Against the backdrop of the restructuring of global trade structures and continuous technological innovation, the seemingly familiar "old battlefield" of the US market is quietly brewing new changes...

Image source: Internet

01/A Huge Market, Complex Entry

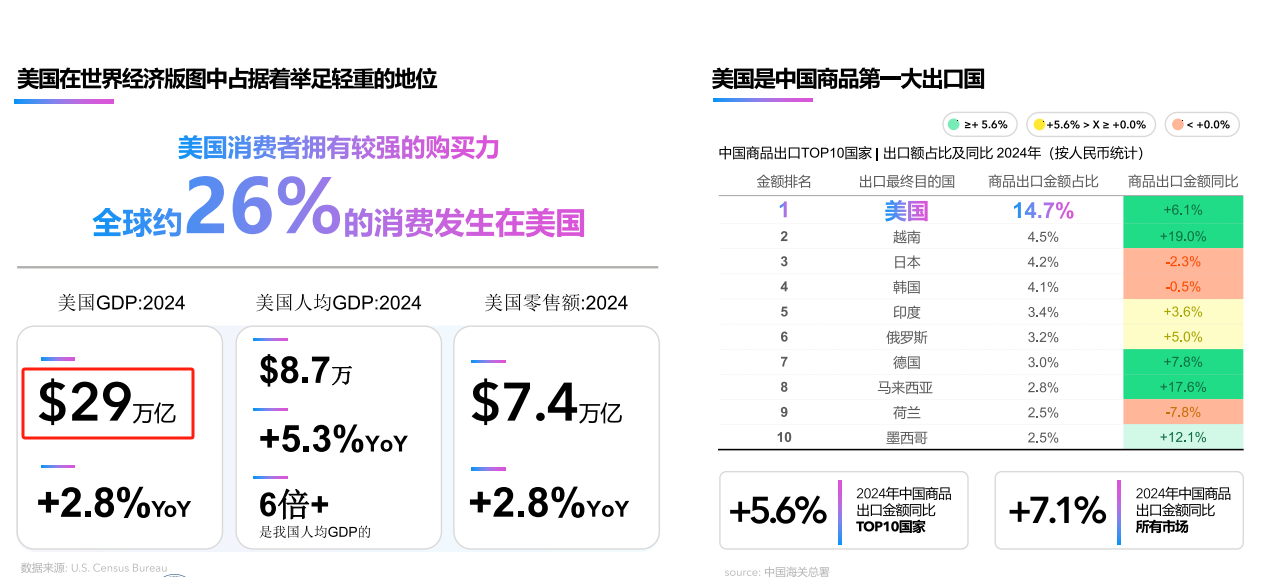

According to the "2025 US Consumer Market Consumer Electronics Industry Trend White Paper" released by Payoneer, in 2024, the US GDP will reach $29 trillion, with a per capita of $87,000, and total retail sales of $7.4 trillion, firmly ranking as the world's largest consumer market. In the field of consumer electronics, US sales are about $150 billion, ranking third globally, only behind China and Europe.

However, behind the huge market also come more severe challenges. Starting in 2025, the US will raise tariffs on Chinese-made electrical/electronic equipment to 145%, including categories such as machinery, furniture, and optical equipment, which will also face heavy pressure. Coupled with policy uncertainty, relying solely on product competitiveness is no longer enough to support brands breaking through; it is even more necessary to improve the ability to cope with uncertainty.

Image source: Payoneer "2025 US Consumer Market Consumer Electronics Industry Trend White Paper"

