This document is the "Annual Special Analysis of China's Cross-border Payment Industry 2025" released by Analysys Qianfan, mainly analyzing the development status, challenges and opportunities of the cross-border payment industry in 2024, as well as future development trends.

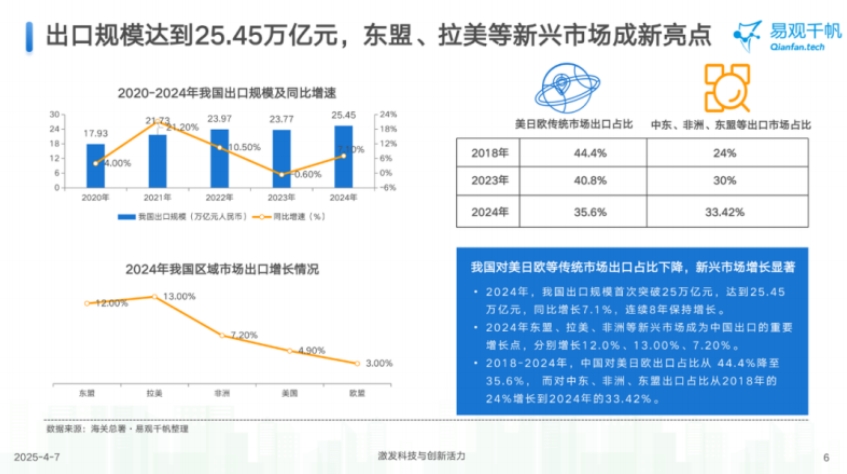

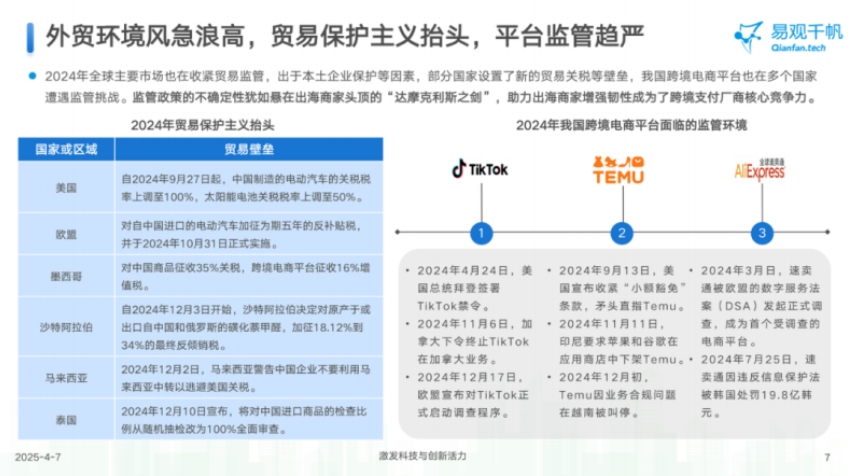

1. Changes in the cross-border payment market: In 2024, the cross-border payment market faces both pressure and resilience. Internally, there is policy support, such as the government continuously releasing policy dividends for cross-border e-commerce and B2B foreign trade; however, the external environment is less optimistic, with rising trade protectionism, stricter platform regulation, greater policy uncertainty after the US election, as well as geopolitical conflicts and trade barriers, all putting significant pressure on the development of cross-border payments.

2. Current market development

- Cross-border e-commerce payment: Cross-border e-commerce is developing rapidly and is the core scenario for third-party cross-border payments. In 2024, China's cross-border e-commerce import and export volume grew quickly, its share of foreign trade increased, and the number of enterprises rose. The market size of third-party cross-border e-commerce payments exceeded 1.2 trillion yuan, with significant growth. Innovative models of cross-border e-commerce platforms have lowered entry barriers and driven increased payment demand. Moreover, cross-border payment providers attract customers through compliant operations and service upgrades, such as connecting with mainstream e-commerce platforms, obtaining overseas licenses, and providing more comprehensive fund management services.

- B2B foreign trade payment: There are many enterprises engaged in import and export business in China, with a high proportion of small and micro enterprises. The pandemic has accelerated the digitalization of B2B foreign trade, and orders have become increasingly fragmented. B2B foreign trade merchants face many pain points in payments, such as difficulty in opening accounts, long payment cycles, and high compliance requirements. Third-party cross-border payment providers address these pain points by offering complete payment solutions for B2B foreign trade scenarios. In 2024, the scale of third-party cross-border B2B foreign trade payments exceeded 300 billion yuan, with rapid growth.

3. Opportunities and challenges in emerging markets: Emerging markets such as Southeast Asia, Latin America, and the Middle East have large populations, strong consumer demand, and fast-developing e-commerce markets, making them new highlights for cross-border payments. However, the payment environment in these markets is complex, with diverse payment methods, significant differences in regulatory policies, and underdeveloped infrastructure. Cross-border payment providers need to operate locally, build localized payment networks, adapt to compliance requirements, and improve technical efficiency to help cross-border e-commerce expand into emerging markets. However, the expansion process is fraught with difficulties and competition is fierce.

4. External environment and technology application

- Tariff impact: Changes in the global trade landscape and tariff policy uncertainty, such as increased tariffs by the US, have squeezed the profits of Chinese companies going abroad, affected the competitiveness of Chinese goods, blocked transshipment trade routes, and put pressure on the development of cross-border payments.

- Regulation and compliance: Regulation is becoming increasingly strict. When expanding overseas business, cross-border payment institutions face challenges such as obtaining licenses, anti-money laundering, and data privacy protection, making compliant operations extremely important.

- Technology application: As an emerging AI force, DeepSeek has many applications in the cross-border payment field, such as anti-money laundering monitoring, compliance early warning, multi-market localized operation support, and customer service optimization, providing more precise and convenient intelligent services for companies going abroad.