This document is Tengdao's analysis report on the 2024 overseas market trends for kitchenware, mainly covering the current development status of mainstream kitchenware import and export, key countries for import and export, interpretation of overseas importers and exporters, as well as market strategies and development suggestions for Chinese kitchenware manufacturers. It also introduces Tengdao Company and its Waimaotong V5.0 product.

1. Current Development Status of Mainstream Kitchenware Import and Export

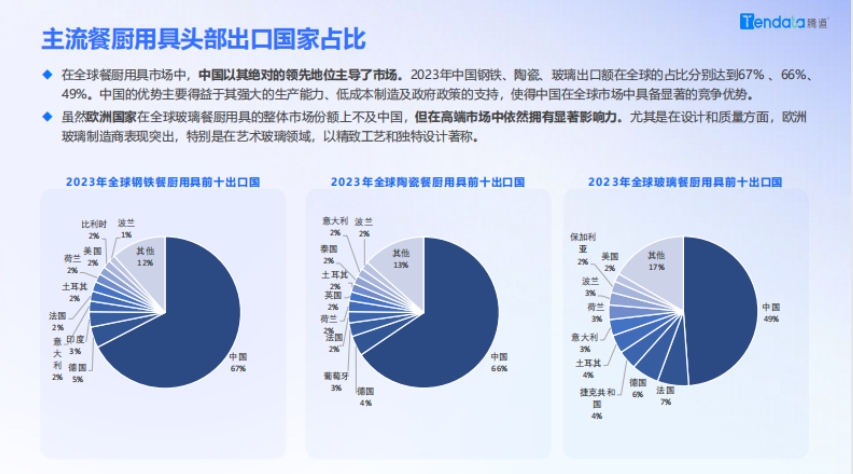

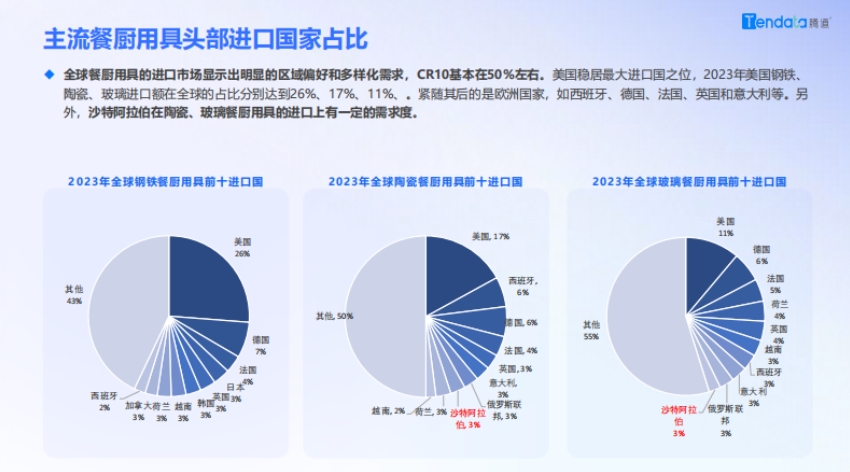

- Global Import and Export Overview: China leads globally in the export of steel, ceramic, and glass kitchenware, while Europe has influence in the high-end glass kitchenware market. The United States is the largest importer, and European countries also have significant import demand. From 2021 to 2023, global mainstream kitchenware import trade showed a downward trend; steel imports declined year by year, ceramics slightly declined, and glass imports increased. In 2024, steel imports fell back, while ceramics and glass began to decline from April onwards.

- China’s Export Situation: China is a major producer and exporter, with total exports reaching $59.6 billion in 2023, a decrease of 4.02% compared to 2022. The export trend from January to June 2024 is basically consistent with 2023, with the number of trade transactions increasing in 2023 and slightly lower at the beginning of 2024 compared to the same period. Export categories are diverse, with major export regions including the United States, Japan, etc. The United States is the largest trading partner. China’s kitchenware industry shows a net export trend, driven by production costs, product innovation, and policy advantages.

- U.S. Import Trend: The share of steel products is declining, ceramic product imports are stable, and glass products show growth potential. The U.S. is gradually favoring countries with geographical and cost advantages for steel kitchenware imports, preferring countries with design craftsmanship and cost advantages for ceramics, and China’s market share for glass kitchenware is dominant and steadily rising.

2. Key Countries for Mainstream Kitchenware Import and Export

- China: Is a major exporter, with a wide range of export categories and regions, and has a significant trade volume with the main importer, the United States, holding an important position in the global market.

- United States: Is the largest importer, with different import trends for various types of kitchenware, and the proportion of imports from different countries for each category also changes.

3. Interpretation of Overseas Importers and Exporters of Mainstream Kitchenware

- Ceramics: The export market is fragmented, with CR8 accounting for about 40% of the market share. Exporters are concentrated in Europe and Asia, with a large number of Chinese exporters and active trade, while some European countries are competitive in high-end niche markets. Importers are mainly in Europe, but also distributed in Asia, South America, and other regions.

4. Market Strategies and Development Suggestions for Chinese Kitchenware Manufacturers: Efforts can be made to strengthen brand influence in high-end markets, optimize supply chain management and diversify logistics channels, vigorously explore emerging markets, develop environmentally friendly and sustainable kitchenware, strengthen online channel construction and localized services, and provide customized and intelligent services.