02/Reshaping Consumption Structure, New Opportunities Emerge

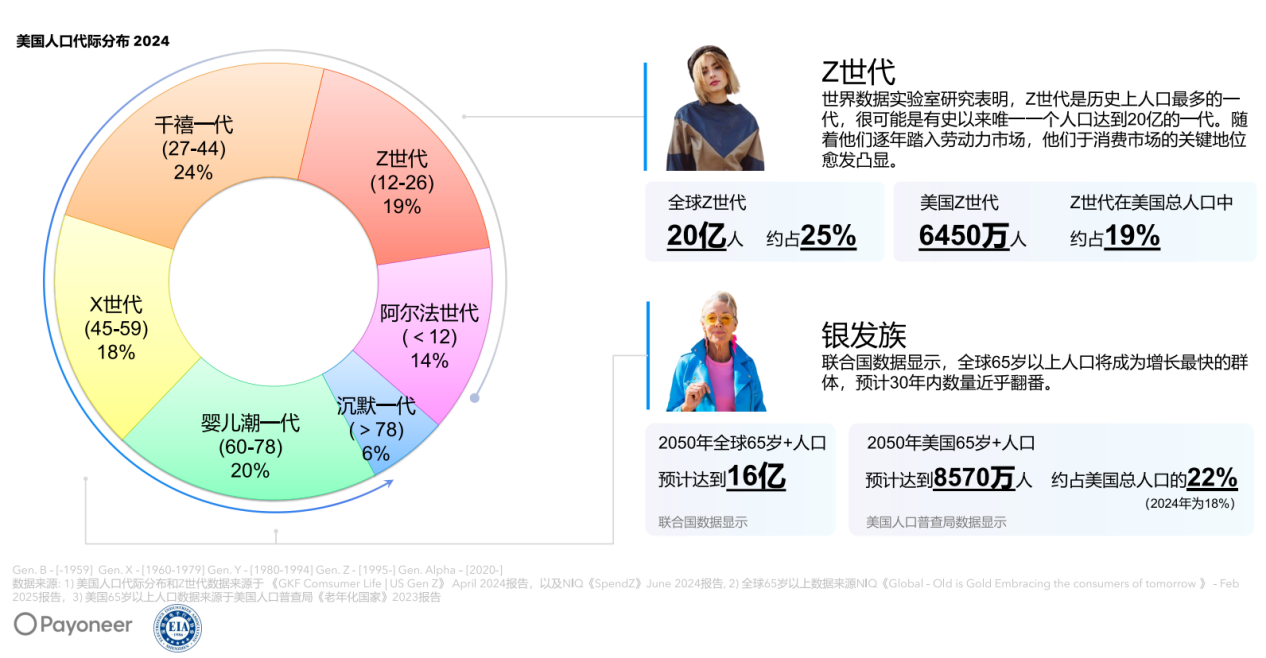

At the same time, the consumption structure of the US market is also quietly being reshaped, providing new entry points for Chinese brands. Among them, Generation Z and the silver-haired group have become the main consumer forces.

Generation Z (18-26 years old) accounts for 19% of the US population, has a high acceptance of Chinese brands, and focuses on design, functionality, and social communication. The brand's country of origin is not a key factor in their decision-making.

Meanwhile, the proportion of the silver-haired group in the total population is also rising, reaching 18% in 2024 and expected to reach 22% by 2050. The silver-haired group pays more attention to health, convenience, and comfort in their consumption and has strong purchasing power.

The intersection of these two groups is driving consumer electronics products toward new trends of intelligence, multi-functionality, and environmental friendliness.

Image source: Payoneer "2025 US Consumer Market Consumer Electronics Industry Trend White Paper"

03/Omni-channel Integration Becomes the New Normal

While the consumer structure is being reshaped, the evolution of purchasing channels is also changing the way brands connect with users. In 2024, online sales of consumer electronics in the US will account for nearly 60%, much higher than the overall retail online share (about 40%).

Moreover, although the share of offline channels has declined, retail giants represented by Costco and Walmart, relying on their membership systems, one-stop experience, and logistics advantages, still maintain strong stickiness. Especially among middle-aged and elderly user groups, offline experience remains important.

At the same time, the rapid rise of social e-commerce has made it an important shopping scenario for young groups such as Generation Z. It is reported that TikTok Shop's GMV in the US market increased by as much as 689% year-on-year, daily paying users increased by more than 100%, and among users aged 18-34, 42% have already made purchases through the platform.

Image source: Payoneer "2025 US Consumer Market Consumer Electronics Industry Trend White Paper"

04/How Chinese Brands Break Through

The continuous evolution of channel structure and consumer preferences is forcing brands to deeply adjust their strategies. Faced with fierce competition and policy pressure, Chinese brands have not stopped to wait and see, but are actively seeking change to find breakthroughs.

First, they are transforming toward high-end intelligence and strengthening product innovation. Data shows that 63% of revenue in the global consumer technology industry comes from new products launched within two years, with Generation Z being the key driving force.

Second, they are building new supply chain systems. The "China+N" model is emerging, dispersing production capacity to Southeast Asia or North America to avoid trade barriers. At the same time, AI and blockchain technologies are used to improve the efficiency of capital flow and compliance management.

For example, Anker Innovations saw a 28% increase in sales on its own platform and a 103% increase on Amazon in the first half of 2024, which is the result of the synergy between multi-channel layout and supply chain optimization.

05/Conclusion

The US market is evolving from a single sales front into a "stress testing ground" for verifying a company's globalization capabilities.

Under the new trade pattern, going global is no longer just about selling products, but a competition of systematic capabilities, including a complete set of global operation mechanisms such as brand awareness, supply chain layout, technological innovation, channel operation, cultural understanding, and policy compliance.

It is believed that only companies with "long-distance running" capabilities can truly take root overseas and achieve sustainable growth.