In recent years, people's health awarenesshas beengraduallyimproving.

In addition to maintaining healthy and regular habits in diet, daily routine, and exercise, medical-grade monitoring indicators such as blood oxygen, blood pressure, blood sugar, sleep, and heart rate are gradually moving out of hospitals and penetrating the consumer market.

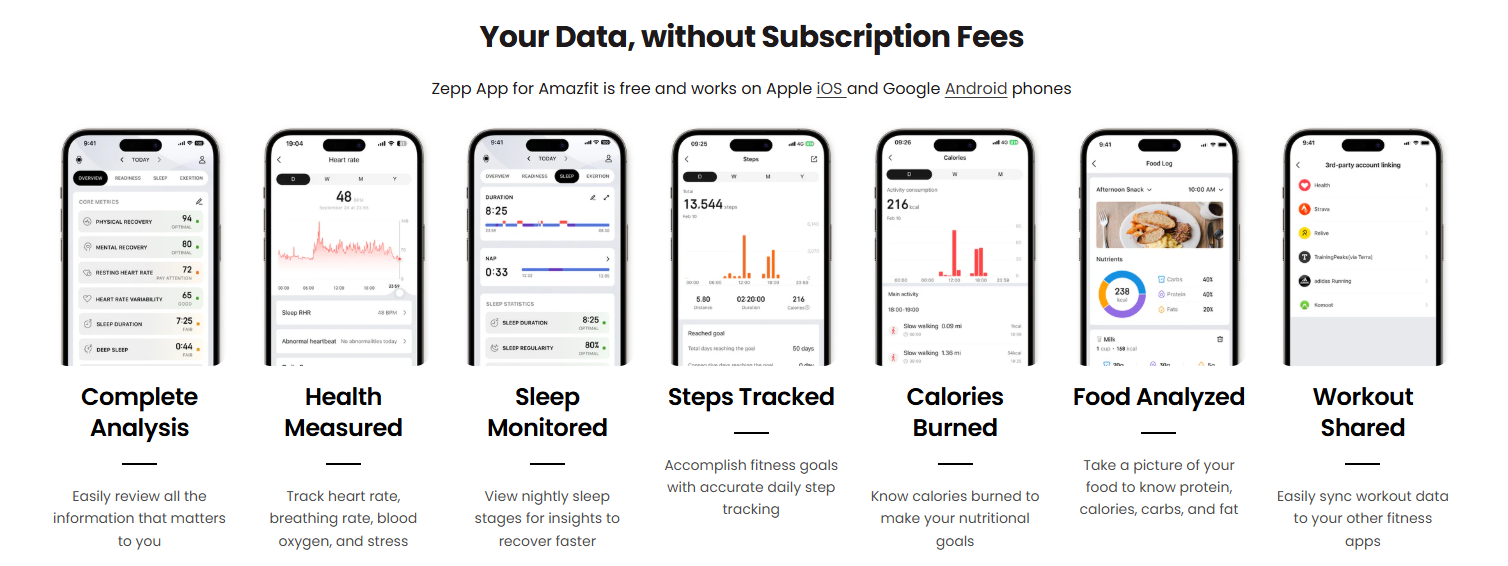

Image source:Amazfit

Under this trend, devices such as smartwatches that can monitor the human body at any time have also gradually transformed from“techtoys”to essential health necessities.

They not only accurately meet the public's health management needs, but also open up huge growth space for the entire niche market.

