Amid the rapid development of global cross-border e-commerce, logistics efficiency has become the core battleground for enterprises. An efficient logistics network is not only key to enhancing the consumer shopping experience, but also the cornerstone for companies to successfully expand into overseas markets.

International logistics giant DHL, well-versed in this field, recently announced a major investment at Lyon-Saint Exupéry Airport in France.

Image source: Internet

The total investment in DHL’s new logistics hub here reaches as high as €121 million, covering an area of 50,000 square meters. It is DHL’s second largest investment project in France, second only to the Paris Charles de Gaulle Airport air hub. DHL announced that a new multifunctional port will be launched at the airport, dedicated to handling international time-definite express (TDI) and international day-definite express (DDI) shipments.

The parcel handling capacity of the new hub is a leap forward. Its maximum processing capacity will reach 17,500 parcels per hour, five times the capacity of existing facilities.

Currently, DHL’s local logistics center processes about 38,000 parcels per day, rising to 60,000 during holiday peaks. As a global leader in express delivery, intercontinental transport, and air freight, DHL boasts a vast network covering more than 220 countries and regions worldwide. The launch of the new hub will greatly ease its logistics pressure and significantly improve parcel handling efficiency and network resilience.

Image source: DHL

However, the competitive landscape of logistics giants is being rewritten. Leveraging its long-accumulated vast infrastructure and comprehensive logistics system, e-commerce giant Amazon has emerged as a force to be reckoned with. According to the "Top 50 Global Freight Companies" list published by Transport Topics, Amazon surpassed traditional logistics giants UPS, FedEx, and DHL in both 2023 and 2024, claiming the top spot as the world’s largest freight company for two consecutive years.

In cross-border e-commerce transactions, logistics timeliness is the key factor determining customer experience. Whether it’s a platform or a logistics provider, whoever can deliver goods to consumers faster will win greater customer trust and loyalty.

Image source: Transport Topics

Cost Reduction and Efficiency Improvement: Survival Rules in Adverse Conditions

In recent years, global freight market demand has remained sluggish, and the entire industry faces the challenge of insufficient growth momentum. DHL CEO Tobias Meyer once pointed out that between 2022 and 2024, DHL’s mail business volume dropped sharply by 20.3%. Profit pressure hangs over many logistics companies, and DHL is no exception.

Its published 2024 financial report shows: annual revenue increased by 3% year-on-year to €84.186 billion, but EBIT (earnings before interest and taxes) fell by 7.2% year-on-year; free cash flow also declined by 11% year-on-year.

Facing turbulent economic expectations (DHL expects the situation to continue into 2025), the company has not given up hope for growth, but has shifted its focus to "cost reduction and efficiency improvement." Tobias Meyer clearly stated: "We are actively improving efficiency, aiming to save more than €1 billion in costs by 2027."

Image source: DHL

To this end, DHL has taken a series of decisive measures:

Streamlining business and assets: In March this year, DHL announced it would cut about 8,000 positions in its domestic mail and parcel delivery business in Germany, then sold its subsidiary carrier Standard Forwarding; in May, it announced plans to cut 346 employees from its contract logistics division by the end of August and close a distribution center in Ontario, California.

Price and service adjustments: Announced that starting July 1 this year, DHL parcel and DHL return services will be charged at a unified rate (excluding DHL small parcel service), and parcel prices will be adjusted. Although the cost per shipment has decreased, for sellers with smaller shipping volumes, the unified rate may mean increased costs.

Image source: DHL

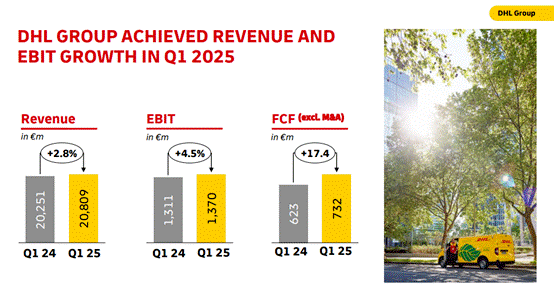

These "combination punches" have begun to show results. In the first quarter of 2024, DHL achieved revenue of €20.81 billion, a year-on-year increase of 2.8%; EBIT reached €1.37 billion, up 4.5% year-on-year; consolidated net profit grew by 6.2% year-on-year to €790 million. Tobias Meyer attributed this positive trend to "strict management of costs and returns."

Image source: DHL

New Hub: Strategic Pivot Amid Challenges

Against the backdrop of industry-wide pressure and internal cost reduction and efficiency improvement, DHL still chose to invest over €100 million in building its second largest logistics hub in Lyon, France—a major strategic decision made after careful consideration.

Despite the current challenges facing the global logistics industry, the long-term prospects for the cross-border e-commerce sector remain broad, driven by continuous optimization of logistics technology and increasing efficiency. For DHL, this modern, high-efficiency Lyon hub is a key pivot for optimizing its global network layout and reshaping future competitiveness. It embodies DHL’s determination to strengthen its core capabilities and seize future growth opportunities amid adversity.