The logistics competition in South Korea's e-commerce market is entering a white-hot stage.

Industry leader Coupang recently announced that it will invest 100 billion KRW in Jecheon, North Chungcheong Province, to build a new generation AI logistics center, which is planned to be operational by June 2026. This is another key move in logistics infrastructure after previously investing 200 billion KRW in an automated logistics base in Gimhae, South Gyeongsang Province.

Coupang's newly built AI logistics center Image source: nate

3 Trillion KRW Bet on Logistics Infrastructure

As the long-term leader in South Korea's e-commerce market, Coupang's ambitions go far beyond two logistics centers. In March last year, the company announced an investment plan totaling 3 trillion KRW, aiming to cover nine core regions in South Korea with its logistics network by the end of 2026 and fully realize nationwide "Rocket Delivery." The name of this service directly reflects its core advantage: relying on a dense warehousing network, over 80% of Korean users can enjoy same-day or next-day delivery.

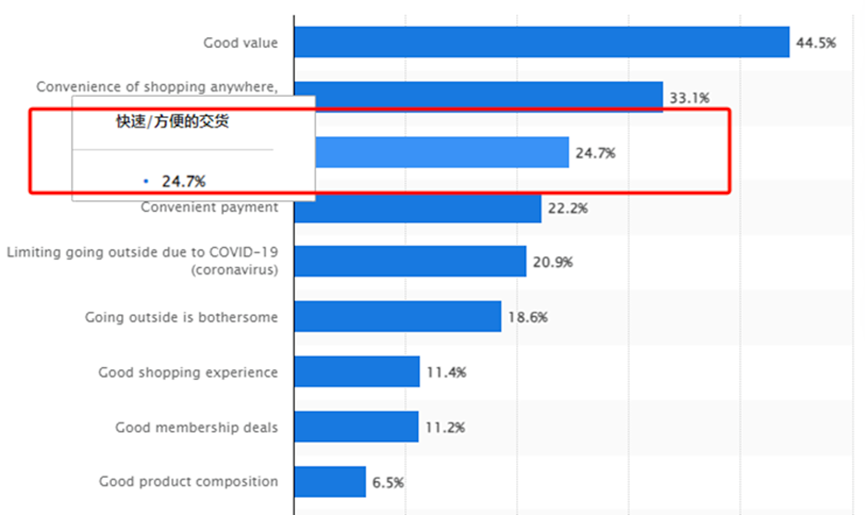

There is a clear business logic behind the heavy investment. According to Statista, 24.7% of Korean consumers list delivery speed as the third most important factor in online shopping decisions, second only to product cost-effectiveness (44.5%) and shopping experience (33.1%). Supplementary data from FedEx is even more striking: 50% of consumers will directly change their purchase decisions due to delivery timeliness. Clearly, logistics efficiency has become the core battleground for e-commerce platforms to compete for users.

Logistics efficiency becomes the primary consideration for online shopping Image source: Statista

Encirclement Battle by Domestic and International Giants

Coupang's aggressive expansion is not without pressure. International e-commerce giant Alibaba has announced a $200 million investment to build an integrated logistics center in South Korea, attempting to grab a share of the market. Local rival Naver has launched the "Naver Delivery" service, which uses algorithm optimization to shorten average delivery time by two hours and plans to fully implement it by the end of this year.

Small and medium platforms are also unwilling to be left behind: Gmarket has partnered with CJ Logistics to launch a 7-day delivery system operating year-round; 11Street has introduced "Express Weekend Delivery" for the Seoul metropolitan area, allowing consumers to receive same-day delivery if they place orders before 11 a.m. on Saturdays. These innovative services are continuously raising industry standards, forcing leading companies to keep increasing their investment in technology.

Naver's diversified delivery services Image source: Naver

The Strategic Significance of AI Logistics Centers

Facing competitive pressure, Coupang has chosen AI technology as the key to breaking the deadlock. The newly built Jecheon logistics center will fully apply intelligent sorting systems and dynamic route planning algorithms, which are estimated to greatly increase daily processing capacity and reduce error rates. Combined with the Gimhae logistics center's specialized delivery capability for daily necessities, the company is attempting to build a complete supply chain from daily fast-moving consumer goods to high-end products.

It is worth noting that while investing in technology, Coupang also plans to add more than 10,000 new logistics positions. This parallel strategy of "machine replacing humans" and "expanding manpower" not only ensures service stability during the automation transition period but also reserves human resources for future business expansion.

Image source: Chosun.com

Industry Reshuffle Behind the Logistics Competition

This trillion-level logistics competition is essentially a battle for the time value of consumers. When "same-day delivery" becomes a basic service, segmented demands such as "on-time delivery" and "scheduled delivery" are creating new market space. Some analysts point out that in the next three years, the scale of e-commerce logistics investment in South Korea may exceed 5 trillion KRW, and intelligence, grid-based, and specialization will be the key to victory.

For ordinary consumers, the service upgrades brought by the giants' battle are already clearly perceptible. From one-hour fresh delivery to next-morning arrival for midnight orders, ever-improving timeliness standards are reshaping Koreans' shopping habits. From an industry perspective, in this never-ending marathon, only players with both technological accumulation and financial strength may have the last laugh.