Image source:Amazfit

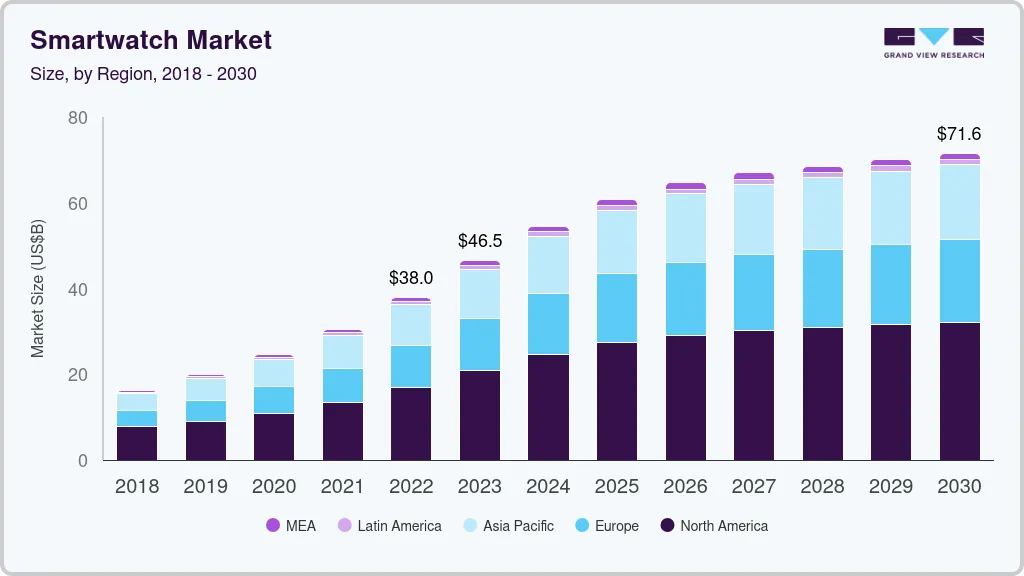

According to data released by research instituteGrand View Research:

The global smartwatchmarket size has been growing continuously since2018. In 2023, its valuation reached $4.65 billion, and it is expected to grow to $7.16 billion by 2030,with a compound annual growth rate of8.2%, the entireindustry showsasteady developmenttrend.

Image source:Grand View Research

Faced with this promising golden track, many domestic manufacturers haveentered the market,Tuketo seek gold. Withstrong product capabilitiesandeffectivemarketing strategies,they have successfully established themselves in overseas markets.

The brand we are talking about today,Amazfitbrand, is exactly the pioneer of Tuke in this track.

According to the 2025 financial report disclosed by its parent company Huami Technology, its self-owned brand Amazfit has an annual revenue of about $75 million (about RMB 540 million), and has grown into an important player in the global smart wearable device market.

Thisstarted as Xiaomiexclusive manufacturer for Mi Band, and has risen to become a dark horse with annual sales exceedingRMB 500 millionbest-selling product, its growth story is quite representative.

Image source:Google

Starting from Xiaomi's supply chain, launching parallel growth of self-owned brands

The brand story of Amazfit starts with its parent company Huami Technology.

Public information shows that in 2013, Huami Technology founder Mr. Huang reached a cooperation with Xiaomi, becoming the core developer and manufacturer of Xiaomi Mi Band.

In 2014, after the launch of the first Xiaomi Mi Band, sales exceeded ten million in just 13 months. This achievement gave Huami, then a Xiaomi supply chain company, valuable R&D and market experience.

Image source:Google

However, Huami's ambition was not limited to OEM manufacturing.In September 2015, Huami officially launched its own brand Amazfit, forming a "dual-wheel drive" model with Xiaomi business.

At that time, with international brands almost monopolizing the market,Amazfit did not confront them head-on, but chose a differentiated route, targeting the then relatively blank mid-to-low-end market and using high cost performance as the core breakthrough point.

Relying on the technical accumulation, mature supply chain, and large user base from the Xiaomi ecosystem period,Amazfit was able to quickly iterate while ensuring quality, successfully filling the gap in the mass consumer market.

Its products are equipped with self-developedBioTracker sensors, supporting heart rate, blood oxygen, sleep monitoring, and 150+ sports modes, and are compatible with both iOS and Android platforms, meeting diverse health management needs.

