The latest data shows that TikTok Shop's market share in Thailand has surged rapidly from 27% in 2024 to 33% in 2026, successfully surpassing former giant Lazada to firmly occupy the second spot in the market, second only to the leader Shopee.

This change is not just a leap in numbers, but marks a decisive victory for the new e-commerce model centered on entertainment+shopping in a key Southeast Asian market.

Image source:Google

Market Share Disruption: The Consumption Revolution from Browsing to Playing

Thailand's e-commerce market is entering a mature phase with a large scale but slowing growth, reaching a total size of 1.15 trillion baht. However, it is in this seemingly settled red ocean that TikTok Shop has stirred up a disruptive wave. Its key to success lies in precisely capturing and igniting the fundamental changes in Thailand's consumer market.

Now, over 96% of Thai internet users are frequent online shoppers. Their needs have long surpassed simply buying cheap goods, shifting towards seeking fun, interaction, and value recognition in the shopping process.

TikTok Shop deeply integrates short video and livestreaming genes into e-commerce transactions, creating an immersive experience of instant viewing, instant interaction, and instant purchase. While traditional shelf-based e-commerce still competes on price and product detail pages, TikTok Shop has already made consumption an entertainment and social activity.

Image source:Google

Currently, this shopping model driven by livestreaming and short videos already contributes a quarter of Thailand's total e-commerce sales, becoming an irreversible mainstream trend.

Meanwhile, the supreme status of mobile (accounting for over 80%) has cleared the way for native mobile platforms like TikTok. In contrast, platforms that have failed to fully adapt to this content-driven and entertainment-oriented transformation face the challenge of declining market share. This reshuffling of rankings is essentially a key divergence between two e-commerce logics in market practice.

Tightening Safety Rules: A Required Lesson Amid High Growth

While market share is rapidly expanding, TikTok Shop Thailand has recently launched a key new safety regulation: certain seller accounts are required to set up two-factor authentication. This regulation is not just a simple process update, but a strategic protective measure implemented by the platform to build a more robust business ecosystem.

According to the official platform notice, relevant sellers will receive instructions via in-site messages, email, and seller backend system notifications. If the setup is not completed within the specified time, some account functions may be temporarily frozen.

The core mechanism of two-factor authentication is to add an extra dynamic verification code process in addition to the regular password check, greatly increasing the difficulty of illegal logins and creating a key defense line for store operation security, core data assets, and cash flow.

Although this mandatory requirement is still being rolled out in phases and has not yet covered all sellers, the platform has clearly called on all merchants to proactively deploy this feature in advance.

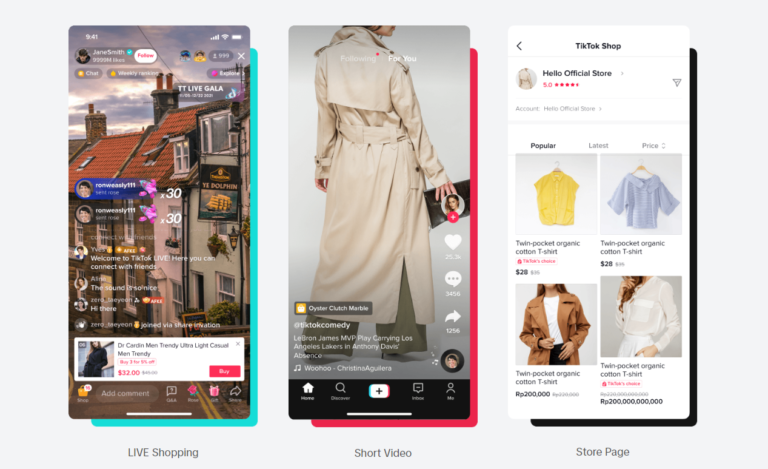

Image source:Google

Double Impact on Sellers and Coping Strategies

For sellers operating on TikTok Shop Thailand, the expansion of market share and the implementation of new safety regulations are both opportunities and responsibilities.

From the perspective of opportunity, the increase in platform market share means a larger traffic pool and potential customer base.Especially with the popularity of entertainment+shopping models, sellers who excel at content creation and can vividly showcase products through livestreaming or short videos have a differentiated track.

Sellers should actively leverage the platform's video features to create attractive content, embedding products into life scenarios or entertainment information to stimulate users' desire to buy. Meanwhile, as Thai consumer trends shift towards value-driven, sellers need to go beyond price competition and focus more on product quality, brand story, and the added value of the shopping experience.

Image source:Google

From the perspective of responsibility and challenge, mandatory two-factor authentication may add steps to the login process, but in the long run, it is a necessary protection for sellers' assets.Sellers should actively respond to the platform's security upgrades and regard them as part of business compliance.

In addition, starting from January 2026, Thailand will cancel the tax exemption policy for imported goods under 1,500 baht, and all cross-border goods will be subject to tariffs and 7% VAT. This poses new requirements for cost control for cross-border sellers, who may need to reassess pricing strategies or consider local warehousing layouts.

In summary, sellers' coping strategies can focus on the following points:

First, deepen content e-commerce capabilities, integrating product sales with video creativity; second, strengthen supply chain management to cope with changes in tax policy and logistics integration trends (such as the logistics changes brought by J&T and SF Express cooperation); third, proactively enhance account security management awareness, actively cooperate with platform security measures, and ensure stable store operations.

Image source:Google

Conclusion

This "sea change" in Thailand's e-commerce market is an industry restructuring triggered by shifts in consumer habits. The rise of TikTok Shop is a victory for content-empowered commerce; and its simultaneous strengthening of safety rules demonstrates the calmness and foresight of entering a mature market.

For all cross-border sellers, this is no longer just a question of which platform is more popular, but a must-answer on how to reshape their own capabilities to adapt to the era of entertainment-driven e-commerce.

Market rankings can be reshuffled, but the real winners are always those who can first understand the rules and evolve quickly. The new battle has begun—are your strategies in place?