Air fryers have become fully popularized in recent years, and their features of being oil-free, healthy, and convenient have won the love of countless families. There is a Chinese kitchen appliance brand that has conquered the US market with its air fryer, successfully reaching the number one market share!

That is the kitchen appliance brand Cosori, under Shenzhen Vesync.

As a cross-border e-commerce brand, Cosori has been deeply involved in the kitchen appliance sector for many years. Its success is not only due to a single popular product, but also the result of deeply understanding consumer needs, optimizing product functions, and skillfully using marketing strategies.

01|In-depth Optimization of Product Strength

The success of Cosori air fryers is first attributed to its in-depth exploration and optimization of product strength.

Because Cosori air fryers are targeted at European and American households, whose usage needs differ from those in China, Cosori abandoned the features of compactness, fashion, and easy storage found in similar domestic products, and instead emphasized industrial aesthetics and a sense of technology, as well as higher health and convenience performance, making it more in line with the local aesthetics and usage needs of Europe and America.

Furthermore, the main selling point of air fryers is using hot air to fry food, reducing oil usage and ensuring food health. On this basis, Cosori further optimized temperature control technology, so that its products can get closer to the taste of traditional deep-fried foods (such as fried chicken and French fries) while maintaining low fat. This is particularly attractive to health-conscious consumers and is an important competitive advantage that distinguishes Cosori from other brands.

02|Building Brand Awareness with Top KOLs

No matter how good a product is, it cannot do without promotion, especially for a cross-border brand like Cosori. Although its parent company Vesync was founded in the United States, Cosori has never given up on brand promotion opportunities during its years overseas.

Initially relying only on independent site operations, Cosori adopted a strategy of cooperating with top KOLs for brand promotion.

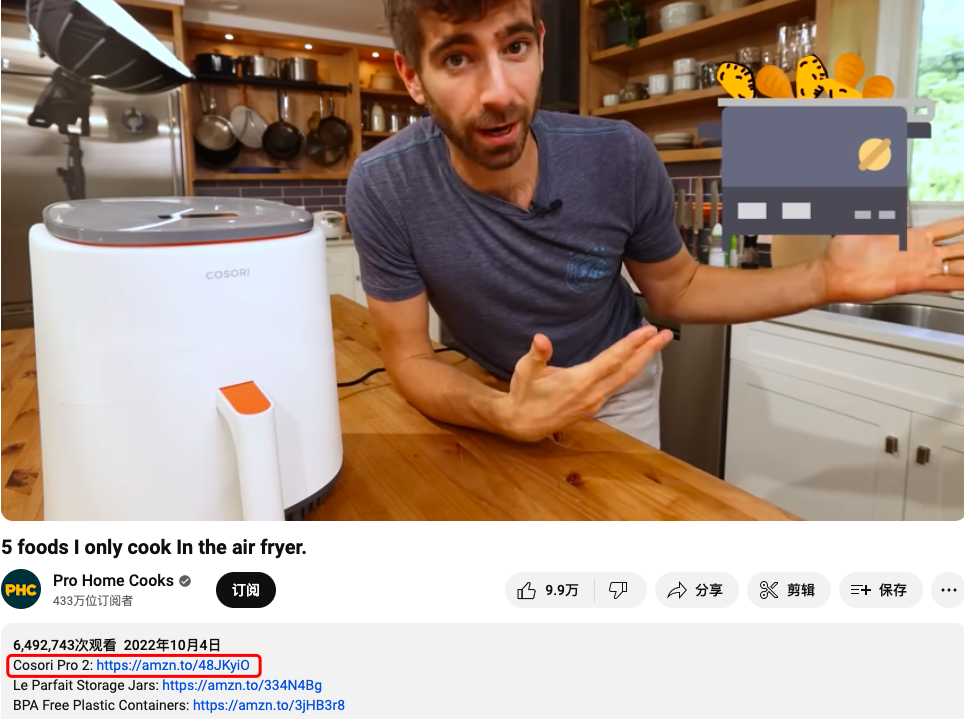

There are collaborations with influencers on YouTube, Facebook, Instagram, TikTok, etc., among which the video in cooperation with YouTube food channel Pro Home Cooks has reached nearly 6.5 million views!

The video shows in detail five kinds of dishes made with the Cosori air fryer, from vegetarian cookies to roasted ribs. These rich demonstrations not only enhance the product's appeal but also greatly increase Cosori's brand awareness and market recognition.