Image source:Google

With excellent functionality and user-friendly interaction design,the Amazfit brand has grown rapidly in the global market, once ranking among the top three in the global smart wearable device market.(Data source: Ennews)

As of2025, Amazfit's business map has expanded to more than 90 countries and regions worldwide, with a focus on the US, Germany, Spain, Indonesia, Thailand, Brazil, Mexico, India, Russia, and other markets, becoming a true Tuke dark horse.

Image source:Google

Breaking out strongly, social media platforms are accelerators for overseas development

For Tuke brands, improving product strength and user experience is certainly key, but to continue selling well in overseas markets, the biggest challenge is often how to make potential users know you first.

After all, without awareness, it is difficult to generate subsequent conversions.

Against this background, the globally popular social media platformsnaturallybecomethe core battleground for manyTuke companies to break through,and the Amazfit brand is no exception.

ItleveragesTikTok and other traffic hubs, using the platform's algorithmic distribution and dissemination mechanisms, successfullyhelpingthe brand reacha broader audience and become known to moreglobalconsumers.

Next, let's take a look at howthe Amazfit brand is deploying onTikTokplatform.

1. Build a localized account matrix for precise reach

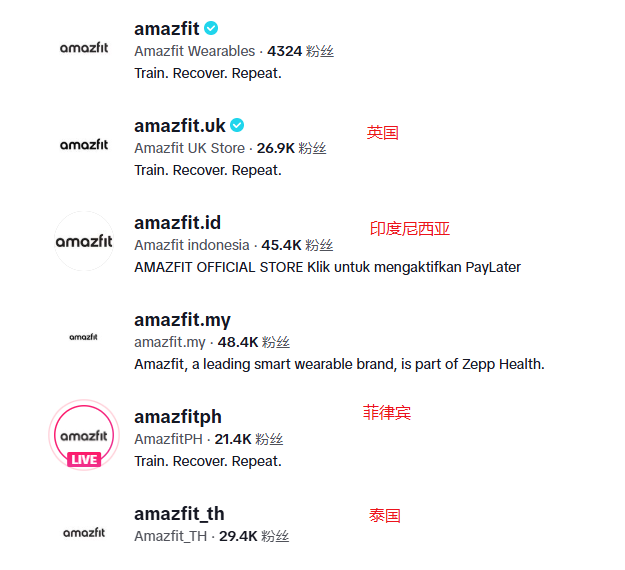

To achieve precise reach to users in different regions,the Amazfit brand has built a refined account matrix on TikTok, setting up independent localized accounts for key markets such as the UK, Indonesia, the Philippines, and Thailand.

Image source:TikTok

Currently, the total number of followers in this matrix has exceeded170,000. Among them, the official account for the Indonesian market @amazfit.id stands out, having accumulated 45,400 followers and 98,800 likes.

The content strategy of this account focuses on immersive feature demonstrations, using outdoor real-life operations to intuitively showcase the product's advantages in sports mode diversity, responsiveness, drop and pressure resistance,GPS positioning, and long battery life.

This fast-paced, visually strong content format highly fits the dissemination logic of short video platforms. In addition to quickly hitting users' pain points, it is also very helpful in improving the conversion rate of potential customers.

