OnTuke, beauty influencers can sell out a lipstick, and outdoor experts can make an entire category popular with a single camping video—but what you might not expect is that the quietest "bedding" is quietly becoming the new dark horse in cross-border e-commerce.

The Hangzhou brandBedlore, in just two years, has grown from a startup to the TOP3 home textile brand on Tuke US, with cumulative sales exceeding $5.2 million and a single-month peak transaction amount of $1.5945 million (about RMB 11.5 million), proving the weight of the bedding track.

What did it do right?

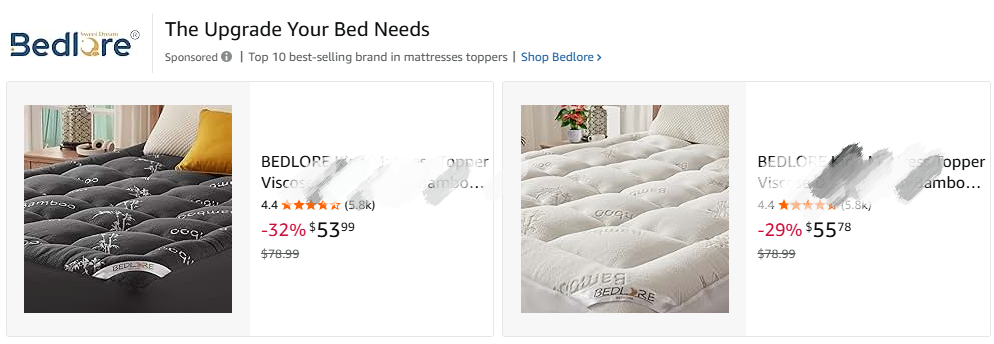

Image source:Bedlore

A niche track? No, it's the underestimated"sleep economy"

From available information,Bedlore's brand story reveals the typical path of a new generation of Chinese companies going global:precise positioning, digital-driven, and omni-channel layout.

This Hangzhou brand, focused on high-quality and uniquely designed bedding, quickly emerged after entering Amazon US in 2023, ranking among the Top 500 sellers on Amazon.

Image source:Amazon

However,Bedlore's real explosive growth did not rely solely on traditional e-commerce platforms.

Around October 2024,the brand officially enteredTuke US, and in just over a year, achieved impressive results.

According to data,Bedlore's Tuke shop has sold 162,300 items, with sales reaching $5.2196 million, successfully ranking among the top three in the US home textile category.