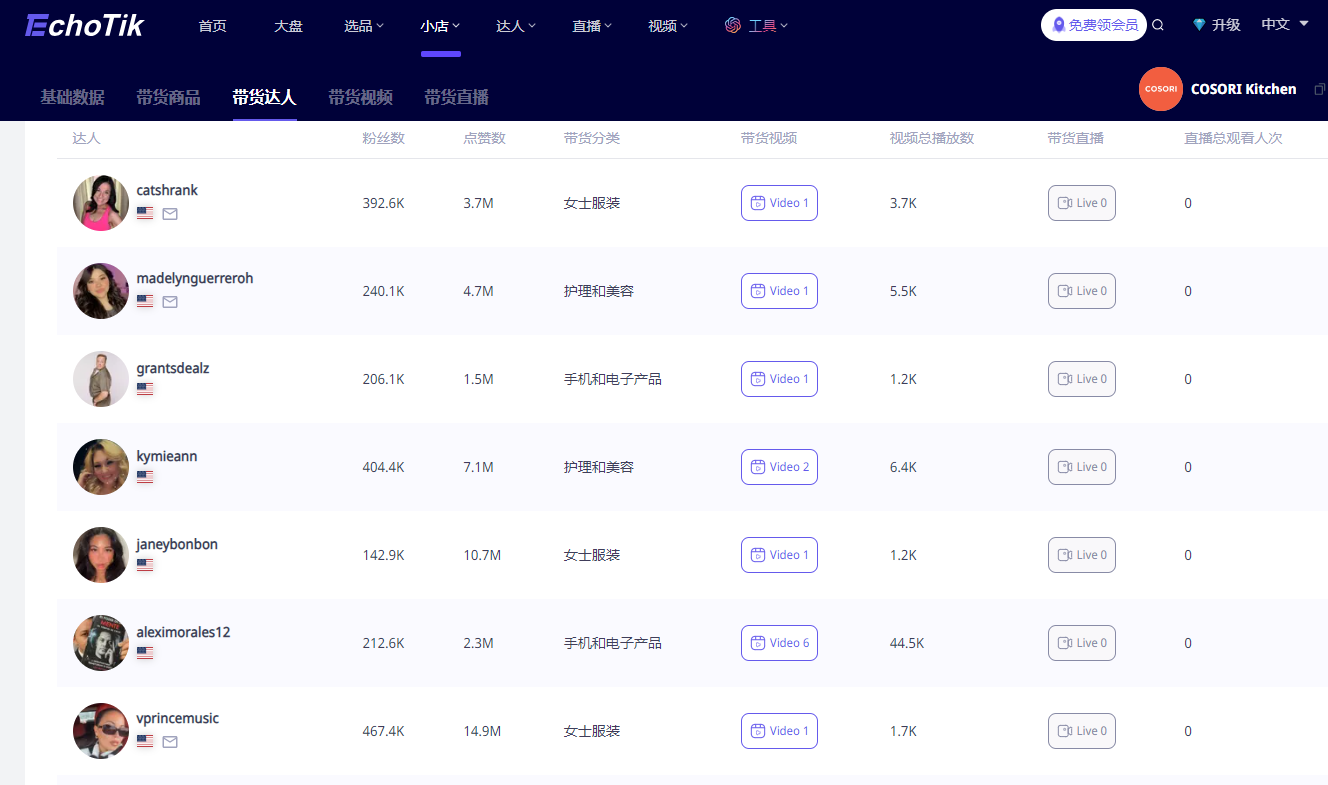

On Tuke, Cosori not only shares recipes on its official account but also cooperates with influencers for live-streaming sales, effectively increasing the market recognition of its products.

According to statistics from the third-party data platform Echotik, Cosori signed up as many as 2,300 influencers for promotion within 30 days. These influencers intuitively present the multifunctionality and convenience of the air fryer to consumers through their personal experiences in videos.

This "seeding" video strategy in cooperation with influencers effectively opened up product awareness and laid a solid foundation for Cosori's promotion in the US and global markets.

03|Localized Strategies to Deepen Niche Markets

In addition to unified global brand promotion, Cosori also attaches great importance to localized strategies.