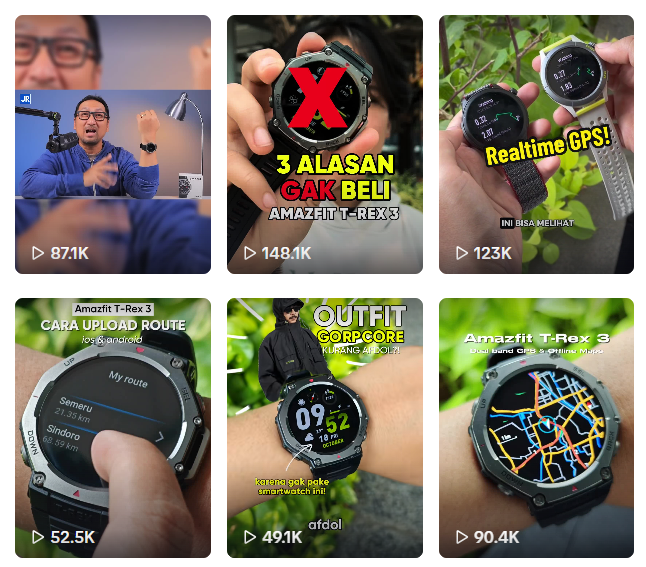

Image source:TikTok

2. Leverage vertical influencer ecosystem to penetrate core circles

In addition to cultivating the brand account matrix,Amazfit also knows how to leverage vertical influencers to amplify brand voice.

In influencer selection, the brand did not blindly cast a wide net, but based on precise user profiles, focused on the two core circles of sports and fitness. These two groups are accustomed to wearing smartwatches to monitor data during training, highly overlapping with the brand's target audience.

At the same time,the Amazfit brand also broke the limitation of fan base size, adopting a full-link coverage strategy—whether top, mid-tier, or micro-influencers, as long as the style matches, they are within the scope of cooperation.

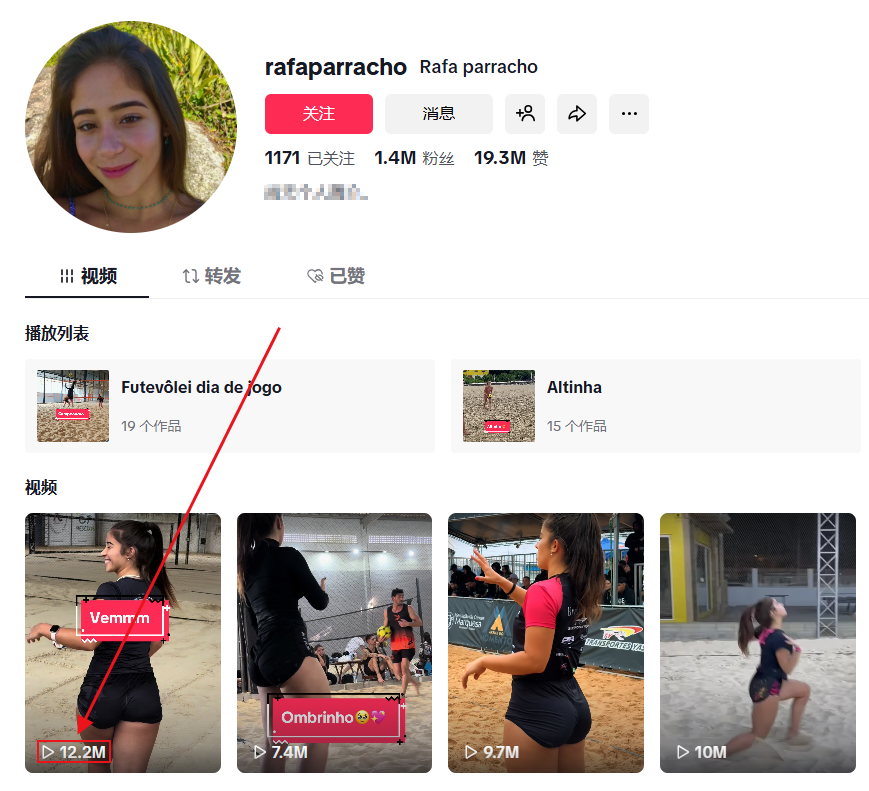

For example, in sports influencers, they cooperated with top influencer @rafaparracho who has1.4 million followers.

