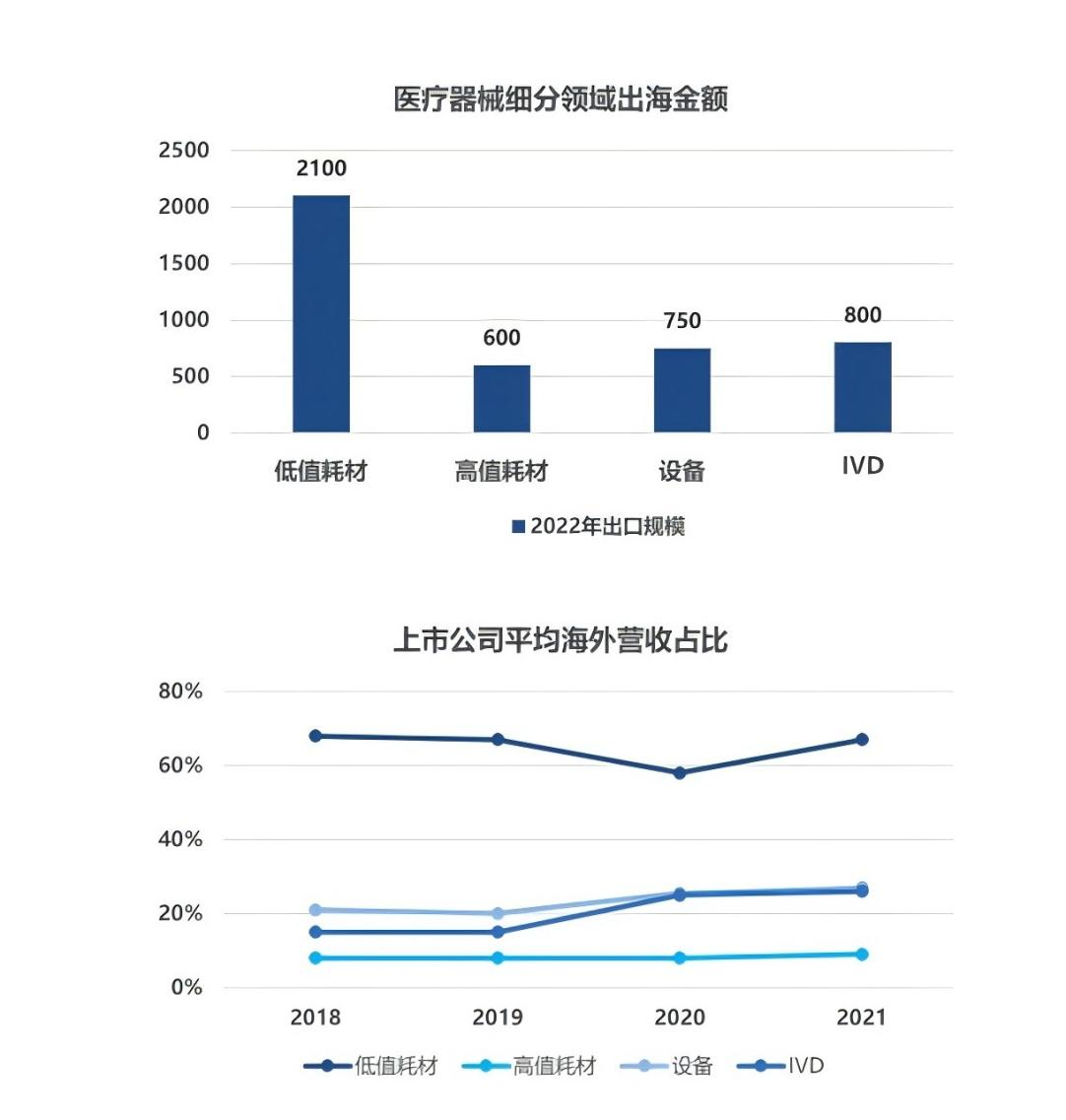

In recent years, with the rapid development of China's medical device industry, going global has become an important way for enterprises to expand their markets. Especially after the pandemic, both the export scale and innovation capability of Chinese medical devices have been significantly enhanced, providing a solid foundation for companies to enter the international market.

