In recent years, the Southeast Asian market has become a popular choice for enterprises going Tuke, and Indonesia, with its unique advantages, has attracted the attention of a large number of investors. For companies wishing to establish a presence in Indonesia, it is crucial to understand the local investment environment, policy incentives, and potential risks.

Image source: Internet

Indonesia's Market Potential and Investment Appeal

According to the “2025 Indonesia Guide” released by Hongxin International, as the largest economy in Southeast Asia, Indonesia has a population of 270 million, and its huge consumer market provides enterprises with broad development space.

Here, not only is the labor cost low, but there are also abundant natural resources, from palm oil and rubber to nickel ore and natural gas. These resources provide a solid foundation for the manufacturing and energy industries.

In addition, the Indonesian government has continuously optimized foreign investment policies in recent years, simplifying approval processes and further lowering the entry threshold for enterprises.

Geographically, Indonesia controls key shipping lanes such as the Strait of Malacca, serving as a hub connecting Asia and Oceania.

For companies relying on international trade, this is undoubtedly an ideal choice for regional deployment. Coupled with the advancement of the “Industry 4.0” plan, Indonesia is gradually improving its infrastructure and industrial level, with considerable future growth potential.

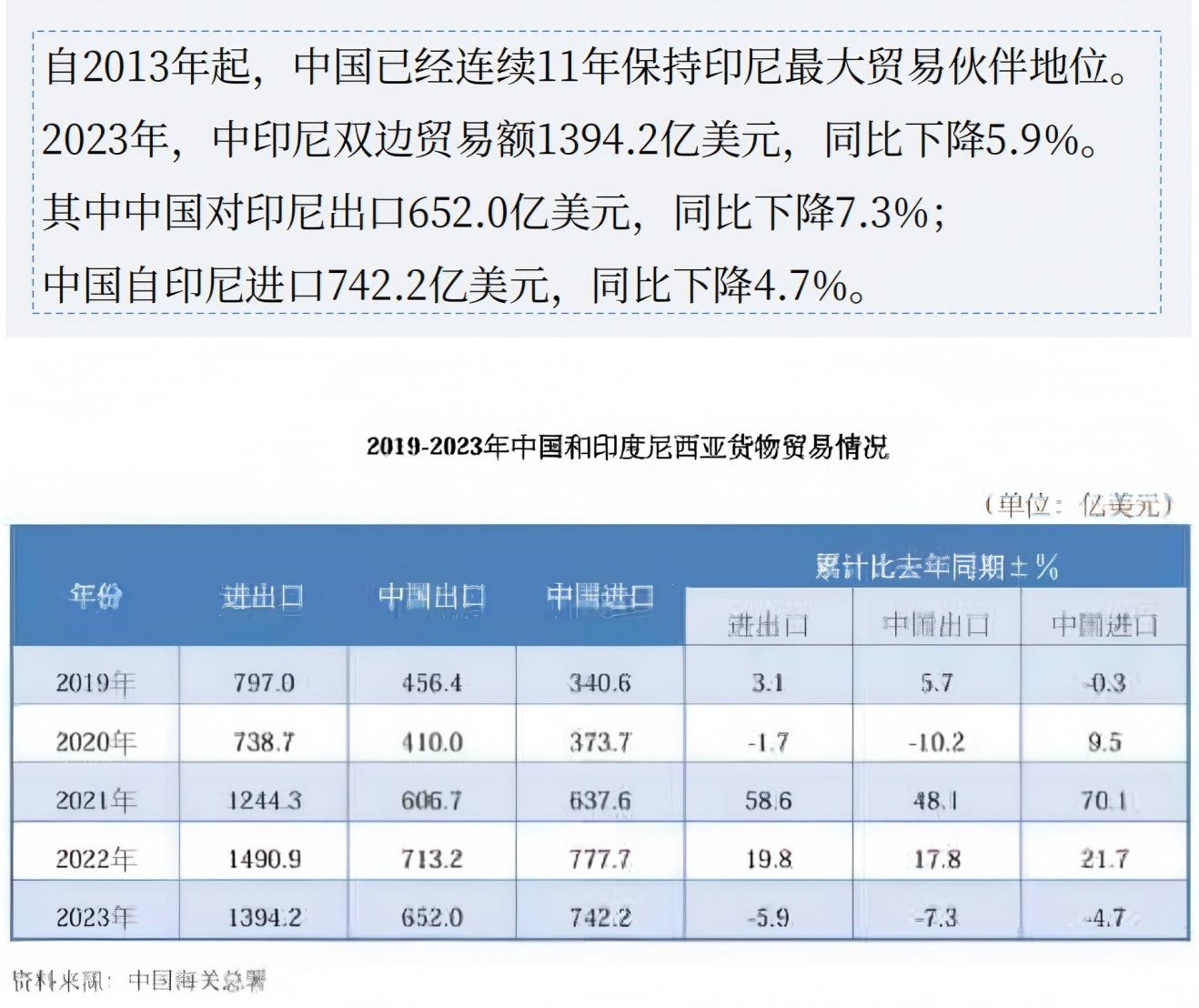

Image source: “2025 Indonesia Guide”

Key Industries and Investment Opportunities

Indonesia has a diverse industrial structure, and its mineral resource development has always been a focus for foreign investment, especially nickel and coal. The government guides foreign investment into downstream processing sectors, such as smelters and battery material production, through policies.

In manufacturing, the textile, electronics, and automotive industries already have a certain foundation, but there is still room for improvement in technology and capacity, which provides cooperation opportunities for enterprises with advanced technology.

Tourism is also one of Indonesia's pillar industries. In 2023, the number of foreign tourists nearly doubled year-on-year, driving the prosperity of related industries such as hotels, catering, and leisure entertainment.

Moreover, the digital economy in Indonesia is developing rapidly, with strong demand in e-commerce, fintech, and logistics, making it suitable for asset-light enterprises to quickly enter the market.