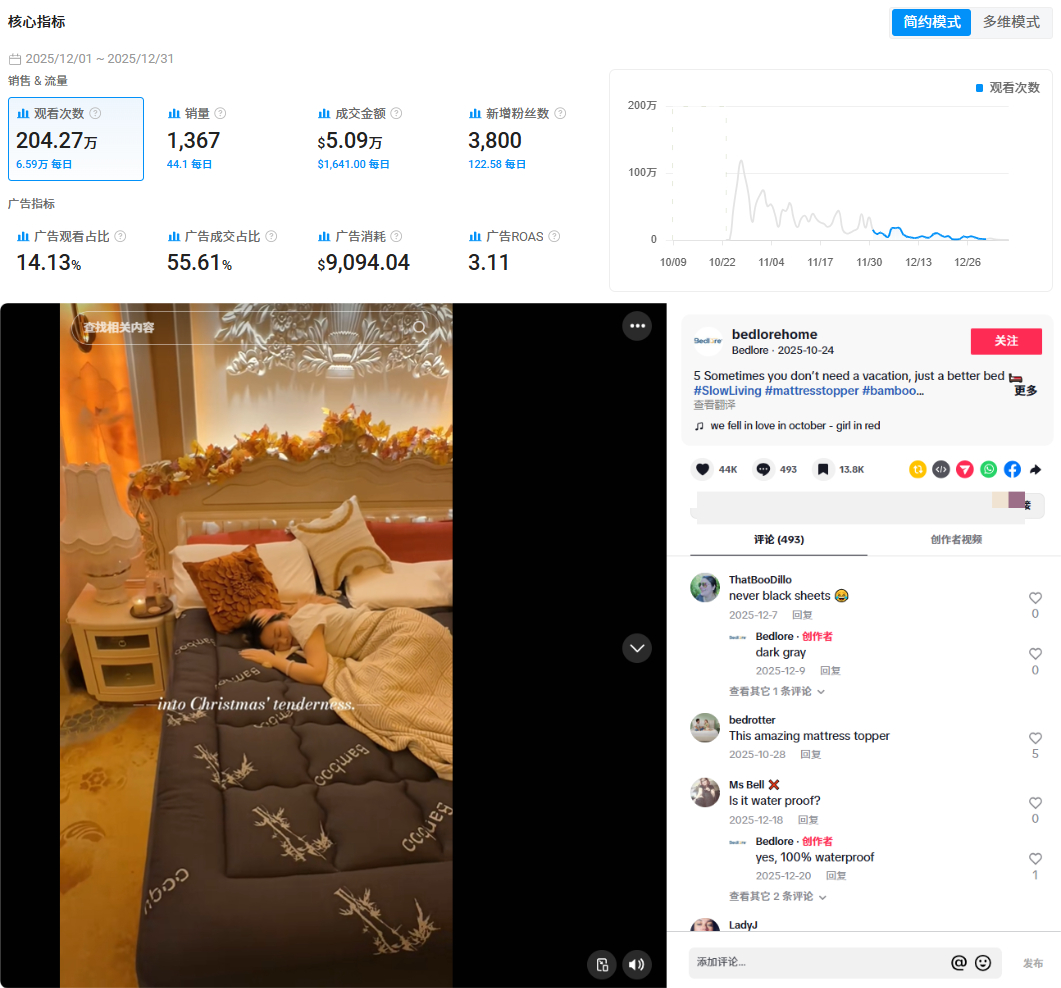

Image source:fastmoss

Meanwhile,during the year-end promotion inDecember 2025, the brand's transaction amount on Tukeevenreached$1.5945 million, creating a small-scale sales explosion. Interestingly, in Bedlore'sbrandTuke sales structure, the contribution from the brand's own account and influencer sales is nearly equal.

This is uncommon among many Tuke brands that heavily rely on influencer alliances, indicating that the brand has not abandoned influencer cooperation as a "leverage" growth path, but has also invested enough effort in content production, fan management, and product integration for its own account, treating it as a long-term asset rather than just a showcase.

Image source:kalodata

Self-operated content: Creating an immersive"comfort" theater

A deep dive into its operating model reveals thatBedlore's success in Tuke's self-operated system is due to a carefully constructed "short video + live streaming" high-efficiency conversion loop.

@bedlorehome, the brand's main account on Tuke, has gained nearly 16,000 followers since its first video in April 2025. Although the number is not large, its monthly video views have reached 19.65 million, directly driving $287,800 in transaction value, showing its considerable actual influence.

This fully demonstrates that, under the logic of interest-based e-commerce, the"penetration power" of high-quality content is far more important than the number of followers itself.

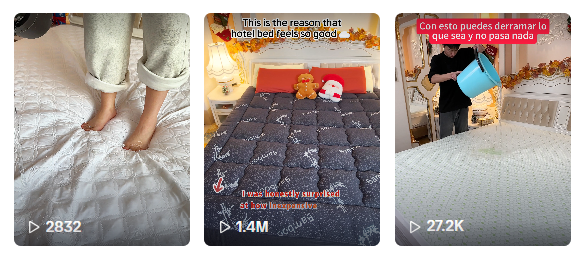

Image source:kalodata

In terms of content model,Bedlore has largely borrowed from the mature short video routines of domestic e-commerce.

One type is the slightly exaggerated function tests, intuitively showing waterproof performance in extreme scenarios; another is the immersive bedroom scene experience, creating the feeling of"lying down in bed and instantly enjoying a stable, quiet, and dry sleeping environment."

Image source:Tuke

From the account's traffic data, this model is indeed very suitable for US users.

For example, their immersive experience video released inOctober 2025, with its delicate texture presentation and cozy bedroom atmosphere, has received 17 million views to date.

Notably, the long-tail effect of this video continues to ferment, still contributing nearly$50,900 in transaction value to the brand two months after release.

