This document is the "2024 Overseas Jewelry Brand Influencer Marketing Insights Report" released by the Nox JuXing Data Research Center in November 2024. It mainly analyzes the current situation and trends of overseas influencer marketing for jewelry brands in 2024 from the perspectives of market insights, influencer marketing insights, influencer marketing data, and category influencer insights, providing references for brands going global.

1. 2024 Global Jewelry Market Insights

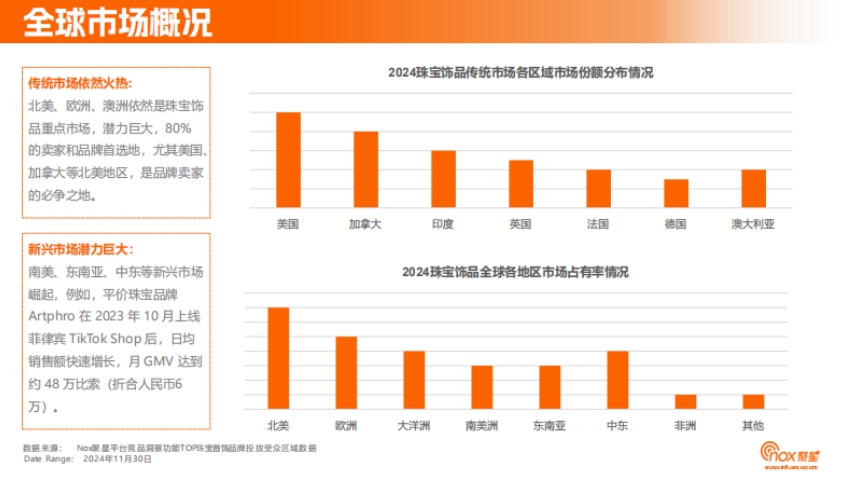

- Market Overview: Emerging markets such as South America, Southeast Asia, and the Middle East are rising, and affordable jewelry brands are developing rapidly; traditional markets such as North America, Europe, and Australia remain key markets with huge potential.

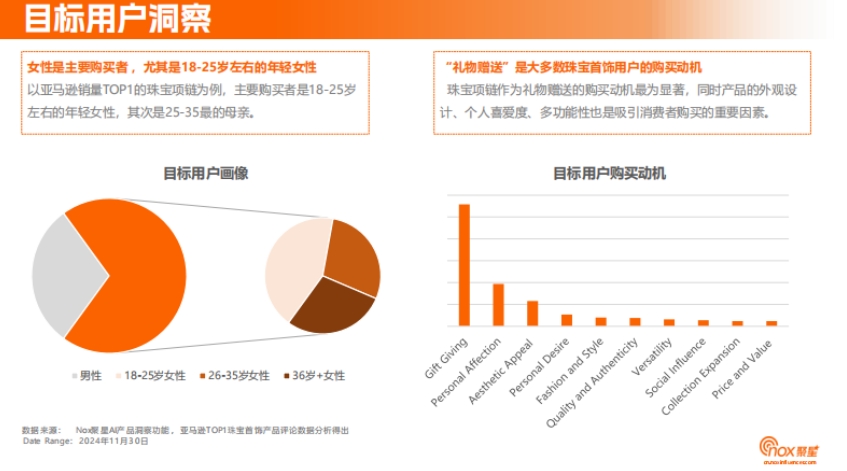

- Target User Insights: Women are the main buyers, especially young women aged around 18 - 25; "gift giving" is the main purchase motivation, while product appearance design, personal preference, and multi-functionality are also important factors.

- Product Trend Analysis: Necklace category is a hot seller, smart jewelry is on the rise, and lab-grown diamonds are attracting attention.

2. 2024 Jewelry Brand Influencer Marketing Insights

- Popular Placement Regions: The US is the hottest, followed by India, the UK, Vietnam, etc.; the share of placements in leading European and American markets is expanding, and some regions have high demand for specific jewelry.

- Popular Placement Platforms: Instagram leads by far, followed by YouTube; the former is suitable for showcasing products, while the latter is good for displaying product details.

- Popular Influencer Types: Fashion influencers are the most favored, especially those in fashion styling, fashion reviews, and fashion product recommendations.

- Popular Influencer Levels: Small and micro influencers continue to be favored, with mid-tier influencers (50,000 - 500,000 followers) being the most loved by jewelry brands.

- Popular Collaboration Forms: Mention, product placement, and customization are the main forms, with unboxing being highly favored.

3. 2024 Jewelry Brand Influencer Marketing Data

- Brand Insights: Taking brands such as 4℃, MOTF, PDPAOLA, ARTPHRO, BRILLIANT EARTH as examples, the report analyzes data such as the distribution of cooperating KOL follower levels, main country markets, placement platforms, number of ad videos, total exposure, classification of cooperating KOLs, and popular tags, showcasing different brands' marketing strategies and results.

- Brand Strategy Analysis: Artphro focuses on the Philippine market, emphasizes brand building, adopts differentiated strategies, and deeply cultivates the influencer economy; Brilliant Earth targets special group needs, provides customized services, and breaks boundaries through influencer marketing.

4. 2024 Jewelry Category Influencer Insights

- Regional and Platform Distribution: North America and Asia are the main distribution areas for fashion jewelry influencers, with Instagram as the main platform; jewelry influencers on YouTube are mainly distributed in Asia, while those on TikTok and Instagram are more concentrated in North America.

- Level Distribution: There are many small and micro influencers, especially on Instagram, where their number far exceeds other platforms; TikTok has more small and micro influencers than YouTube and has great development potential, but the number of medium and large influencers is less than YouTube; Instagram is the preferred operating platform for jewelry influencers of all levels.

- Popular Tag Features: The distribution of popular tags on the three platforms has its own characteristics. Tags led by #jewelry remain highly popular, and tags such as #fashion, #necklace, #bracelet also have high popularity.

- Influencer Resource List: Lists information on some jewelry category influencers, including follower count, engagement, region, and areas of expertise.