This document is a retrospective analysis of the Chinese automotive industry's overseas expansion in 2024 by the CAIC International Research Team, covering aspects such as policy, passenger vehicles, commercial vehicles, and the industrial chain. It aims to provide comprehensive market information and development recommendations for the overseas expansion of China's automotive industry.

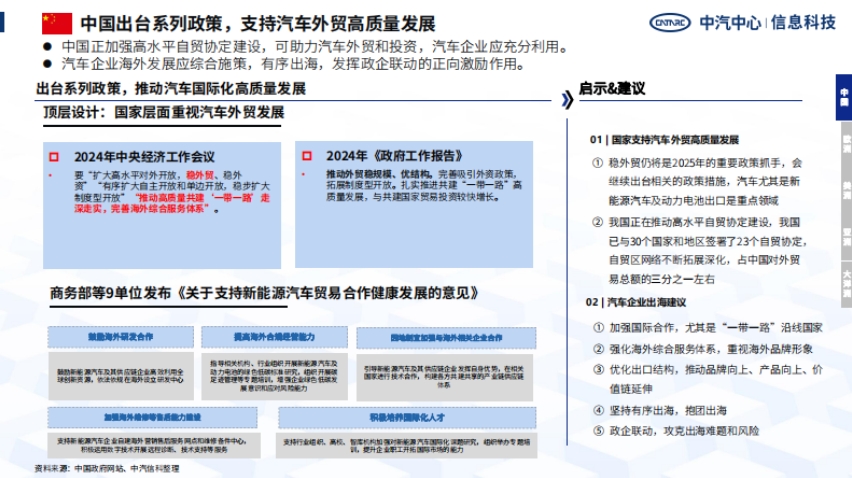

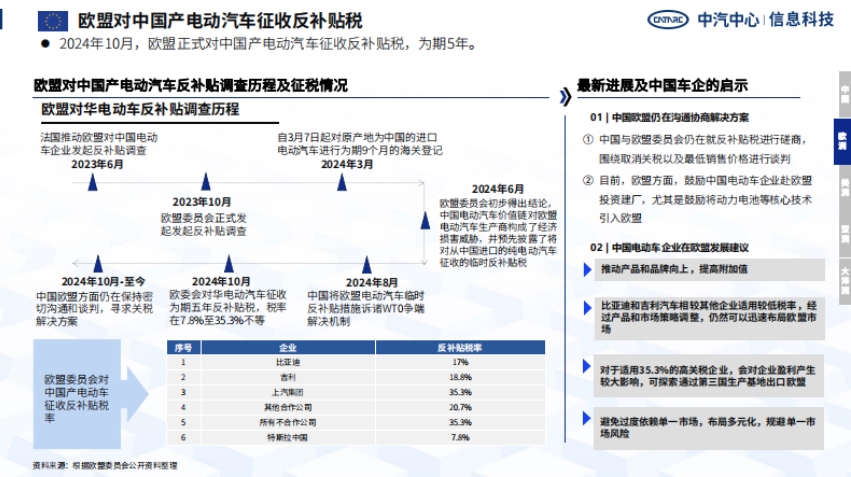

1. Policy Section: China has introduced a series of policies to support the high-quality development of automotive foreign trade, such as the Central Economic Work Conference and the "Government Work Report," which emphasize stabilizing foreign trade and promoting the construction of high-level free trade agreements. Meanwhile, overseas countries are showing trends such as the generalization of national security concepts, increased CBU import taxes and fees, and the emergence of new barriers. For example, the EU has imposed anti-subsidy tariffs on Chinese-made electric vehicles, and the US has introduced multiple measures to restrict Chinese-made electric vehicles from entering the US market.

2. Passenger Vehicle Section: In 2024, China exported 5.496 million passenger vehicles, a year-on-year increase of 24.0%, with the overall export unit price declining and new energy vehicle exports growing rapidly. Key enterprises such as Chery, SAIC, and Geely performed outstandingly in exports, and the influence of Chinese brands in overseas markets is gradually increasing, with a significant trend of localized production in some countries.

3. Commercial Vehicle Section: In 2024, China exported 794,000 trucks, a year-on-year increase of 16.1%, mainly to Central and South America, the CIS, and Africa; bus exports reached 82,000 units, a year-on-year increase of 15.8%, mainly to Central Asia-Pacific, Central and South America, and the Middle East. The overseas commercial vehicle market performance in some key countries is slightly weak; Chinese brands occupy a large share of the Russian truck market but have a relatively small share in the Brazilian truck market.

4. Industrial Chain Section: In 2024, China's auto parts exports reached 664.76 billion yuan, a year-on-year increase of 7.8%, but the overall growth rate still lags behind that of complete vehicle exports. The overseas expansion of various system component enterprises varies: power systems are mainly focused on commercial vehicles, body systems target Europe and North America, automotive electronics are concentrated in the European market, chassis systems have relatively little overseas layout, and power battery enterprises occupy a large share of the global market and are actively expanding in Europe.