Recently,TikTok officially launched the short drama mini program section TikTok Minis within the platform, building a complete in-app closed loop around the distribution, viewing, payment, and monetization of short dramas.

Currently, the short drama mini programs that can already be seen includeShortMax, NetShort, starshort, SnackShort, and more than ten others. When users swipe to a trailer, they can click into the mini program to watch a preview, and if they find it appealing, they can pay to unlock the plot on the spot. The entire process takes place within the TikTok App.

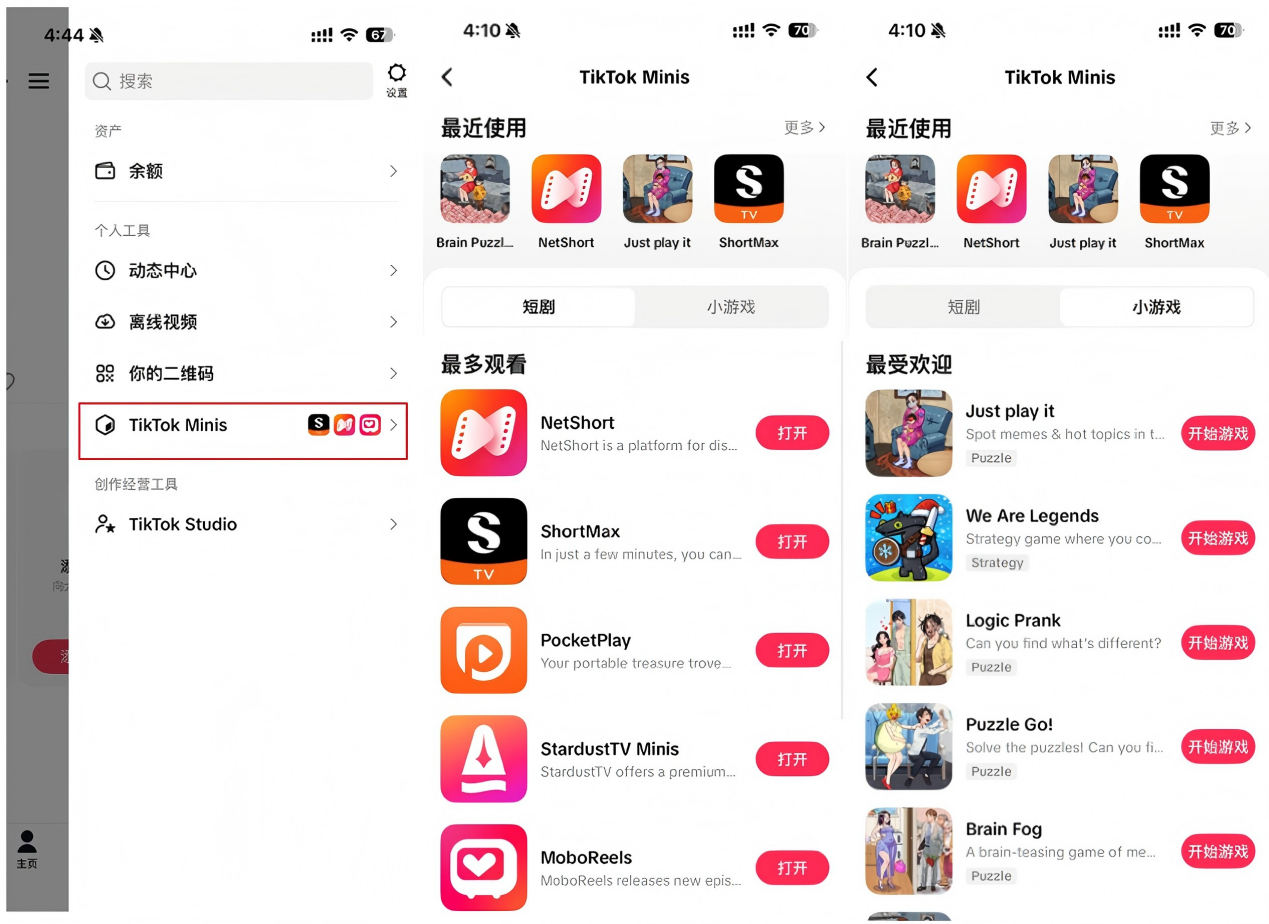

TikTok Minis section entry schematic Source: TikTok

For short drama entrepreneurs, this means a brand new“native scenario.”

