latest information. At the same time, Tuke is actively researching feasible solutions to save costs, hoping to provide some practical help and advice for sellers during this turbulent period.

If you have any ideas or questions, you are also welcome to consult Tuke at any time. Let’s stick together and get through this difficult time.

In short, the road ahead is still long and there are many challenges. But as long as we work together, we will always find a way to break through and continue to ride the wave of cross-border e-commerce!