Since Tuke exploded in popularity worldwide, it seems that everything related to Tuke has become “hot.”

Slipper brand POSEE (Puxi) has exported slippers to Southeast Asia through Tuke, and musical instrument brand Donner (Tangnong) has also gained a large number of customers via Tuke. Even traditional domestic silicone factories have posted creative videos on Tuke, with single videos reaching over 120 million views.

All of this seems to demonstrate Tuke’s powerful influence.

But if the success of the above brands is due to their creative videos on Tuke attracting their target audience,

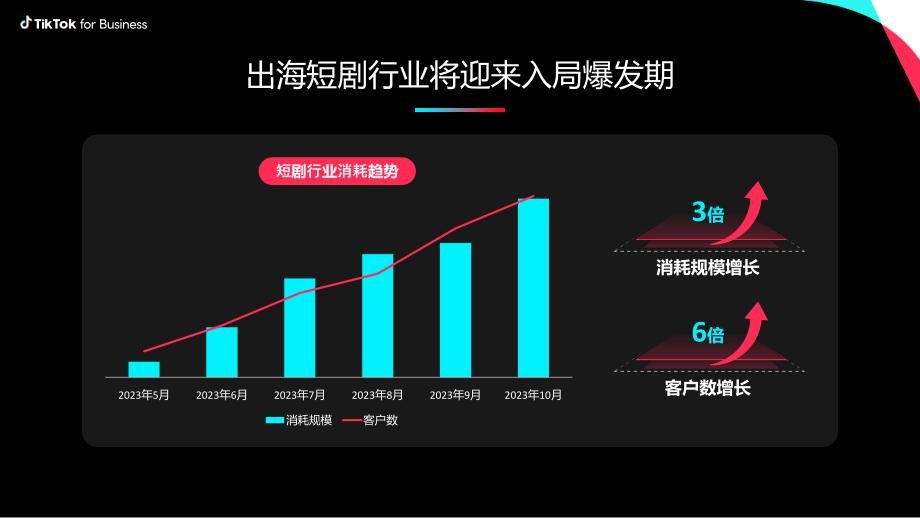

then what is the reason behind the surge of short dramas going overseas since the second half of 2023?

Melodramatic short dramas exported overseas, making people unable to stop watching

In April 2020, the number of domestic micro-short dramas increased significantly. From the second half of the year, “online micro-short dramas” were officially included as a key category of online film and television works. At the same time, the video ads we often saw were gradually replaced by these micro-short dramas.

That same year, Tuke surpassed Facebook and Instagram to become the most downloaded app globally. Tuke short videos also began to fully enter overseas markets.

As time went on, some video content on Tuke shifted from creative output to cultural output, and micro-short drama content from China began to flood overseas markets.

From this, we can roughly estimate the current overseas path of short dramas:After domestic short videos mature, they go overseas, and short dramas born alongside short videos are replicated and tested by domestic capital in overseas markets.

This is how the overseas short drama trend gradually caught fire.

However, at first, exporting short dramas simply meant taking those already proven successful in China, adding foreign subtitles, and directly moving them overseas, or using mature AI technology to swap faces and adjust voice content.

But such short dramas often failed to resonate on Tuke due to “cultural differences,” since overseas audiences aren’t as enthusiastic about mother-in-law and daughter-in-law conflicts as in China.