For most accounts that rely on short-term sales driven by viral content, this"long-tail transaction" sustainability means the content's search and recommendation value is continuously recognized by the platform, and that a stable match has formed between product and content. Therefore, brands looking to do Tuke should pay special attention to this point.

Image source:Tuke, kalodata

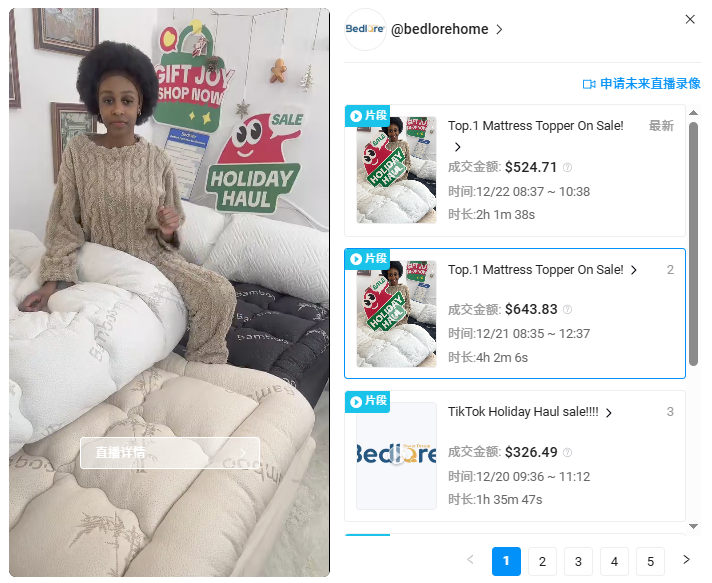

Besides short videos,Bedlore is also actively exploring Tuke live streaming.

Since it's bedding, it naturally can't be separated from"bed" as the core scene.

In the brand's live streaming room, the host wears comfortable home pajamas and sits or lies directly on aBedlore mattress.

This extremely realistic setting not only intuitively demonstrates the fit, texture, and comfort of mattress covers and sheets, but also creates an immersive"home" and "relaxation" atmosphere, allowing viewers to easily imagine themselves in their nightly resting scene, greatly enhancing trust and purchase desire.

Althoughitslive streaming model is still being optimized and tested, its conversion potential has already begun to show. For example, inDecember 2025, Bedlore'sself-operatedlive streaming transaction value has exceeded ten thousand dollars, becoming an important sales supplement beyond short video content.

Image source:kalodata

Influencer ecosystem: Building a trust-diffusing"dandelion network"

InTuke marketing, influencer cooperation is indispensable, and Bedlore is no exception.

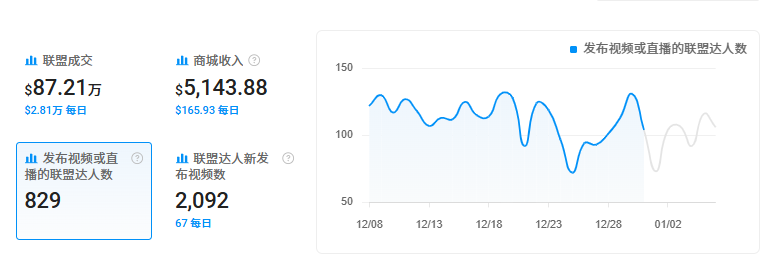

According to data, in just one month lastDecember, there were 829 active alliance influencers working with the brand, publishing a total of 2,092 promotional videos—an average of 67 promotional videos per day.

Image source:kalodata

Their influencer selection strategy is very broad and flexible, ranging from mid-tier home and lifestyle influencers with hundreds of thousands of followers, to vertical reviewers, and even many "nano influencers" with small but authentic and trustworthy content.

This strategy allowsBedlore's products to reach a wider range of potential consumers, not just those interested in home textiles.

