Since its launch in France on March 31,,in just six months, the transaction volume of Tuke Shop France has achieved a sevenfold increase. Among them, livestream e-commerce sales have grown steadily by 3.5 times, while short video e-commerce has shown even greater explosive power, becoming the primary driver of sales growth with an astonishing 14-fold increase.

In a mature e-commerce market like France, why has Tuke Shop been able to break through so quickly? Can the logic behind its growth be sustained?

Image source: Les Echos

Rise of the French Market: User Base and Content E-commerce Drive

Thanks to a high 93% internet penetration rate and about 35 million e-commerce users, France, the third largest economy in Europe, provides fertile ground for the prosperity of social e-commerce.

Tuke has about 27.8 million monthly active users in France, and over 200 million monthly active users across Europe. This massive user base provides unique conditions for the rapid development of Tuke Shop.

Tuke Shop adopts a "content discovery + instant purchase" model, providing users with a closed-loop "shoppertainment" experience. Users can place orders directly while browsing short videos or watching livestreams, greatly shortening the consumer decision-making path.

In France, the dual-wheel drive effect of content e-commerce is very significant. On one hand, livestream e-commerce grows steadily, with sales increasing 3.5 times; on the other hand, direct sales conversion from short videos shows even more rapid growth, with a 14-fold increase, establishing its position as the primary growth driver.

Image source: Internet

Platform Strategy Analysis: Low Commission and Local Giants Join

To stimulate initial ecosystem development, Tuke Shop France set its commission rate at 5%, lower than the 9% in mature markets like the UK. This strategy significantly lowers the entry threshold for merchants and accelerates the enrichment of the platform's supply side process.

The commercial ecosystem of the French site has begun to take shape: about 16,500 merchants form its solid supply foundation, and the entry of local giants such as Carrefour and Fnac Darty marks the platform's recognition by mainstream local commercial forces.

The participation of these well-known local enterprises not only enriches the platform's product supply, but also enhances French consumers' trust in Tuke Shop.

Currently, the platform mainly covers core categories such as beauty and fashion, which have high display value and impulsive consumption attributes, and are highly compatible with short video and livestream formats.

According to NielsenIQ data released in August 2025, Tuke Shop has secured a foothold in the French e-commerce market with a 1.13% market share. This achievement not only allows it to surpass traditional platforms such as eBay and La Redoute, but its user penetration rate has also entered the competitive range of mainstream brands like H&M and Boulanger.

Image source: ecdb

Logistics and After-sales: Challenges Behind Growth

Despite rapid growth, the platform is also keenly aware that the livestream e-commerce model is facing triple pressures of manpower, creativity, and cost. To turn the current explosive growth into sustainable growth, the key lies in systematic long-term optimization of logistics, after-sales service, and merchant capabilities.

In the instant consumption scenario of livestream e-commerce, logistics fulfillment efficiency has evolved from a supporting link to a core competitiveness affecting user retention and repurchase.

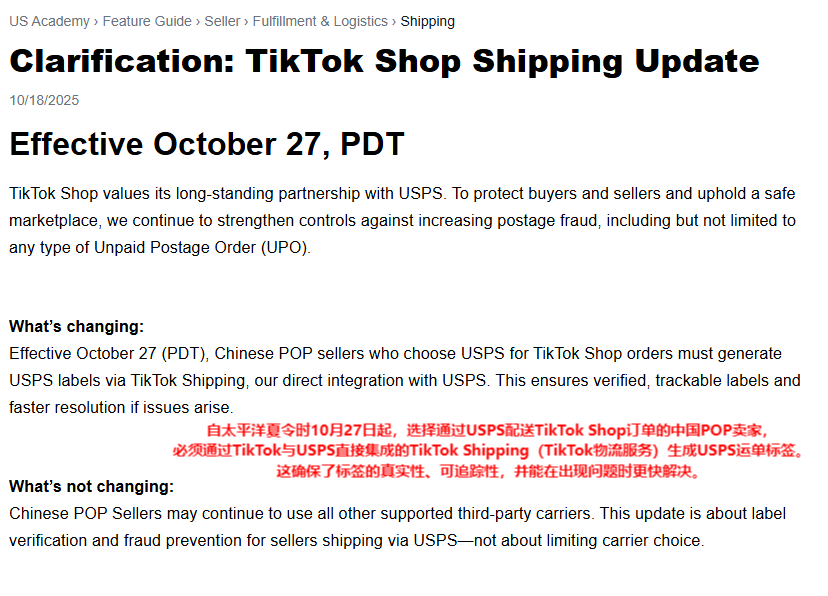

Meanwhile, in terms of logistics, Tuke's recent policy adjustments in the US market also reflect the platform's emphasis on logistics experience.

On October 17, Tuke Shop US announced that starting October 27, 2025, it will make important adjustments to merchant self-shipping rules, restricting the use of USPS for self-shipping. This move aims to further compress the space for violations and promote standardization of logistics fulfillment.

Image source: Tuke

Future Prospects: From Rapid Growth to Sustainable Development

For Tuke Shop France, whether the current explosive growth can be sustained depends on whether it can turn short-term growth into a sustainable business model.

The platform must maintain content experience while ensuring fulfillment speed, return management, and information transparency; otherwise, it will be difficult to retain consumer trust in the long term.

In reverse logistics processing, leading brands have already established intelligent quality inspection grading systems, using AI visual inspection technology to classify returned goods into six levels, raising the residual value recovery rate of returned goods to 78%.

At the same time, establishing a return reason analysis model can identify high-frequency issues, such as size mismatch (accounting for 35%), product color difference (accounting for 28%), etc. By using these data to drive product improvement, a certain footwear brand reduced its return rate by 22 percentage points.

With the peak of local brand entry expected in Q3-Q4 2025, the proportion of fashion and beauty GMV is expected to exceed 50%, and Tuke Shop is likely to become the new revenue engine for Tuke in Europe.

Image source: Internet

The rapid growth of Tuke Shop in France proves the huge potential of social e-commerce in the European market.

In France, more than a quarter of monthly active users are using Tuke, which itself is a powerful traffic pool.

With local retail giants such as Carrefour and Decathlon continuing to join, the boundaries between content and consumption in the future French e-commerce market will become even more blurred.