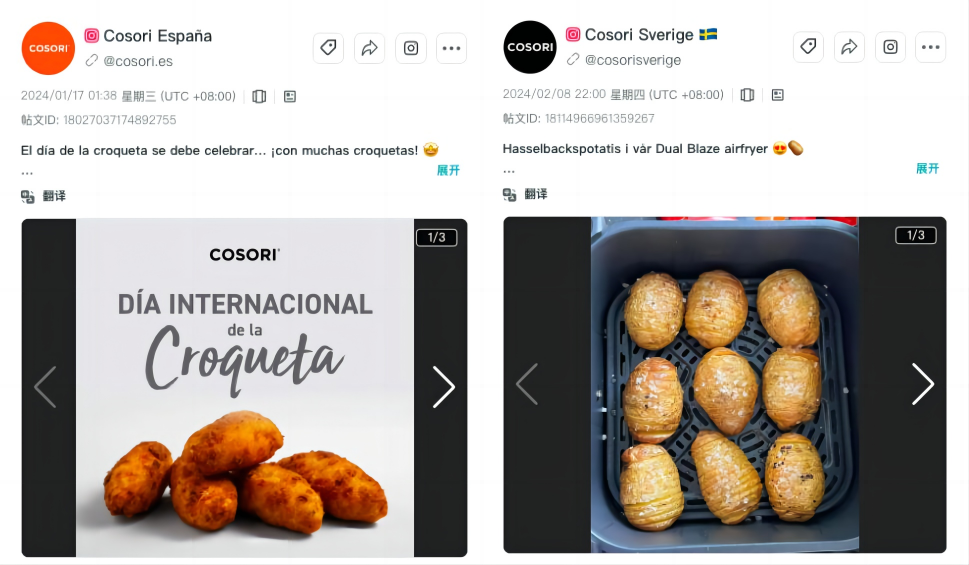

On the social media homepages of different countries and regions, it pushes ingredients and recipes that suit local consumers' tastes, such as promoting fried meatball recipes in Spain and Hasselback potato recipes in Sweden.

This strategy not only demonstrates the diverse usage scenarios of Cosori products but also effectively enhances the emotional connection between the brand and local consumers, increasing market stickiness.

Through such authentic food introductions, Cosori has successfully combined the functions of small kitchen appliances with local food culture, making the products better suited to the actual needs of the local market and consumers' lifestyles.

As a Chinese company, Cosori has successfully demonstrated the strong competitiveness of "Made in China" on the international stage.