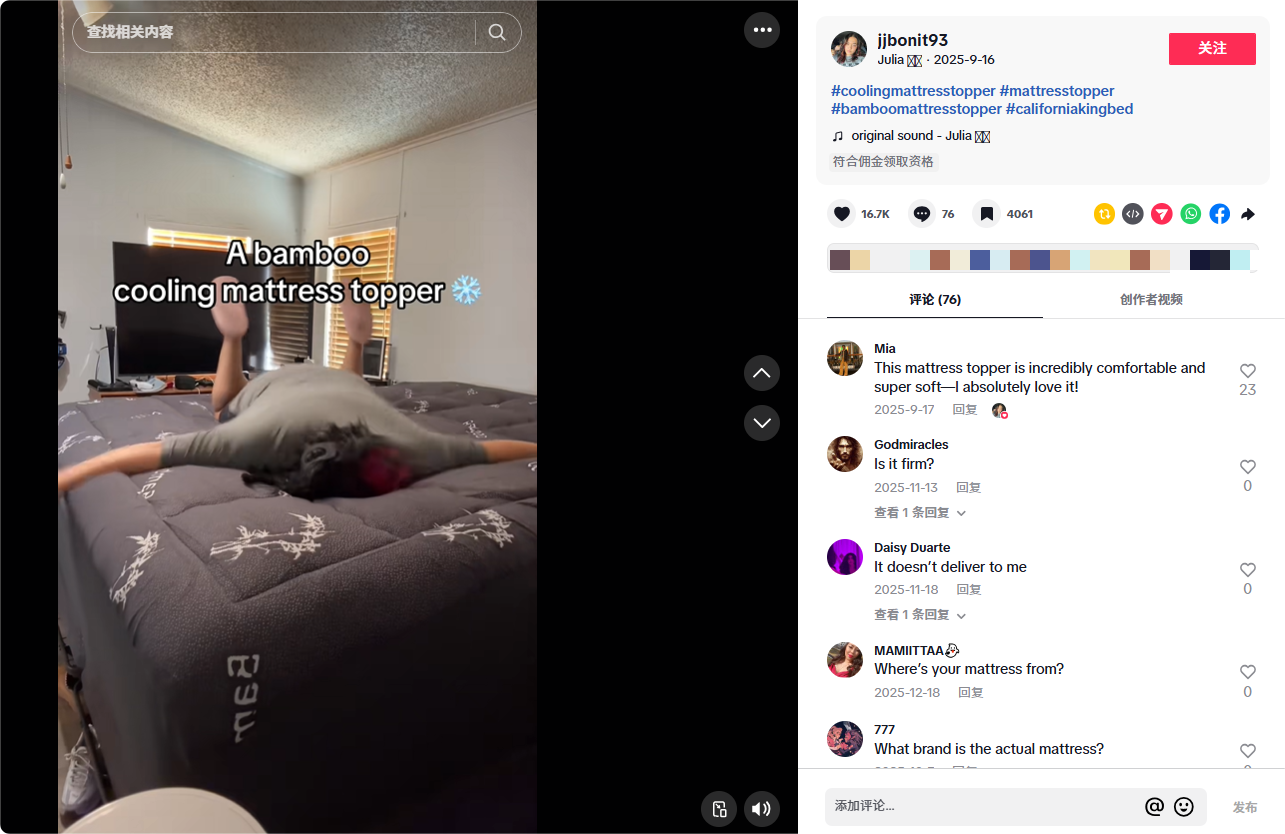

Tuke influencer @jjbonit93 is a great example. Although she has only 63,700 followers, her authentic content quickly pushed her collaboration video with Bedlore past 2.8 million views, with cumulative transaction value reaching $44,800.

This proves that in theTuke ecosystem, working with influencers whose follower profile matches the brand—even if they're not top-tier—can bring considerable resonance and viral potential through authentic sharing.

Image source:Tuke

Market depth: From a $10 billion base to a new content frontier

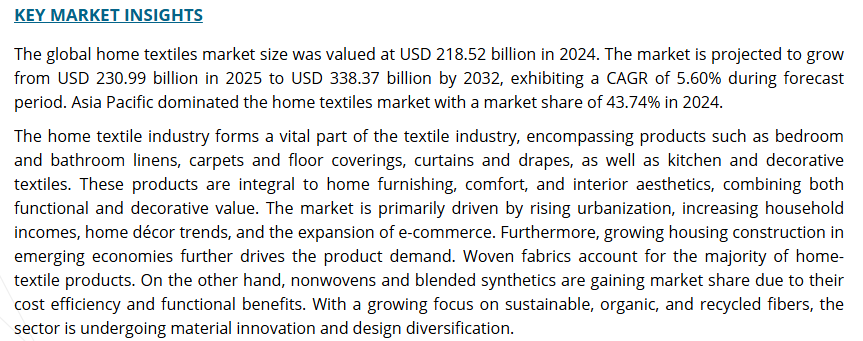

After understandingBedlore's approach on Tuke, we can see that the home textile market is not just a sleeping giant, but a steadily growing value depression.