I. Market Size and Export Situation

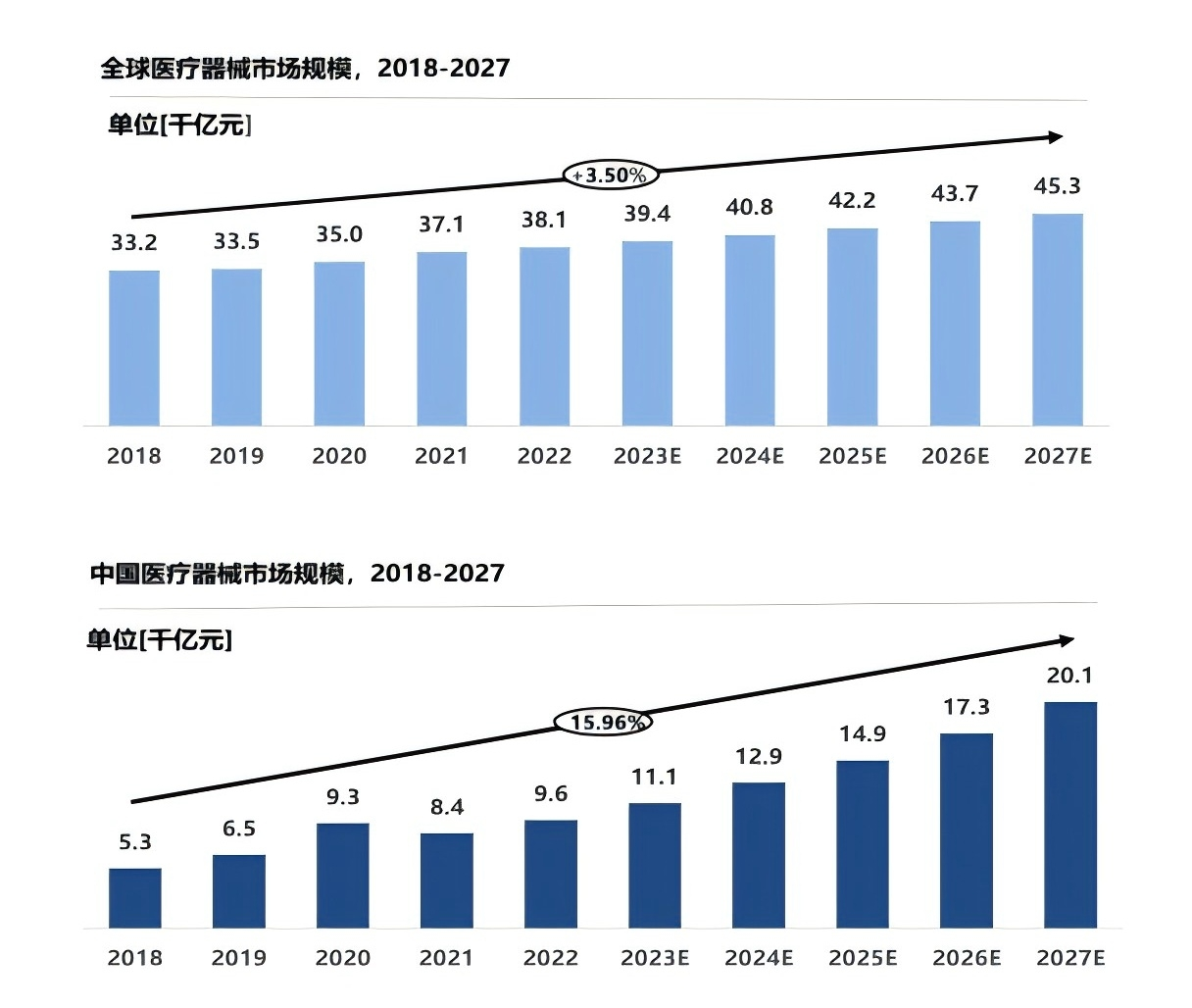

According to relevant data, in 2022, the scale of China's medical device market reached RMB 950 billion, accounting for 25% of the global market, making it the world's second largest market after the United States. It is expected that by 2027, the scale of China's medical device market will reach RMB 2,008.8 billion, accounting for 44% of the global market. This growth momentum not only reflects the vitality of the domestic market but also creates favorable conditions for exports.