Image source:TikTok

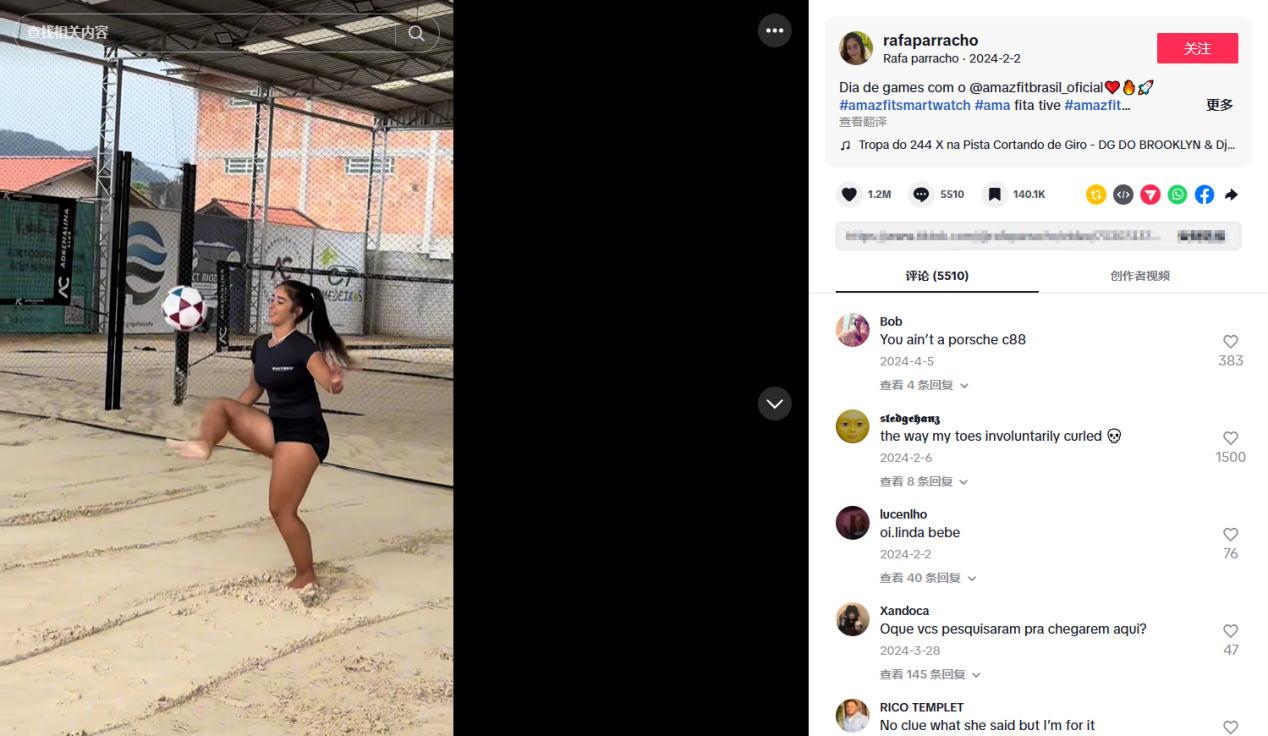

He posted a daily video of wearingAmazfit brand smartwatch for volleyball training, recording details such as checking heart rate in real time during training and showering with the watch after training.

This highly life-like video has so far garnered12.2 million views and 1.2 million likes.

Many viewers, while enjoying the training, subconsciously noticed the product worn by the influencer, effectively increasing brand exposure and favorability.