According to market research,the global home textile market size reached $218.52 billion in 2024, and is expected to climb to $338.37 billion by 2032, with a CAGR of 5.60%.

Among them,the mattress protector segment that Bedlore focuses on has even greater growth potential, expected to reach $31 million by 2025.

Image source:fortune business insights

More importantly, this is a typical"ant market" with limited influence from leading brands and low market concentration.

This means that new brands likeBedlore don't need to compete head-on with giants, but can establish their own advantages in niche areas through differentiated products and precise marketing.

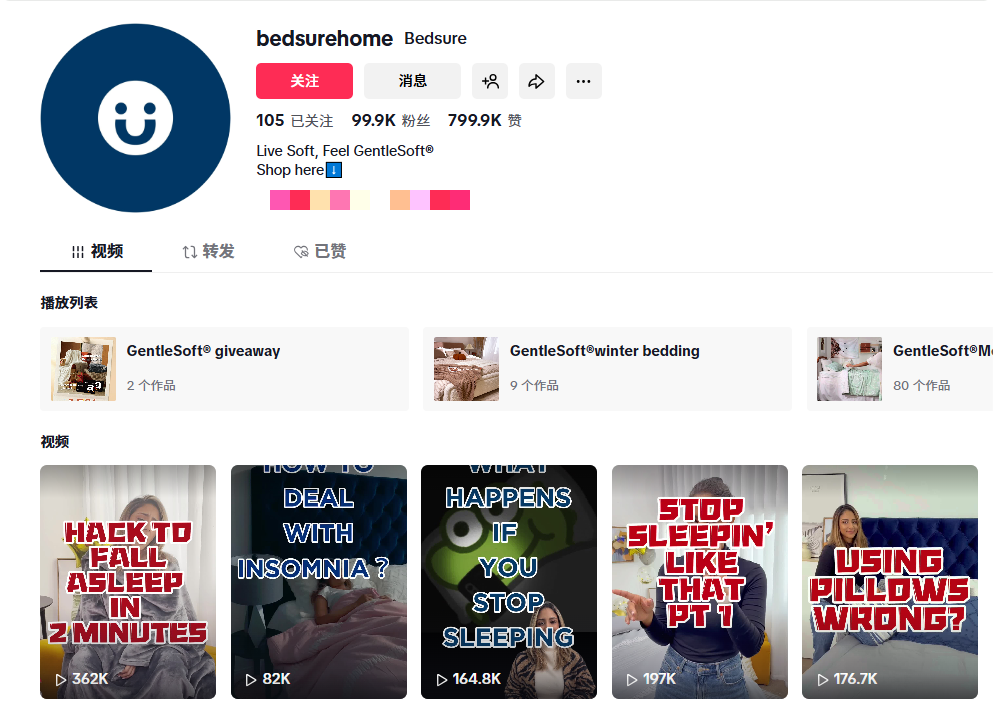

For example, another Chinese home textile brandBedsure has achieved annual sales of over $10 million by focusing on Tuke, further validating the feasibility of strategies such as "self-broadcast + influencer broadcast" matrix and "localized product function innovation."

These successful paths show thatTuke is not just a sales channel, but a closed-loop position for brand building, user insight, and rapid product iteration.

Image source:Tuke

Conclusion

The story of Bedlore is essentially an upgrade competition from "supply chain advantage" to "content communication advantage."

For other brands watching or going global, the opportunity now is not simply to copy, but to understand the market essence behind it: a mature market of over$1.8 billion, pursuing quality and emotion, is waiting to be reactivated by more vivid content.

In the wave of cross-border expansion, there is no eternal hotspot, but there are always opportunities.

Perhaps, the next hit product could be you—who knows?