While the overall European economy is still slowly recovering, the German e-commerce market has already ignited a spark.

The latest industry data reveals that in 2025, Germany's online goods consumption will exceed 83.1 billion euros, a year-on-year increase of 3.2%. Not only is the scale impressive, but the growth rate has also surpassed previous market expectations.

This strong performance has been hailed by local industry organizations as "a rare growth highlight in the German economy," and it is predicted that this momentum will continue into 2026.

Image source:ecommercenews.

Platform economy leads growth, significant contribution from Chinese power

A closer look at this growth reveals that platform-based e-commerce has absorbed most of the market dividends.

Among them, cross-border platforms from China stand out. Data shows that about 30% of the growth in Germany's online consumption in 2025 will be contributed by platforms such as AliExpress, Shein, and Tuke.

With their rich product categories, competitive prices, and flexible supply chains, they have firmly captured the attention of German consumers, especially the younger generation seeking value for money, becoming an unignorable force driving market growth.

Industry research institute IFH KÖLN predicts that the German e-commerce market is expected to continue growing until 2030, with an average annual growth rate of about 4%.

On this ever-expanding map, comprehensive platforms represented by Amazon are expected to continue reaping the largest share of growth dividends.

Image source:ecommercenews

Not just "low prices", "second-hand" and "social" become new trends

In addition to traditional product retail, two niche tracks are rapidly emerging in Germany.

The first is second-hand e-commerce. According to estimates by the UK's Centre for Economics and Business Research, the size of Germany's second-hand e-commerce market is expected to climb to 7 billion euros in 2025.

The rise of this trend is partly due to consumers' real need to "save money" under inflationary pressure, and also closely related to the increasingly popular concepts of environmental protection and circular consumption.

The second is the budding of social e-commerce. A recent survey by the German Digital Association Bitkom found that more and more users are beginning to see social platforms such as Instagram, TikTok, and Facebook as shopping channels. Among young people under 30, nearly 30% said they would shop entirely through social media in the future.

This shift indicates that the starting and ending points of shopping decisions are being reshaped by social content, bringing new traffic and conversion logic to the market.

Image source: Internet

Solid market foundation, deepening layout by giants

Germany's rise as the e-commerce highland of Europe is due to its strong fundamentals: the largest economy in Europe, high per capita GDP and disposable income, a huge base of internet users, and a high internet penetration rate, all together forming fertile ground for e-commerce development.

The market structure is also relatively clear. Surveys show that over 70% of German consumers consider e-commerce platforms the most convenient place to shop, giving Amazon a significant share of mind and market.

To consolidate its advantage, Amazon continues to deepen local operations. For example, before the peak season at the end of 2025, it announced the hiring of about 12,000 seasonal employees in Germany.

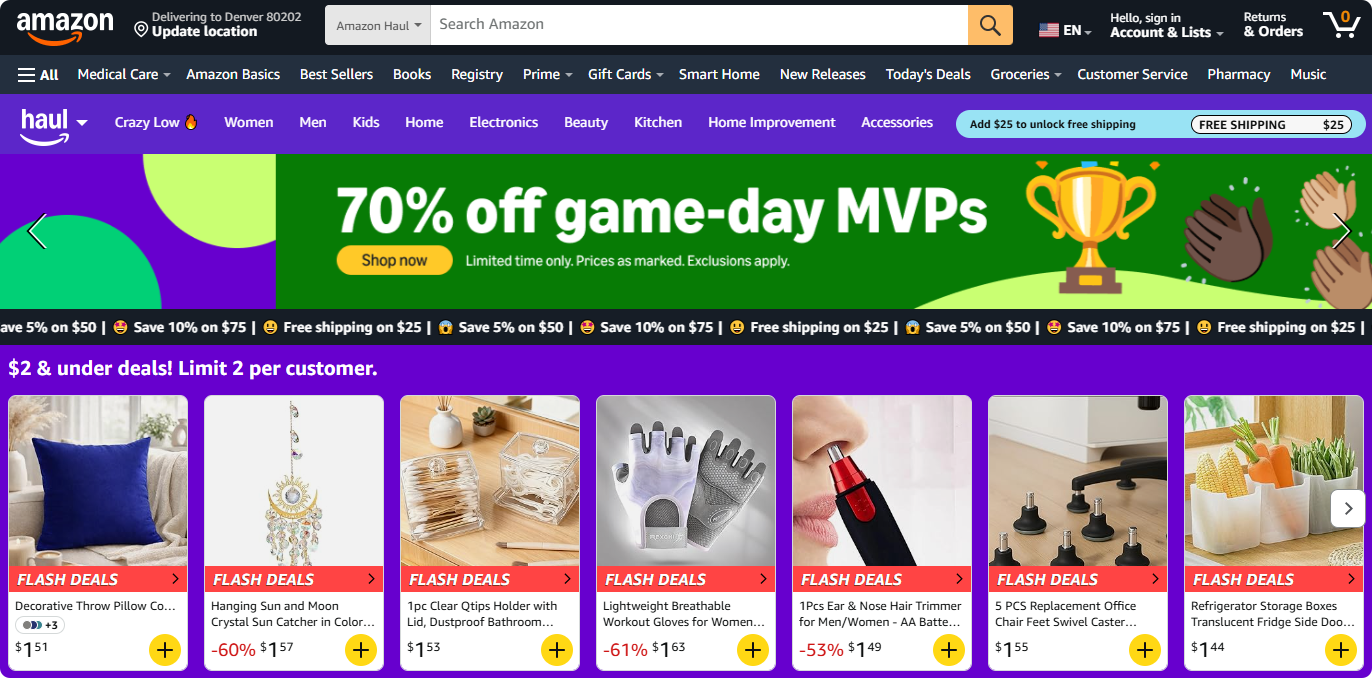

At the same time, to respond to consumers' pursuit of "low prices" and "second-hand" trends, Amazon Germany has also launched a beta version of the low-price section "Amazon Haul", focusing on products under 20 euros and offering corresponding discounts.

Image source:Amazon

In the era of diversified competition, sellers welcome new opportunities

Overall, the German e-commerce market has entered a new stage of steady recovery and structural upgrading. Its solid economic and consumption foundation is the fundamental support for the market's long-term positive outlook. At present, the market is undergoing three major transformations: platform concentration, category segmentation (such as second-hand), and socialization of channels.

It is foreseeable that the future German e-commerce market will no longer be a single-mode arena, but a diversified ecosystem jointly built by platforms, independent sites, social ecosystems, and vertical models. Whoever can more accurately grasp the changes in local consumption trends, and more flexibly adapt to new channels and new playstyles, will have a better chance of winning their own growth space in this competition in the core European market.