Image source:TikTok

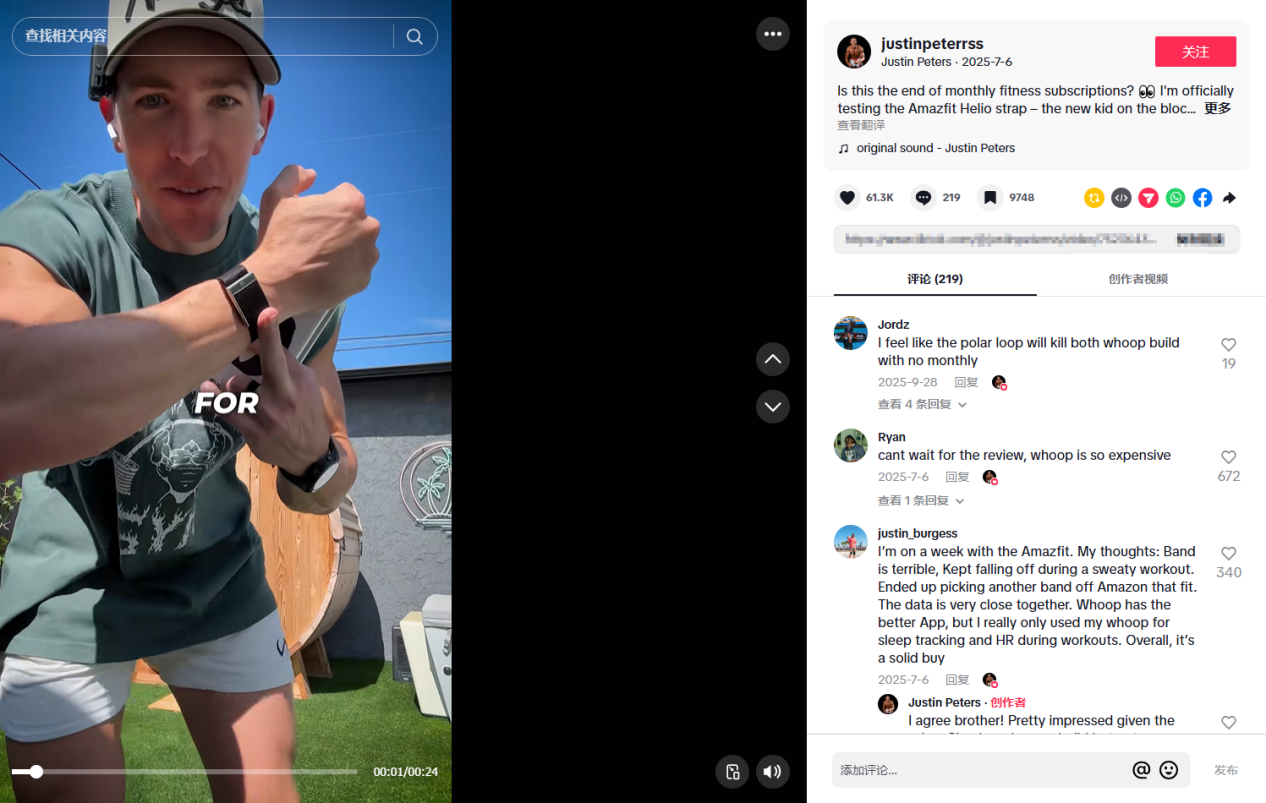

In the fitness influencer field,Amazfit has also worked with micro-influencer @justinpeterrss who has only about 7k followers.

Image source:TikTok

Although this influencer has a small fan base, the content conversion rate is quite impressive.

For example, in a viral video,@justinpeterrss tried out Amazfit's Helio wristband and said this device would be his main tool for exercise and sleep monitoring in the coming weeks.

Currently, the video has accumulated2.1 million views and 61,300 likes.

There are also comments in the comment section after watching:"Amazfit watches are great." The influencer replied: "So far so good!!!"

This case fully proves that through real reviews and trial experiences, even micro-influencers can effectively convey the practical value of products and achieve a small-to-big communication effect.

Image source:TikTok

Conclusion: Where is the road for Tuke?

The story of Amazfit tells us that in the era of globalized health consumption, the smart wearable industry is far from reaching its end, but the rules of the game have changed.

For brands to break out, they must grasp two points:First, precisely enter segmented scenarios, such as sports and health monitoring; second, establish emotional connections through social media content to expand brand influence.

For domestic companies, whether it is the mature European and American markets or the rapidly growing Southeast Asia and Latin America regions, consumers' demand for high cost-performance smart hardware remains strong.

The real test is whether you can, likeAmazfit, maintain product innovation while flexibly adapting to localized marketing.After all, the essence of globalization is not"going out", but "taking root".