Chinese e-commerce platforms are rapidly expanding globally, with Pinduoduo's cross-border e-commerce platform TEMU's layout in the Southeast Asian market being particularly noteworthy.

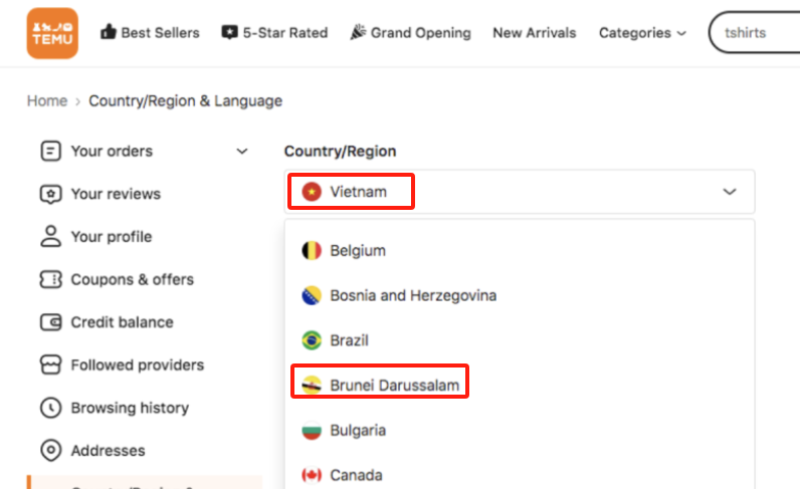

Recently, TEMU has quietly extended its services to Vietnam and Brunei, bringing its total market coverage in Southeast Asia to five countries.

Since its first entry into the Philippines in August last year, TEMU has embarked on its journey to expand into the Southeast Asian market. Shortly after, TEMU launched its Malaysia site in September of the same year, and further expanded to Thailand in July this year.Currently, TEMU's services have covered most of the major e-commerce markets in Southeast Asia.

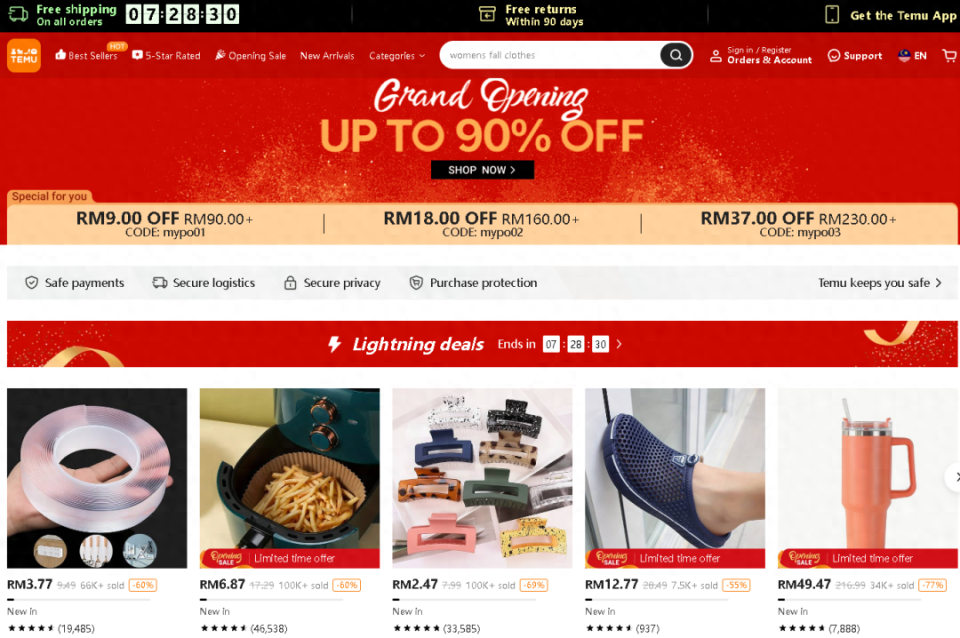

Although the initial launch of TEMU's Vietnam site is relatively basic in terms of functionality, it has already provided some preliminary shopping convenience for local consumers. At present, the site only supports an English interface, which may cause some inconvenience for Vietnamese consumers who are accustomed to using their local language. In terms of payment methods, TEMU Vietnam currently only accepts credit card payments and has not yet integrated popular local payment methods such as e-wallets, which may limit the shopping experience for some consumers.