Image source: “2025 Indonesia Guide”

Policy Incentives and Special Economic Zones

To attract foreign investment, Indonesia has established multiple economic and industrial zones, offering policies such as tax reductions and land incentives.

For example, in the economic zones of Batam and Bintan islands, enterprises can enjoy a 5-10 year corporate income tax exemption period, and imported equipment and raw materials can also be exempted from tariffs.

These areas are adjacent to Singapore, allowing enterprises to fully utilize Singapore's financial and logistics advantages while reducing operating costs.

In terms of taxation, Indonesia's corporate income tax rate is 22%, but there are additional incentives for small and micro enterprises.

It is worth noting that if enterprises reinvest dividends in Indonesia, personal income tax can be reduced to 0%, a policy that encourages long-term foreign investment.

Furthermore, the government also plans to introduce a carbon emission tax, focusing on highly polluting industries, and environmentally friendly enterprises may receive more support.

Image source: “2025 Indonesia Guide”

Challenges and Suggestions

Despite the many opportunities, the Indonesian market also faces some challenges. For example, land policies stipulate that foreign capital cannot directly own land, and can only obtain rights for a limited period through building rights or usage rights. This requires enterprises to make long-term plans before investing.

Moreover, although the labor market is large, the skill levels are uneven, and the employment of expatriates is strictly restricted. Enterprises need to plan for local talent cultivation in advance.

In addition, Indonesia's legal system is very complex, and implementation standards may vary in different regions. Therefore, it is recommended that enterprises consult professional institutions before entering the market to ensure compliant operations.

Image source: Internet

Conclusion

As the core market of Southeast Asia, Indonesia offers both attractive growth potential and unique operational challenges.

For Tuke enterprises, the key is to identify the right industry entry point, make full use of policy incentives, and at the same time, carry out effective localization strategies.

Whether it is resource development, manufacturing upgrades, or digital economy services, Indonesia offers a wealth of possibilities.

With early planning and steady advancement, long-term success can be achieved in this hot land.