The gates of Mexican customs are slowly coming down. Since the Mexican government implemented a series of new import regulations, its almost "strict" customs clearance procedures have brought a lot of trouble to cross-border sellers.

The most headache-inducing change for sellers is the cancellation of the simplified parcel clearance system, especially the significantly strengthened supervision of goods such as automobiles, motorcycles, bicycles, and their accessories.

These goods, which previously enjoyed fast-track clearance, are now included in the exclusive customs regime of "Appendix 21 of the Customs Regulations" and can only be cleared at designated ports.

Image source: Internet

01 Double Blow of Tariffs and Inspections: Sellers Face "Hell-Level" Clearance

Mexican customs clearance has long been known as "devil clearance," but the policy upgrade in 2025 has pushed the difficulty to the extreme. Although sellers previously could clear customs quickly through the T1 e-commerce clearance model, the new exclusive customs regime has caused the retention rate of non-local parcels to soar.

"During the Manzanillo port strike, more than 5,000 trucks were stuck at checkpoints every day," a logistics company report shows. "Once the customs 'red-green light inspection system' turns red, inspections start at 3 days, and if there is a Tactical Force secondary inspection, you have to wait at least another 5 working days."

Manzanillo port strike scene Image source: LatinUS

02 Platforms Forced to Cancel Orders, Sellers Deeply Trapped in Compliance Maze

The chain reaction triggered by the new policy is destroying the delivery chain of cross-border orders.

Mexican customs expert El Rayo Aduanero revealed on TikTok: Due to the lack of authorized customs in non-capital regions, Amazon has already canceled a large number of non-local orders.

Some sellers posted warning notices on logistics forums: "A certain customs broker had 986 containers detained, and it is recommended to immediately change the clearance method for those not released after more than 15 days."

Platforms are also simultaneously pressuring for compliance:

△ TEMU requires sellers to provide RFC tax numbers, otherwise shipments will be stopped

△ Mercado Libre pre-deducts VAT from payments transferred to international accounts

△ Amazon withholds 16% VAT on payments to non-Mexican bank accounts

This series of reactions has ultimately reached the consumer end, with a large number of complaints appearing on Mexican social platforms: Residents of Nuevo León in the north had their bicycle accessory orders refunded unilaterally by the platform; buyers in the Yucatán Peninsula had branded sports shoes returned due to "no authorized clearance point."

Image source: EL IMPARCIAL

03 Policy Shockwaves Affect Global Cross-Border Logistics Chain

Mexico's predicament is not an isolated case; the fragility of cross-border logistics is frequently exposed in global markets.

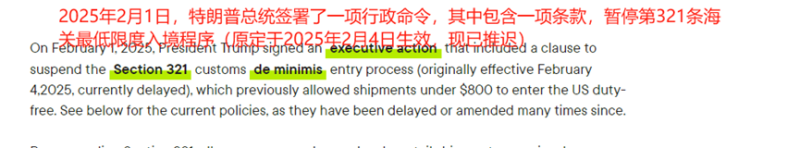

In February 2025, former U.S. President Trump suddenly announced the termination of the T86 clearance model (Section 321 Type 86).

This model originally provided a fast clearance channel for low-value parcels with a single ticket value ≤ $800, exempting them from tariffs and some taxes, and was the "lifeline" for many small and medium-sized cross-border sellers.

Image source: DCL

The sudden cancellation of T86 triggered a panic shipping wave. Sellers rushed to send goods to the U.S. before the policy took effect, but U.S. customs severely overestimated its own processing capacity. Coupled with the temporary suspension of the U.S. Postal Service (USPS), the clearance system was nearly paralyzed.

At JFK International Airport in New York alone, millions of small parcels were backlogged, plunging the cross-border logistics chain into massive chaos, ultimately forcing the U.S. government to postpone the implementation of this decision.

Image source: Internet

The sudden change in Mexico's customs clearance policy is like a mirror, reflecting the systemic risks faced by global cross-border e-commerce.

When convenient simplified channels are blocked, and whether goods can clear customs depends on which specific port they arrive at, the livelihoods of countless small and medium-sized sellers hang by a thread.

This "customs clearance earthquake" brings not only immediate order losses, but also shakes the very foundation of trust in cross-border trade.