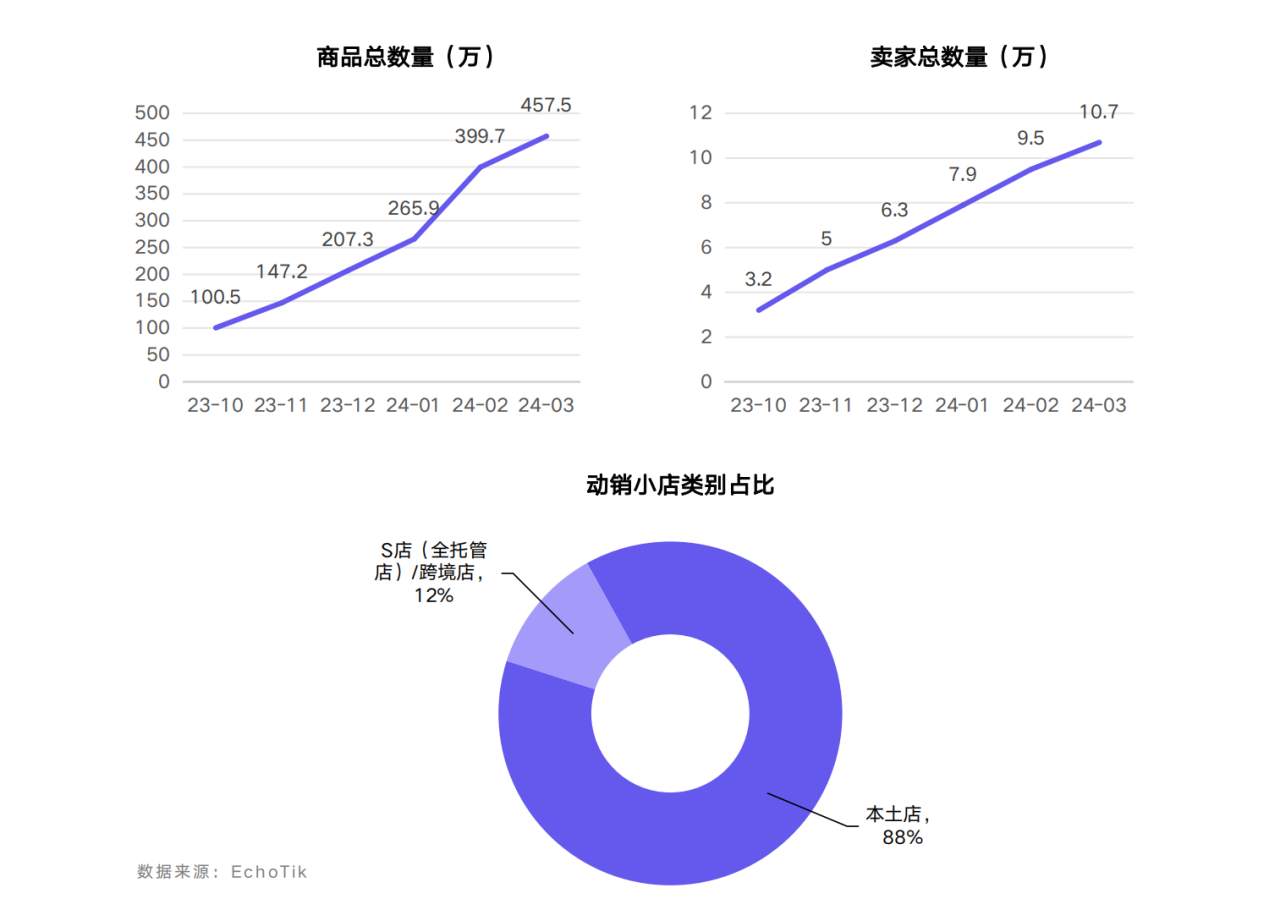

Although Tuke's development in the US is currently hindered and many domestic cross-border sellers have slowed down their efforts to expand the US market via Tuke due to the ban, according to a statistical report from the third-party data platform Echotik, Tuke US stores are showing a trend of growth against the odds under the ban,with 90% being local sellers. This shows that regardless of how the external environment develops, the major trend of content marketing is unstoppable.

Moreover, the US ban has also given Tuke some buffer, and Tuke has stated that it will not compromise, so the tug-of-war between the two sides will inevitably continue.

We cannot foresee the future, but the current trend is real and tangible.

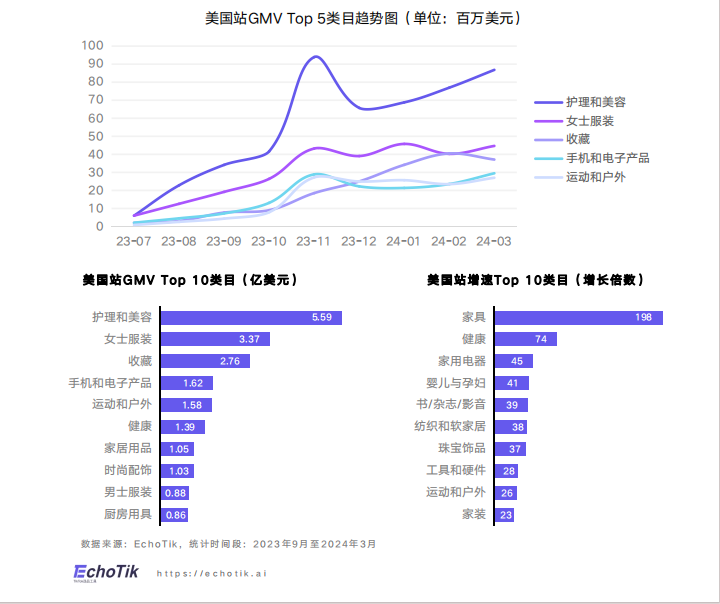

Echotik's statistics show that in Q1 2024, personal care and beauty remain the top GMV category on the US site, while the GMV of the furniture category has increased nearly 200 times, making it a current hot trend.

As for other trend analyses, there is a detailed explanation in EchoTik's report "Tuke Shop 2024 US Market Insights after the Ban," which can help many cross-border sellers and practitioners analyze opportunities in the US site and clarify their operational direction.

If you are interested, you can follow the official WeChat account and reply with the keyword: US Report, to get the full version of the report.