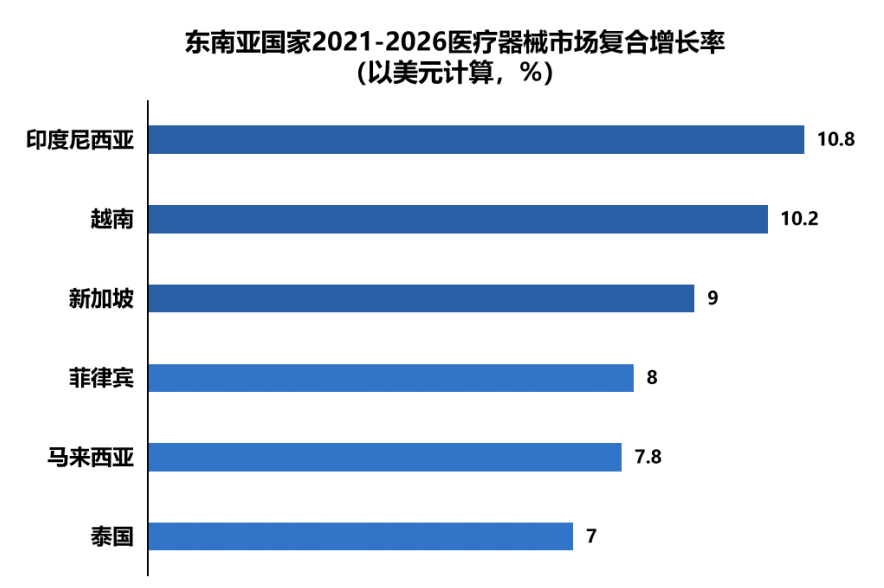

In terms of exports, the demand for Chinese medical devices to go overseas has increased year by year. In 2021, China's medical device exports exceeded USD 20 billion, with major export markets including the United States, the European Union, and emerging markets in Southeast Asia. Especially in Southeast Asia, due to rapid economic growth and continuous improvement of medical infrastructure, it has become an important destination for China's medical device exports.

Data source: "White Paper on Chinese Medical Devices Going to Southeast Asia"

II. Opportunities in the Southeast Asian Market

As one of the fastest-growing economic regions in the world, Southeast Asia has a huge population base and an expanding middle class, with medical expenditure increasing year by year, providing a broad market space for Chinese medical devices to go overseas. According to statistics, in 2022, China's export value of pharmaceutical and health products to ASEAN reached USD 13.68 billion, of which the export value of medical devices reached USD 5.125 billion.

