This year's back-to-school spending data in the United States has been released, and the results are not very optimistic.

According to Deloitte's latest 2025 Back-to-School Retail Survey, total back-to-school spending for K-12 students across the U.S. is expected to reach $30.9 billion, a significant decline compared to previous years. Looking at per-student spending, the average is $570, which is $16 less than last year's $586. Although the difference may not seem large, this is the first drop after several consecutive years of growth, indicating that American families are truly starting to be more careful with their spending.

Image source: chainstoreage

Tariffs are the "real culprit behind the scenes"

Why has back-to-school spending decreased this year? The main reason is tariffs.

According to the latest data from the U.S. Department of the Treasury, tariff revenue surpassed $100 billion for the first time this fiscal year, reaching $113 billion, with $27 billion collected in June alone—13% more than the same period last year. As tariffs rise, the cost of imported goods increases, and ultimately these costs are passed on to consumers.

Image source: Reuters

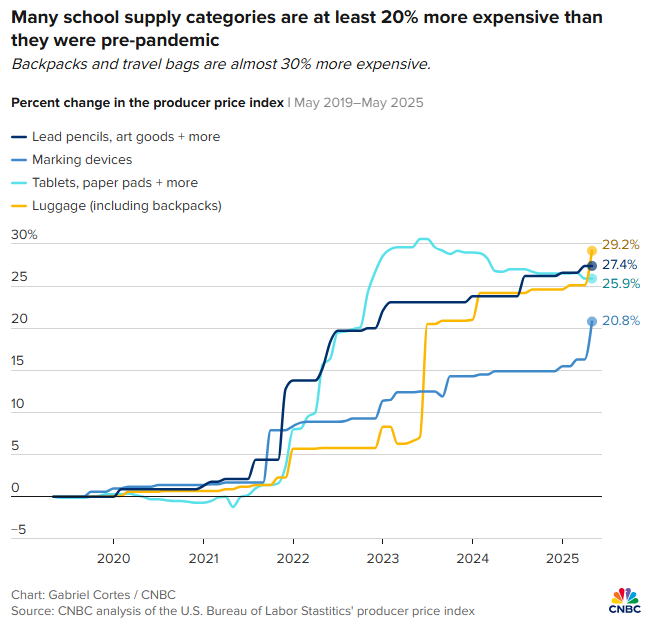

For example, commonly used items like backpacks and lunch boxes are now 15% to 20% more expensive than in 2019. Products that were once affordable are no longer such a bargain. Not only are back-to-school supplies getting more expensive, but so are everyday food and household items, squeezing household disposable income and forcing families to cut back elsewhere. Deloitte's survey shows that 56% of families have already started reducing purchases of non-essential items, and more than 70% of parents say they will switch to cheaper alternatives if brands are too expensive. Sixty percent are even turning directly to low-price retailers.

Image source: CNBC

Walmart grabs market share with low-price strategy

Although overall spending is shrinking, the back-to-school season is still a fiercely contested battleground for retailers. After all, aside from the year-end shopping season, this is the period that drives the most sales. To attract budget-conscious parents, major retailers are slashing prices.

Take Walmart as an example: its promotional offers are quite attractive. For instance, the prices of 14 commonly used stationery items are even lower than last year, with some items as low as $0.25 each. A basic stationery set plus a backpack costs only $16, and the total cost of back-to-school supplies for the whole family can be kept under $65. They have also launched a new brand called Weekend Academy, focusing on teen apparel, with most items under $15. A full outfit from head to toe costs just $42.

Last back-to-school season, Walmart became parents' top choice with a 46.4% market share. This year, they are doubling down, offering more than 200 discounted items and providing one-hour pickup or delivery services to help parents quickly shop according to school supply lists.

Image source: walmart

Opportunities and challenges for cross-border e-commerce

For cross-border e-commerce businesses targeting the U.S. market, this year's back-to-school season presents both opportunities and challenges. The opportunity lies in the fact that consumers are more price-sensitive than ever, so as long as you can offer cost-effective products, you have a chance to capture market share. The challenge is that tariffs have increased costs and squeezed profit margins, so sellers must work on both price and service.

Overall, the consumption trend for this year's U.S. back-to-school season is clear: parents are spending more cautiously, and low-priced products are more popular. For businesses to capture this wave of demand, the old strategies may not be enough—they must excel in price, quality, and service.