On February 1, 2025, Trump signed an executive order announcing a 10% tariff on goods imported from China, sparking widespread controversy in the international community.

However, less than a month later, on February 27, Trump announced again that an additional 10% tariff would be imposed on Chinese goods starting March 4, bringing the total tariff rate to 20%. At the same time, the 25% tariff on Mexico and Canada was reinstated.

White House officials have confirmed that this move aims to "curb the inflow of fentanyl" and reverse the trade deficit, but some analysts point out that tariffs are actually a tool of pressure and may later be linked to the "reciprocal tariffs" on April 2, further expanding the scope of taxation.

Image source: Reuters

This round of tariff increases marks the continuation and escalation of Trump's second-term trade policy.

As early as January 2025, Trump had signaled that he might impose a 60% tariff on Chinese goods, but ultimately chose to implement it in stages.

Although Wall Street once worried about the impact of high tariffs, the current 20% rate is still lower than market expectations, showing Trump's weighing of inflationary pressure and political goals. The U.S. budget deficit for 2024 is as high as $1.8 trillion, and tariff revenue can partially ease fiscal pressure. However, if prices are pushed up, it may trigger voter dissatisfaction.

Image source: Reuters

Cross-border Sellers Face "Triple Blow": Cost, Model, and Compliance Risks

1. Soaring Costs and Squeezed Profits

The 20% tariff directly leads to increased export costs. If U.S. importers require Chinese companies to share the costs, profit margins will be greatly squeezed. For example, for a product priced at $100, the tariff cost may increase by $20. Small and medium sellers may be forced to raise prices by 10%-15%, but their low-price advantage will be weakened, and orders may shift to alternative sources such as Southeast Asia.

Image source: Internet

2. "Wide Distribution + Low Price" Model Fails

Sellers relying on the "wide distribution" model with small profits and quick turnover are the first to be hit. Industry insiders point out that about half of small and medium sellers in Shenzhen use "gray customs clearance" to evade tariffs, but under the new policy, customs inspections are becoming stricter and compliance costs are rising sharply. Well-known brands, with stronger premium capabilities, can still absorb the costs, but generic sellers may face elimination.

3. Supply Chain and Logistics Challenges

Some companies plan to shift production capacity to places like Vietnam and Mexico, but must meet rules of origin (such as Mexico needing to comply with the USMCA), and deal with local supply chain shortcomings and rising labor costs. In addition, stockpiling goods in advance may lead to overseas warehouse overload, lower inventory turnover, and further increase financial pressure.

Image source: Internet

Although China has filed a lawsuit with the WTO and plans to take countermeasures, the pressure from tariffs is unlikely to be relieved in the short term.

Cross-border sellers need to face two major trends: First, the long-term nature of policy uncertainty. Trump may continue to use tariffs as leverage, demanding concessions from China in areas such as fentanyl control and market access. This strategy aims to create trade tensions and force China to make more compromises in negotiations, thereby securing more favorable trade terms for the U.S.

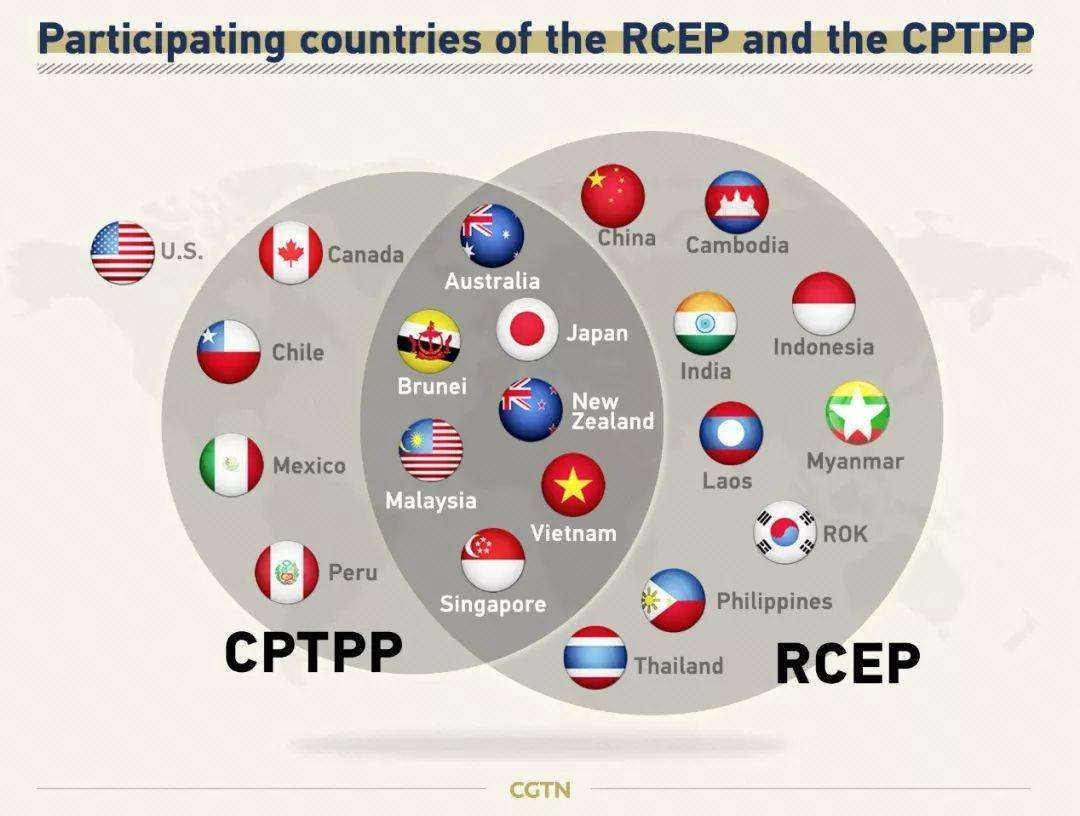

Second, the acceleration of global supply chain restructuring. With the implementation of the Regional Comprehensive Economic Partnership (RCEP), more than 90% of goods trade within the region will eventually achieve zero tariffs. This makes the RCEP region (including Japan, South Korea, and ASEAN) a new trade hotspot due to tariff preferences. Enterprises with supply chain integration capabilities will be able to better leverage this advantage by optimizing resource allocation, reducing operating costs, and standing out in the process of regional economic integration.

Image source: Internet

The tariff escalation is not only a severe challenge for cross-border sellers, but also an important opportunity for industry reshuffling. In the new trade environment, sellers must break away from the old model of relying solely on low-price competition and shift to a three-dimensional competitiveness centered on brand building, supply chain optimization, and market insight. Only by quickly adapting to this change and actively adjusting strategies can cross-border sellers find opportunities to break through in the midst of the trade war and achieve sustainable development.

(Note: The information in this article is compiled from various public news reports, and policy details are subject to official releases.)