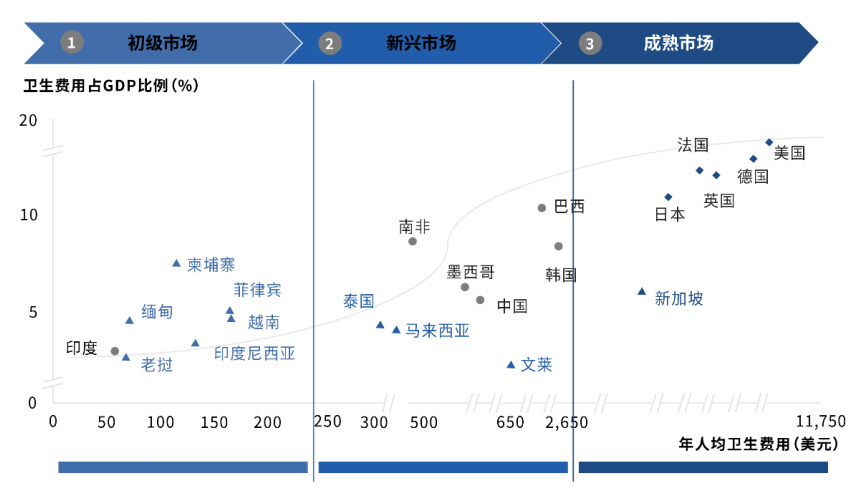

After the pandemic, Southeast Asian countries generally attach great importance to investment and construction in the medical industry. For example, Malaysia allocated the largest portion of its national budget to the Ministry of Health in 2023, showing its emphasis on medical infrastructure. In addition, the medical product manufacturing industry in Southeast Asian countries is relatively weak, and most medical devices rely on imports, which provides good market opportunities for Chinese enterprises.

Data source: "White Paper on Chinese Medical Devices Going to Southeast Asia"

III. Demand in Major Southeast Asian Countries

--Singapore

Singapore has the highest annual per capita healthcare expenditure. According to the Singapore Ministry of Health, the country's health expenditure is expected to increase to USD 43 billion by 2030. With the intensification of population aging, the demand for medical devices continues to rise, especially in the fields of chronic disease management and telemedicine.

--Malaysia

Malaysia's medical device market is expected to grow rapidly in the coming years, especially in the monitoring and treatment of non-communicable diseases. The Malaysian government is also actively promoting the development of medical tourism to attract international patients.

--Thailand

Thailand's medical tourism market is valued at about USD 829 million, attracting a large number of international patients. With the increase in the elderly population, the demand for elderly medical services will rise significantly.

--Indonesia

Indonesia's medical device market is growing rapidly and is expected to reach USD 1.9 billion by 2026. The government's promotion of localized production also provides opportunities for Chinese enterprises.

--Vietnam

Vietnam's medical device market is undergoing a transformation, with the government increasing investment in medical construction. It is expected that the market size will reach USD 2.1 billion by 2026.

--Philippines

The medical market in the Philippines is developing rapidly under the promotion of universal health insurance policies. The demand for advanced medical equipment continues to grow, especially in the fields of cardiovascular and cancer treatment.

Data source: "White Paper on Chinese Medical Devices Going to Southeast Asia"

