In the vast world of fashion e-commerce, the apparel market, with its enormous scale and continuous growth momentum, has become the "cake" that many merchants are vying for.

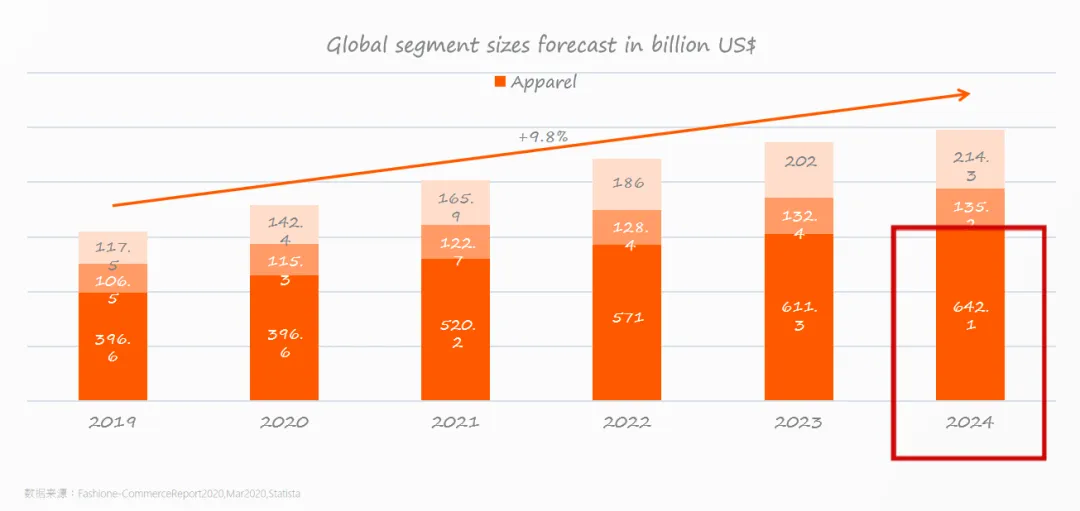

According to forecasts, by 2024,global apparel e-commerce sales will soar to an astonishing $642.1 billion, accounting for 64.8% of total fashion e-commerce sales. This data undoubtedly highlights the strong momentum of online apparel sales. Especially in the women's clothing sector, its online market share is gradually increasing, becoming an important force driving the growth of the entire apparel e-commerce market.

Image from the Internet

As a leader in global e-commerce, the Amazon platform attracts the attention of about 119 million apparel consumers every month. Its mobile flagship store provides brands with valuable opportunities to reach more fashion enthusiasts, with nearly 40 million users visiting Amazon each month and actively engaging with fashion-related content.

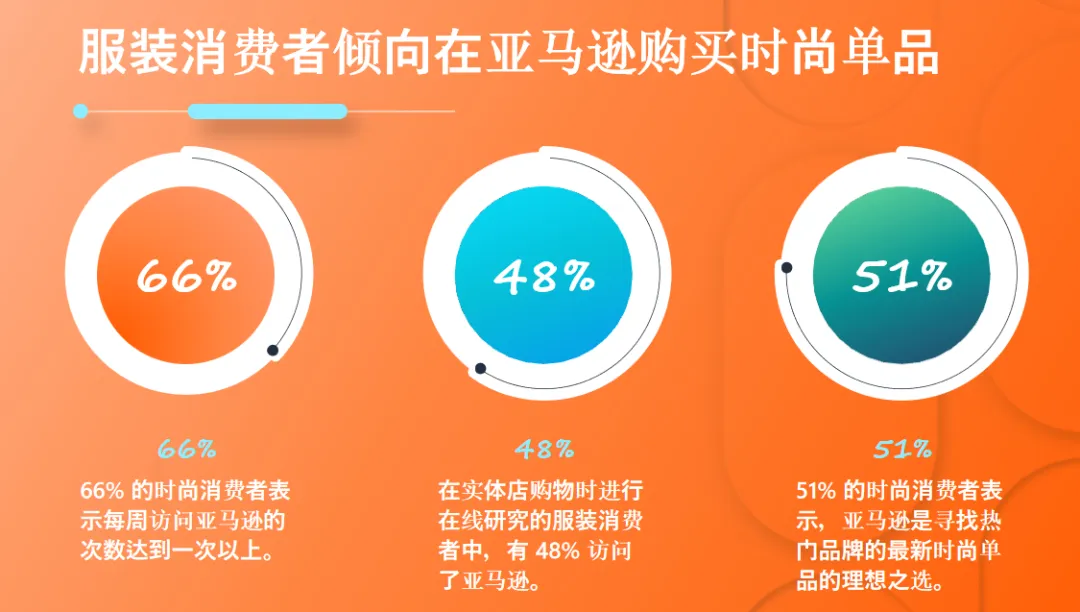

On the Amazon platform, purchasing preferences for fashion items show distinct characteristics: 66% of fashion enthusiasts visit Amazon at least once a week; over 50% of fashion consumers consider Amazon the top platform for finding trendy items from popular brands; 48% of apparel consumers choose to visit Amazon for online research before shopping in physical stores, further demonstrating the platform's strong appeal to users.

Image from the Internet

The most favored categories among new apparel consumers includesportswear, women's apparel, accessories, socks and underwear, as well as children's and baby clothing. The popularity of these categories not only reflects consumers' dual pursuit of fashion and comfort, but also reveals the future development trends of the apparel market.

It is worth mentioning that basic apparel occupies the largest market share in the apparel sector and continues to grow. Its sales rank first among apparel categories, and its sales growth rate is also among the highest, exceeding the growth rate of other apparel subcategories by 30%-40%, providing huge business opportunities for merchants of basic apparel.

Amazon apparel consumers typically conduct multiple keyword searches and browse product detail pages before making a purchase decision. This behavioral pattern indicates that consumers pay more attention to information acquisition and comparison during the shopping process, gaining a deeper understanding of products.

At the same time, apparel consumers generally have trust in brands and are willing to try new brands. This characteristic provides broad development space for emerging brands and prompts brand owners to continuously strengthen brand building and promotion while maintaining product quality and uniqueness.

Image from the Internet

With the increasing awareness of environmental protection, consumers are raising higher requirements for the environmental friendliness and sustainability of apparel. The McKinsey 2020 Fashion Industry Report points out that environmental protection and sustainability have become key concerns for consumers. Overseas consumers are more inclined to choose "ethical fashion," that is, brands that focus on environmental protection and adopt sustainable materials and production methods.

For Chinese sellers, when building a brand, they should actively respond to this trend,integrating green, environmentally friendly, and public welfare production, manufacturing, and sales measures into the brand concept to attract more consumer attention and favor.

Image from the Internet

In summary, the Amazon apparel category in 2025 will show diversified, personalized, and sustainable development trends. Merchants should keep up with the trends, deeply understand consumer needs and market changes, continuously optimize product structure and enhance brand influence to stand out in fierce market competition.

At the same time, focusing on environmental protection and sustainability and actively fulfilling social responsibilities will help brands win more consumer trust and support.