As a short video platform with over 1 billion global users, once TikTok incorporates short dramas into its product ecosystem, the landscape established by short drama platforms that previously relied on independent App Tuke (such as Reelshor, etc.) is likely to be reshuffled.

In fact,TikTok's moves in the short drama direction did not appear suddenly.

In May this year, the platform had already started small-scale testing of short drama mini programs, with only 3 short dramas and 8 mini games at that time, and the entry point was relatively hidden, more like a product experiment. After half a year of feature refinement and content accumulation, by late December, this section was finally opened to more users.

For Chinese teams already working on or preparing to launch Tuke short drama projects, this round of opening has created new imaginative possibilities.

Source:TikTok for Business

From independentApp to in-app mini program: The key differences in TikTok's entry into the short drama track

In the past two or three years, the mainstream path for Chinese short drama Tuke has almost all been focused on independentApp.

The core problem with this model is: customer acquisition requires separate advertising, users have to download another app, the cost of acquiring new users is high, the conversion path is long, and users may drop off at every jump point.

The emergence of TikTok Minis is equivalent to providing an “in-app version” of this path:

Creators no longer have to build an independentApp, but can rely on TikTok's content recommendation to place short drama trailers in short videos, attracting users with the plot through natural browsing, and then seamlessly connecting to the mini program for preview and payment.

For users, the entire process from swiping to → preview → payment → finishing a drama can be completed without ever leavingTikTok, which greatly shortens the conversion path and reduces customer acquisition costs.

For entrepreneurs, the payment step no longer needs to“pull users out of the platform,” traffic loss is controlled within the platform, and both reach efficiency and monetization efficiency have the opportunity to be greatly improved.

Source:TikTok for Business

The pricing system also presents a structure completely different from that in China.

In China, many short dramas have gone from“dozens of yuan per drama” all the way to users watching for free and platforms monetizing through ads; but on TikTok, short dramas usually allow free unlocking of the first 8–10 episodes, and subsequent episodes are charged either by buyout or subscription—the buyout price per drama is about $7–10, and if you subscribe monthly to unlock all episodes, it ranges from $40–80/month.

This means that the same“9.9 yuan” dominating CEO short drama in China can be sold overseas for $10 to audiences willing to pay for excitement and emotional value.

