This document is the 2024 Global Maternal and Infant Products Market Insight Report produced by Dashu Cross-border, mainly analyzing the current situation, trends, consumer insights, industry analysis, and brand cases of the global maternal and infant products market, providing comprehensive market information and strategic guidance for the industry.

1. Market Analysis

- Market Definition and Classification: The maternal and infant market covers baby food, care products, maternity products, and maternal and infant health products, including milk powder, maternity wear, diapers, baby skincare products, and other segmented categories.

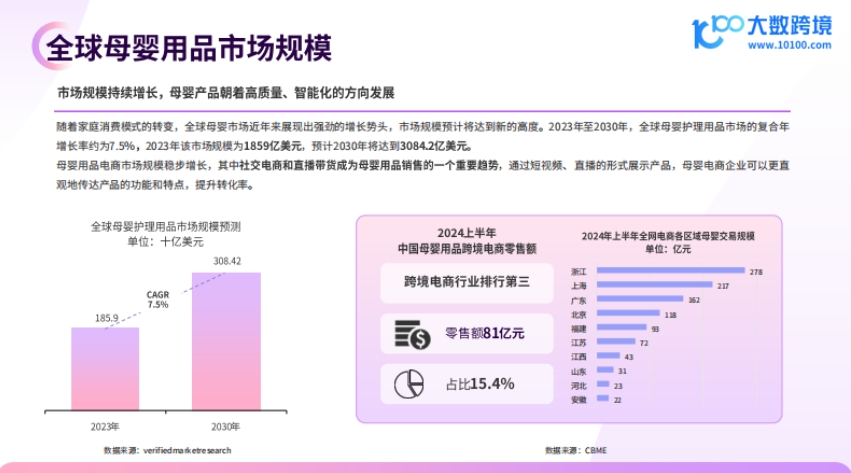

- Market Size

- The global maternal and infant care products market size is expected to grow from $185.9 billion in 2023 to $308.42 billion in 2030, with a compound annual growth rate of about 7.5%. The e-commerce market size is steadily increasing. In 2023, the size of China’s maternal and infant products market grew to RMB 384.29 billion, with the largest expenditure on clothing and footwear.

- Competitive Landscape: Multinational brands such as Johnson & Johnson and Kimberly-Clark dominate, while local brands like Babycare are rising and expanding their market share.

- Distribution Channels: Supermarkets/hypermarkets are the main channels, accounting for about 46%, while e-commerce platforms account for 17% and are growing rapidly. Consumers show different online and offline purchasing preferences for different product categories.

2. Product Insights

- Category Analysis

- Baby Care: The product market is heating up, and the market size is expected to continue growing from 2023 to 2033. Hair care and cleansing products have the highest revenue share, while skincare products are growing fastest.

- Baby Food: The market is showing stable growth. Asia is the largest and fastest-growing market, with China having the highest revenue. Consumption upgrades are driving demand growth.

- Maternity Care: The market size is growing steadily. From 2024 to 2029, the compound annual growth rate of maternity care products is 5.88%, and from 2024 to 2031, the compound annual growth rate of maternity support products is 5.72%.

- Hot Product Analysis

- Baby Diapers: Market demand is stable. Asia has the highest revenue and fastest growth, with a large market size in China. From 2024 to 2027, the global market is expected to grow annually.

- Infant Formula: Market size is expanding, with China leading the growth. The compound annual growth rate from 2024 to 2029 is 5.61%, and per capita consumption is increasing.

- Maternity Wear: The market is popular, with a compound annual growth rate of 6.9% expected from 2023 to 2033. Cotton tops are the most popular.

3. Hot Region Analysis

- Regional Overview: The Asia-Pacific region leads the market, with rapid growth in China, the US, India, and South Korea. Emerging markets have great potential. In 2023, China led in revenue in the baby and children’s skincare market, while the European market holds an important position with high-quality products.

- Asia-Pacific: Population dividend drives market growth, with a large market share. The Indian market is expanding rapidly. Developed countries see growing demand for high-end products. The compound annual growth rate of the baby care products market from 2024 to 2033 is 6.1%.

- North America: The market is growing steadily, with the US holding a significant share. The compound annual growth rate from 2024 to 2031 is 5.4%. The US baby and child skincare industry has broad prospects.

- Europe: The market is growing steadily, with Germany leading. Organic and eco-friendly products are favored. The compound annual growth rate from 2024 to 2031 is 5.1%, and baby food market revenue is expected to grow.

- Middle East and Africa: The South African baby care market is growing steadily. The Middle East mainly relies on offline retail, while online consumption is gradually rising.

4. Consumer Insights

- Consumer Profile: Includes expectant mothers, new mothers, and their family members. Male participation is increasing, with ages mainly distributed between 26 and 35 years old.

- Consumer Concepts: Diverse needs, focus on scientific parenting, product quality and safety. Consumption upgrade trends are obvious, with more attention to product ingredients and brand reputation.

- Consumption Matrix: Consumers at different stages have different needs, covering various products and services for pre-pregnancy, early pregnancy, newborns, and preschool children.

- Behavioral Preferences: Focus on quality and personalization, accustomed to online shopping, sharing, and reviewing. Information acquisition channels are diversified.

5. Industry Analysis

- Industry Chain: Upstream includes chemical raw materials, agriculture and animal husbandry, etc. Midstream covers baby and maternity products and services. Downstream includes various online and offline channels.

- Industry Outlook: The middle class drives consumption upgrades, promoting the development of high-quality maternal and infant products. Global population growth and middle-class expansion provide a sustainable consumption base.

- Overseas Opportunities: Parents’ disposable income increases, global consumer demand rises. Chinese government policy support, mature supply chain, and strong innovation and R&D capabilities.

- Overseas Challenges: Different market environments and consumption habits exist. Overseas consumers prefer products from regions with sound regulation. Chinese brands need to build trust.

- Development Trends: Female and parent consumption concepts are upgrading. Product ingredients pursue natural and non-irritating properties. Emerging sales channels are rising.

6. Brand Cases

- Yoboo: Focuses on the maternal and infant market, providing breastfeeding products and solutions. The brand image is good, leading in sales after entering Shopee, with guaranteed quality and safety. Marketing through channels such as TikTok, adopting a tiered product positioning strategy.

- Babycare: Founded in 2016, covers all categories, cooperates with well-known enterprises, has won multiple honors, and expanded to more than 30 countries worldwide. Marketing focuses on product design, multi-platform layout, diversified content, hot topic marketing, and private domain traffic operations. The product line is rich, and some products have a high degree of market monopoly.