IV. Overseas Expansion Models and Challenges

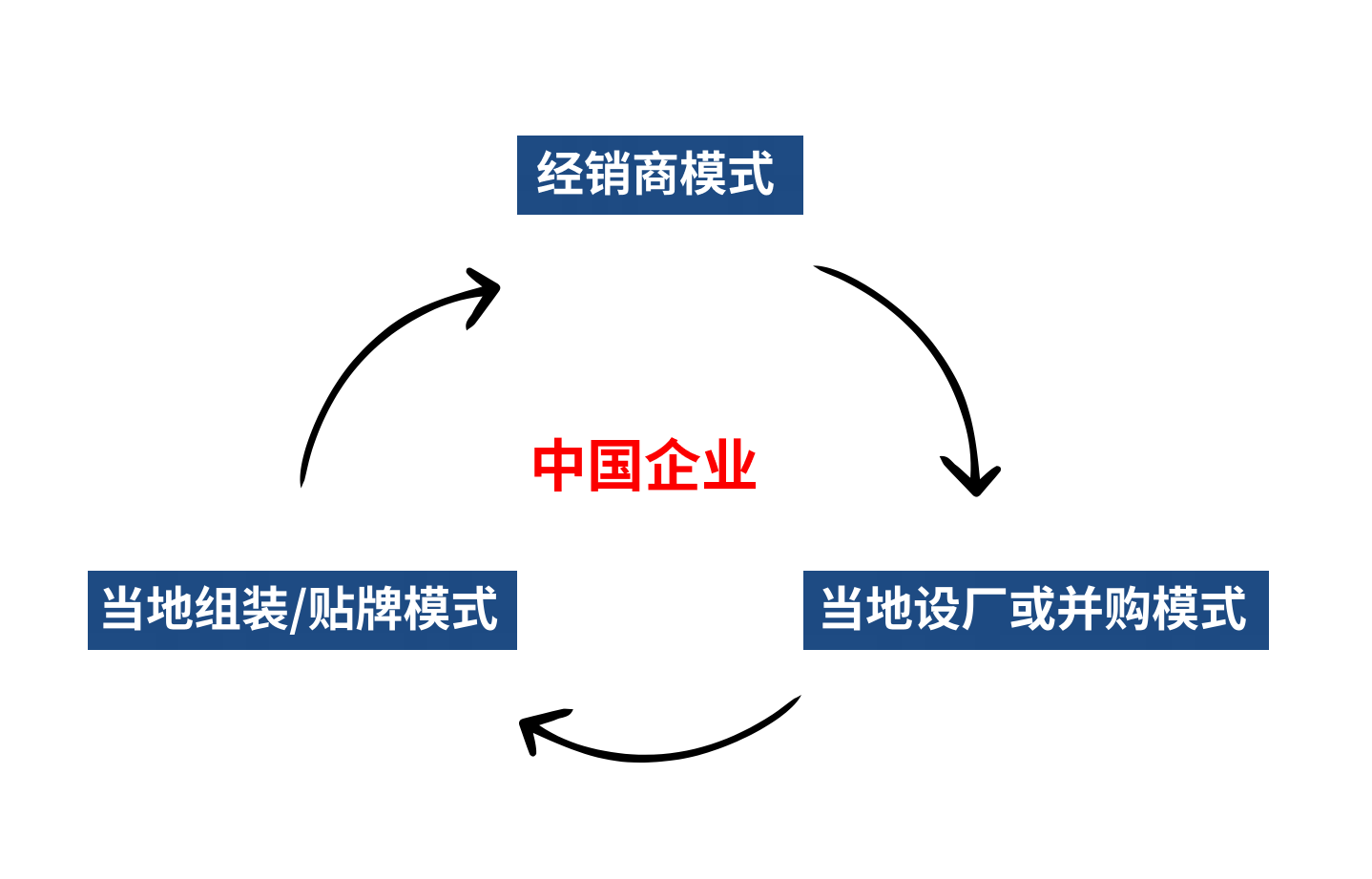

Chinese medical device enterprises mainly adopt three models for overseas expansion: distributor model, local assembly/private label model, and local factory establishment or acquisition model.

1. Distributor Model:This is the mainstream model for most enterprises in the initial stage of going overseas. By cooperating with local distributors, companies can quickly enter the market, but it is necessary to find suitable distributors and establish good cooperative relationships.

2. Local Assembly/Private Label Model:Some countries require localized production, and enterprises can meet this requirement by assembling and private labeling locally. This model requires companies to conduct due diligence on the qualifications of local manufacturers and ensure that the production process meets standards.

3. Local Factory Establishment or Acquisition Model:For companies intending to cultivate the market in the long term, establishing factories or acquiring local enterprises can help effectively manage supply chains and sales channels, and achieve independent decision-making.

However, there are also many challenges in the process of going overseas, such as the complex and ever-changing policy environment and regulatory requirements in different countries. Enterprises need to have sufficient market research and legal compliance capabilities. Therefore, before going overseas, companies should form professional teams to interpret and analyze the policies and regulations of target markets, and adjust strategies in a timely manner based on feedback.

Image source: TuKe Going Overseas

Conclusion

The medical device market in Southeast Asia is in a stage of rapid development and contains huge market potential for the future. Chinese enterprises should accurately understand market demand, choose the appropriate overseas expansion model according to their own situation, and continuously improve their ability to cope with complex policy and regulatory environments. Only in this way can they move forward smoothly in the opportunity-filled blue ocean of the Southeast Asian market and achieve their own international development goals.