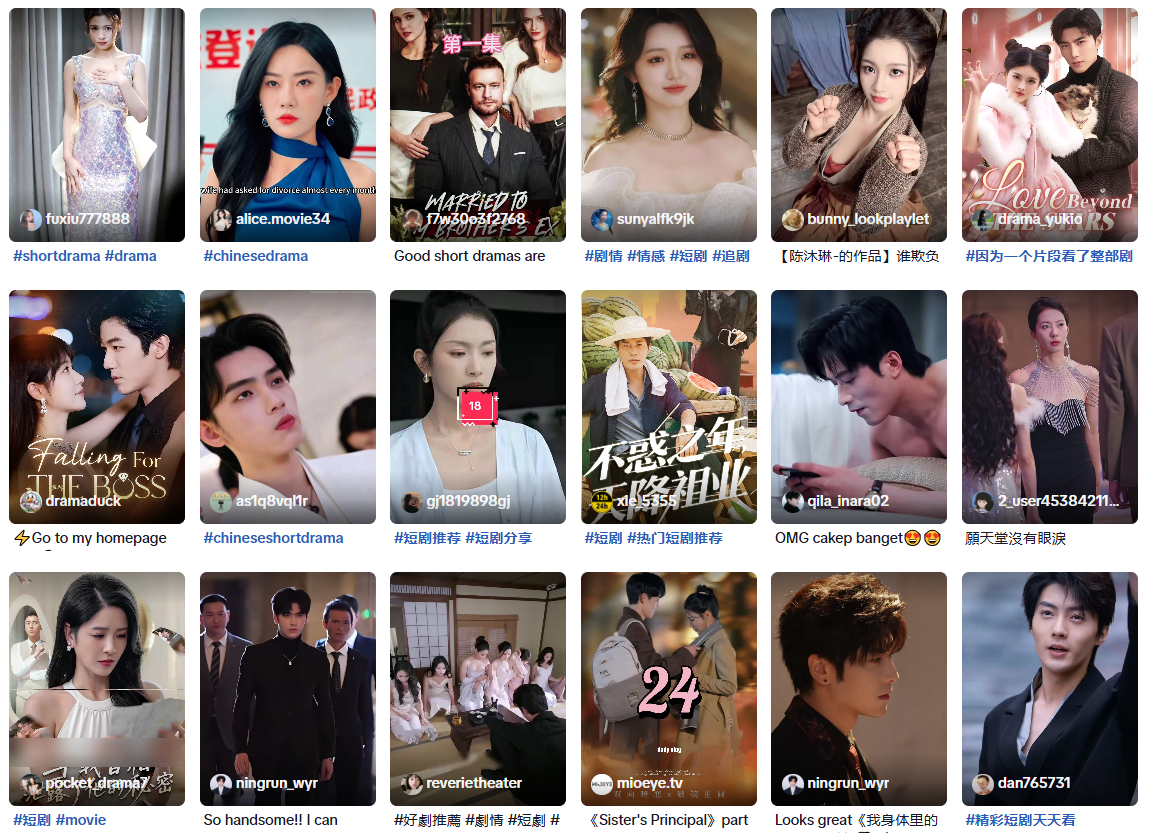

Source:TikTok

CEO, Counterattack, Forbidden Love: The Content Landscape of Overseas Short Dramas

From the current supply of overseas short dramas, the concentration of genres is very high.

Mainstream genres still revolve around three main lines: romance, urban, and counterattack, with female-oriented content accounting for more than 70%—CEO sweet romance, wealthy family secrets, werewolf/vampire-style forbidden love and other elements continue to produce hits in different regions.

Although the general direction is similar, there are still obvious differences in preferences for style, pacing, and character settings in different regions.

Some markets prefer extremely dramatic“爽文 adaptations,” while others prefer more realistic urban romance; how to create versions adapted to different regions within the same genre framework will be a challenge content teams must solve when going Tuke.

Looking at the bigger market picture, the scale of this track is already significant.

In 2025, the global micro-short drama market size will be about 90 billion RMB; among which the overseas market has exceeded 22.6 billion RMB, with a year-on-year increase of over 200%. North America has become the world's largest micro-short drama consumption market, contributing nearly half of the in-app purchase revenue.

Chinese teams play an absolutely leading role in this overseas market.

Among the top20 short drama apps by revenue, 90% have a Chinese background, taking about 91% of the market revenue; Southeast Asia and Latin America are the fastest-growing regions, with Indonesia, Thailand, and other countries entering the top ten for Chinese micro-short drama Tuke downloads, and short dramas are becoming a regular entertainment option for young users.

Source:TikTok

Short Drama×E-commerce: The Next Door TikTok May Open

Beyond content forms, the combination of short dramas and e-commerce is also widely seen asone of TikTok's next key directions.

Once short drama mini programs are integrated with e-commerce capabilities, products such as clothing, beauty, and home goods in the plot all have the opportunity to be tagged with purchase links, allowing users to follow the plot and place“same style orders” at the same time, creating a closed loop of content and transaction in the same scenario.

This“watch and buy” model has already been validated in China's live-streaming e-commerce.

IfTikTok Minis commercializes and contextualizes short dramas, it may replay the “content-driven commerce” business story overseas, but this time the protagonist is the plot, not the live room.

For Tuke entrepreneurs, this is not just a new advertising slot, but a new growth framework:

Short dramas are responsible for creating emotions and topics, short videos handle cold start exposure, mini programs realize conversion and payment, and e-commerce completes product conversion at the right nodes—all links are included within the same platform.

What does this mean for Chinese short drama entrepreneurs?

Overall,the launch of TikTok Minis adds a new “in-app closed loop” track on top of the original Tuke short drama path.

It provides a brand new Tuke entry point for Chinese micro-short dramas, and also adds more possibilities for content teams and entrepreneurs: they can continue to focus on the independentApp model, or migrate or synchronize some content to TikTok mini programs for incremental growth.

More importantly, this path allows“traffic value, commercial revenue, and cultural export” to be amplified simultaneously within the same ecosystem.

When this highly Chinese content form of micro-short drama is accepted by overseas users through payment, following, and secondary creation, Chinese teams are not only selling plots and memberships, but also bringing a whole set of narrative methods, character templates, and emotional expressions to the world.

For Chinese entrepreneurs already on the short drama track, the question to consider next may no longer be“whether to launch on TikTok Minis,” but rather:

In this brand new in-app track, how to use topics, genres, and gameplay to be the first to create a short drama brand that global users will remember.