This report is published by the Autohome Research Institute, mainly focusing on the development of Chinese automobiles in the Thai market. It analyzes Thailand's economy, automotive market trends, Chinese brand deployment, and consumer insights, providing references for Chinese automotive companies to develop in the Thai market.

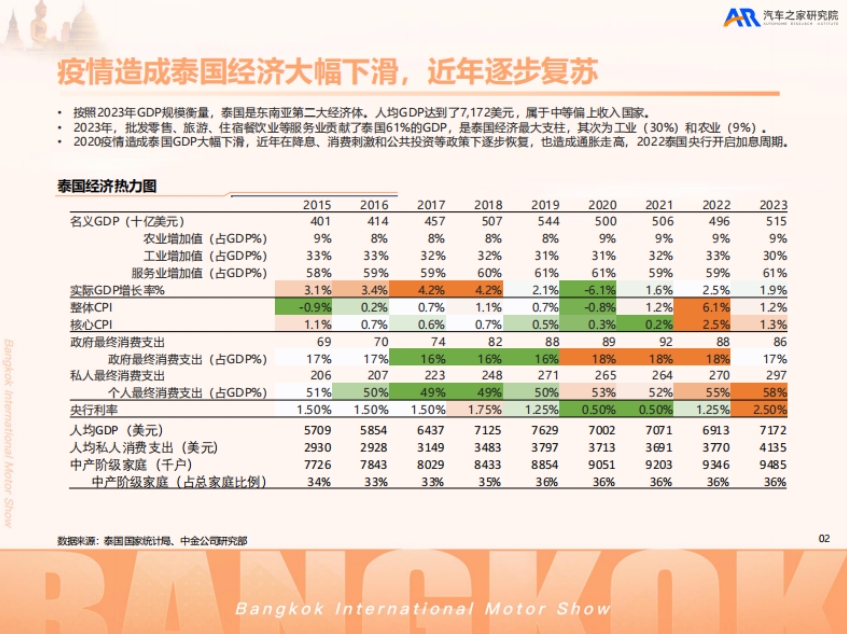

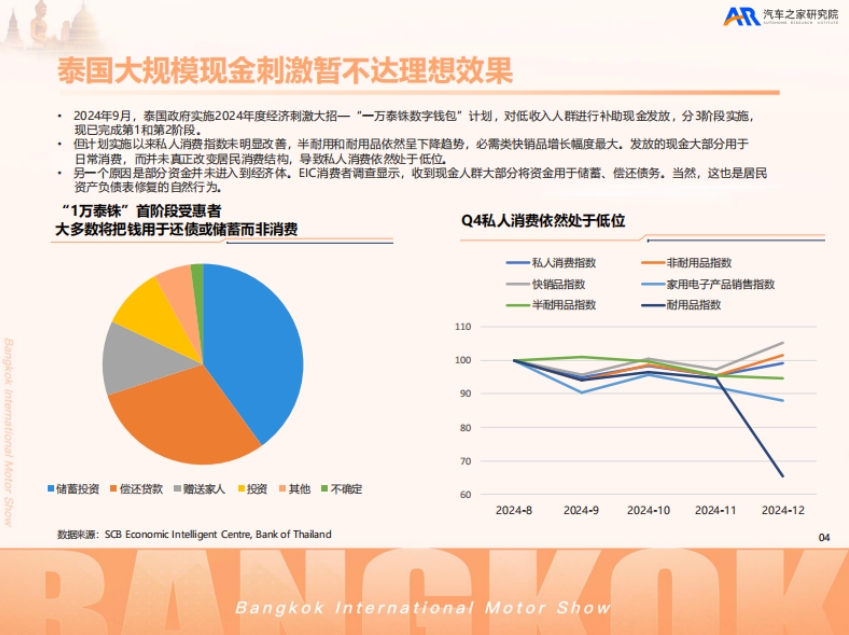

1. Thailand's Economy and Consumption Status: Thailand is the second largest economy in Southeast Asia, with the service industry as its economic pillar. The economy declined due to the impact of the pandemic, but gradually recovered under policy stimulus. However, it also faces issues such as inflation and interest rate hikes. The structure of economic recovery is unbalanced, with private consumption growth as the main driving force. Large-scale cash stimulus has not been very effective, and economic recovery still faces challenges such as high household debt and credit contraction, which have negatively affected the automotive market.

2. Trends in the Thai Automotive Market: Currently, the Thai automotive market is experiencing sluggish sales, affected by high borrowing costs, difficulty in obtaining loans, lack of consumer confidence, and price wars. In the medium to long term, with government support for electrification policies, the market is expected to recover through electric vehicles. In terms of market structure, the share of traditional mainstay pickup trucks is declining, SUV share is rising, and the growth rate of new energy penetration is slowing down. Chinese brands are developing rapidly, surpassing American brands in market share and becoming the first choice for Thai consumers in the new energy market.

3. Analysis of Chinese Brand Deployment: Many Chinese automotive companies are accelerating their deployment in the Thai market, evolving from early vehicle exports to local factory construction and deep cultivation of the entire industry chain. Companies are enhancing competitiveness by building factories and launching new products. For example, BYD and GAC Aion have seen significant sales growth, but also face challenges such as quality control and localization.

4. Thai Consumer Insights: 72% of Thai consumers are willing to purchase Chinese brand vehicles, mainly because Chinese cars have lower prices and usage costs, meeting consumer demands for cost-effectiveness, functional practicality, intelligence, and a sense of fashion. Although fuel vehicles are still the mainstream choice, most consumers have some understanding of Chinese new energy vehicle brands.

5. Summary and Outlook: The Thai automotive market has great potential. Policy support, a complete industry chain, and high consumer acceptance of new energy vehicles are all opportunities. However, there are also challenges such as competition from Japanese companies, insufficient localization, and the need to improve brand reputation. Chinese brands can break through development bottlenecks by expanding the market, innovating services, improving the industry chain, and strengthening technological innovation.