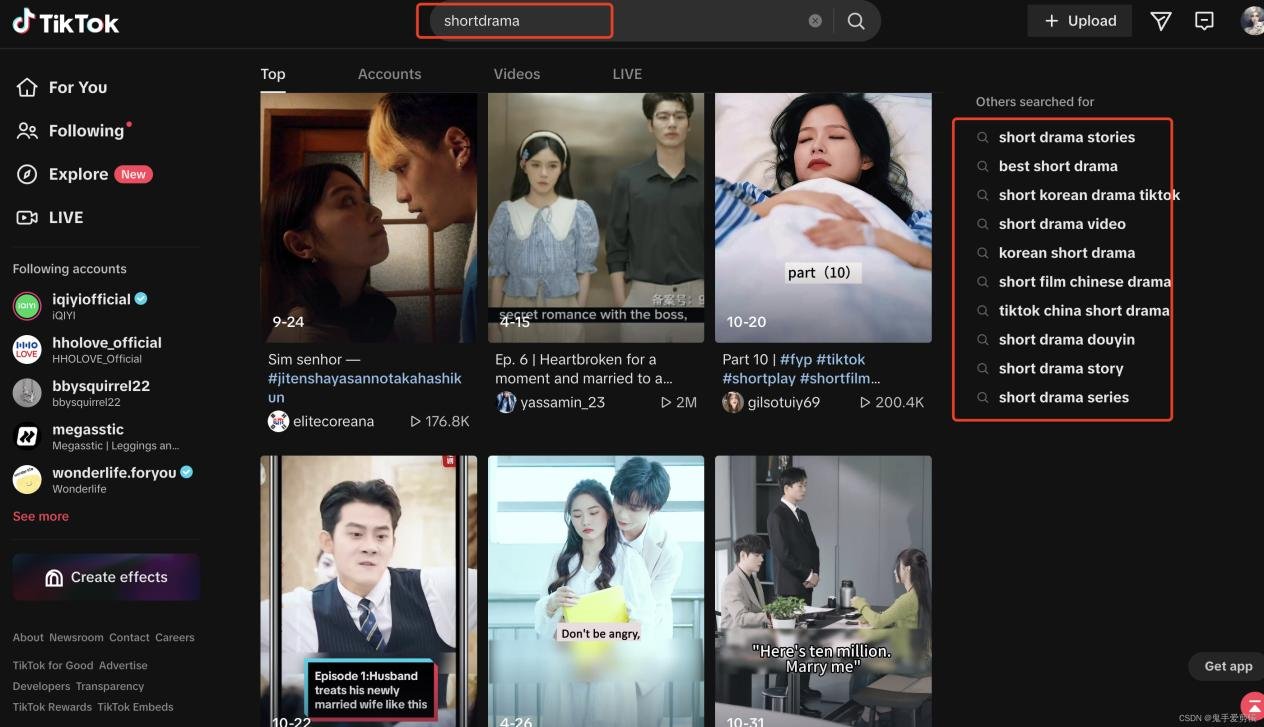

It wasn’t until the past two years that exported short dramas began to focus on localization, adopting local settings such as vampires and werewolves. Coupled with melodramatic plot twists and three reversals per episode, short dramas going overseas truly exploded in popularity.

Short dramas are not a content business, but a traffic business

Although the actors in overseas short dramas are all local foreigners, the filming and post-production are basically done by Chinese people. Moreover, the production cycle is usually very short, so the overall production cost of the drama is not high.

The content of these short dramas often uses “excitement” as the selling point, such as stories of domineering CEOs and sweet wives, the rise of the underdog son-in-law to the top of life, the hidden billionaire husband and my life, or my wife inheriting billions. The titles and posters of these short dramas directly convey the “excitement,” allowing viewers to instantly imagine the general plot and even anticipate some iconic scenes.

Just as netizens often say: “Three minutes is enough to get a thrill, what more can I ask for?”

When “Long Aotian” becomes “Sebastian,” and “Leng Bingning” turns into “Selena,” in a Western setting, the clichéd and melodramatic mutual pursuit easily captures the hearts of foreigners.

Once these types of short dramas enter the traffic investment stage, that is, when they are promoted on social platforms like Tuke and achieve positive returns, their traffic investment costs can reach millions or even tens of millions, with some domestic hit short dramas even reaching hundreds of millions in investment.

So for investors, short dramas are no different from products promoted in live-streaming rooms; they are simply new products constantly launched under the traffic model. Merchants launch many new products, invest in traffic, and trial and error—if they hit a blockbuster, they succeed.

And Tuke, this global social media platform, has become the incubator for success.

Of course, there are other ways to play the overseas short drama game, such as advertising placement, or making ads into short dramas and promoting them as Tuke feed ads. This not only gains traffic but also attracts users, achieving two goals at once.

Another example is seeking cooperation with Tuke agency operation companies, which can shorten the trial-and-error time for traffic investment through professional operation, allowing producers to focus more on improving the quality of short dramas and achieve positive returns faster.