In terms of logistics, TEMU Vietnam has currently established partnerships with only two logistics companies: Ninja Van and Best Express. Although the logistics options are limited, thanks to the advantage of bordering China, the delivery time for the Vietnam site has significantly improved compared to other Southeast Asian countries. Customers can receive their goods within 4 to 7 days, which is much faster than the previous 5 to 20 days required for delivery to Malaysia and the Philippines.

According to the recent "Southeast Asia E-commerce Overview" report released by OpenGov Asia, Vietnam and Thailand have become the two fastest-growing e-commerce markets in the Southeast Asian region.

Especially Vietnam, which has even stronger growth momentum, with the total gross merchandise value (GMV) of e-commerce platforms surging by 52.9% year-on-year in 2023.

In the past four years,the annual compound growth rate of Vietnam's e-commerce market has remained between 16% and 30%, making itrank first globally. Vietnam has surpassed the Philippines to become the third largest e-commerce market in Southeast Asia.

The OpenGov Asia report also points out that Vietnam has vigorously promoted the development of cross-border e-commerce through a series of policies and innovative measures, making it an important driver of economic growth. During the period from 2022 to 2025, the development speed of this sector is 2.3 times faster than traditional e-commerce.

In this fast-growing emerging market, TEMU's entry will undoubtedly bring more intense market competition. As in the entire Southeast Asian market, Shopee and Lazada have already established their leadership positions in the Vietnamese market, while TikTok Shop is also rapidly emerging.

It is worth noting that when TikTok launched its cross-border e-commerce business in 2022, it chose a completely different overseas route from TEMU. It first launched TikTok Shop in Southeast Asia, and it was not until September last year that the platform officially went online in the United States.

In contrast, TEMU's strategic focus was first on "mature developed markets" and then extended to "emerging markets," resulting in its relatively late entry into the Southeast Asian market and missing the opportunity to seize the initiative.

Some analysts believe that for TEMU, in regions of Southeast Asia with relatively low consumption levels, its advantage of winning with low prices may not be fully realized. If it wants to develop steadily in this region, it may mean further reducing its profit margins.

However, Lin Zhiyong, an experienced cross-border e-commerce expert, said in an interview with Wallstreetcn that Southeast Asian consumers prefer low-priced goods and are experiencing a "post-Taobao era," which gives TEMU's low-price strategy a distinct advantage and may allow it to easily replicate its successful model from China in Southeast Asia.

Against the backdrop of near-saturation growth in China's e-commerce market, TEMU represents Pinduoduo's key strategy to seek new growth points.

Through its low-price strategy and pioneering "full custody model," TEMU stormed into the vast blue ocean of cross-border e-commerce in September 2022, rapidly expanding to 48 countries and regions worldwide in 2023.

This year, TEMU's pace of global business expansion has not stopped, and it has entered more countries and regions. According to Wallstreetcn data, as of October 9, TEMU has established operations in 82 countries and regions worldwide.

As TEMU rapidly expands in international markets, it is also facing increasing political and policy challenges.

In Thailand, TEMU has encountered strict government scrutiny. Thai Prime Minister Srettha Thavisin instructed relevant departments to monitor whether TEMU complies with local laws and ensures its tax obligations are fulfilled. Srettha Thavisin also emphasized the challenges international e-commerce platforms pose to local retailers and warned that officials who assist foreign e-commerce in evading taxes will face legal consequences.

In the European and American markets, TEMU also faces tightening policies. The EU's Digital Services Act (DSA) closely regulates platforms like TEMU, and the EU is considering abolishing the tax exemption policy for low-value imported goods from non-EU countries. These challenges pose a test to TEMU's global expansion strategy.

After two years of rapid expansion, it is clear that TEMU still has a long way to go to achieve a leading position in the global cross-border e-commerce sector.