The "Buy Now, Pay Later" (BNPL) payment model is rapidly gaining popularity among Filipino consumers.

According to a report by The Philippine Star, a survey released by fintech company UnaCash shows that nearly half (49.6%) of Filipino respondents said they have used or heard of BNPL services. Only 37.4% of Filipino respondents have heard of but never used this feature.

At the same time, data shows that among Filipino respondents familiar with BNPL, 38% said they might use BNPL services every month; 29% plan to use it at least once every six months; and 26% said they plan to use it once a year.

From the reasons listed by respondents for using BNPL as a payment method, 37% cited urgent need for a product but lack of funds, 23% cited long-term expense allocation, and 20% cited convenience of use.

This data well reflects the popularity of BNPL in the Philippine market, and also indicates that BNPL is not just a payment method, but also a tool that helps consumers with financial planning.

BNPL usage among Filipino respondents. Source: The Philippine Star

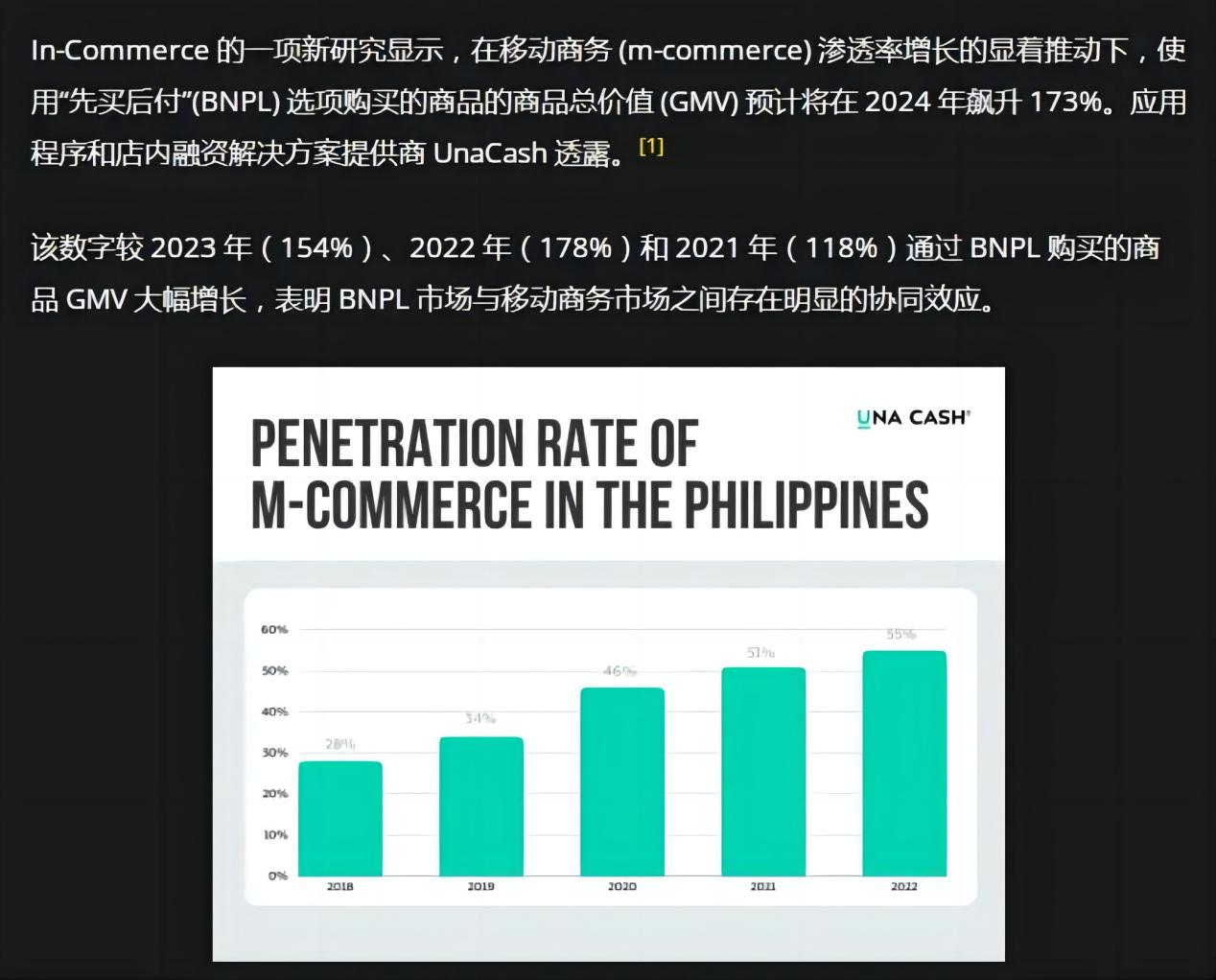

In fact, the popularity of BNPL in the Philippines has long been evident. An earlier research report released by UnaCash indicated that BNPL is very hot in the Philippine market. The data shows that from 2021 to 2023, the total gross merchandise value (GMV) of transactions achieved through BNPL services saw triple-digit growth: 118% in 2021, 178% in 2022, and 154% in 2023. It is expected that in 2024, the market will continue to expand, with GMV expected to soar by 173%.

Regarding this, UnaCash President Aleksei Kosenko once stated that BNPL can provide convenience for consumers and its partner merchants by minimizing initial purchase costs. This convenient payment method is expected to achieve significant growth in the coming years.

BillEase, Tendopay, Cashalo, Plentina, GCash and others are companies in the Philippines that support BNPL. In recent years, e-commerce giants such as Amazon, TikTok, and Shopee have also actively started to deploy BNPL services in the Philippines.

Philippine BNPL product GMV soars. Source: dailyguardian

Not only in the Philippines, BNPL has already become a popular trend in many countries.

In August 2023, Polish e-commerce giant Allegro quickly launched BNPL functionality after entering the Czech market to better meet consumer needs.

In September 2023, Amazon teamed up with payment platform Affirm and the largest US bank, JPMorgan Chase, to add two new BNPL services, providing consumers with more flexible payment options.

In October 2023, Indonesian local e-commerce Bukalapak partnered with Indonesia's AlloBank to jointly launch the Allo PayLater BNPL service, offering Indonesian consumers more flexible payment choices.

In December 2023, Walmart strengthened its cooperation with Affirm, introducing BNPL services in more than 4,500 stores across the United States, further enhancing the consumer shopping experience.

This March, global short video platform TikTok partnered with Indonesian tech giant GoTo Group, planning to launch BNPL services in Indonesia to further enhance the shopping experience and platform appeal.

TikTok and GoTo launch BNPL services in partnership

With the rapid development and popularization of the BNPL model worldwide, more and more consumers are enjoying the convenience and flexibility brought by this payment method. Whether on e-commerce platforms or in physical stores, BNPL has shown strong appeal and growth potential. In the future, with continuous technological advancement and further market expansion, BNPL is expected to become the preferred payment method for more consumers, bringing more innovation and change to the global shopping experience.