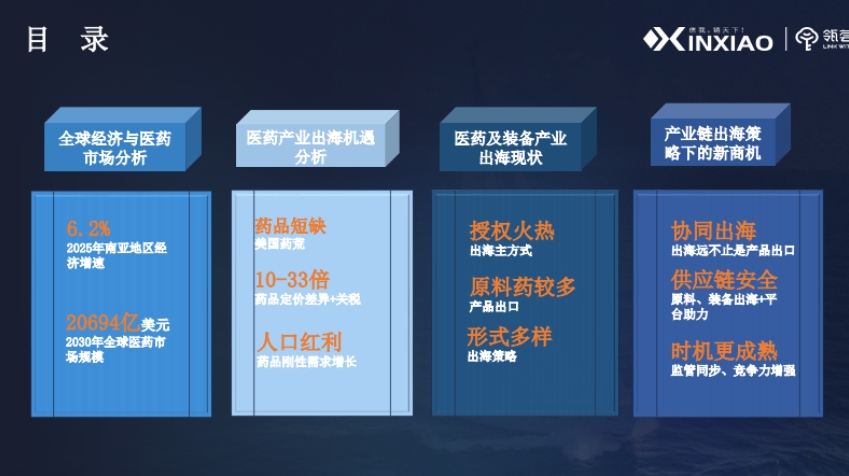

The document is the "2025 Pharmaceutical Industry Chain Overseas Strategy Research Report" jointly released by Shanghai Xinxiao Information Technology and Linghui Think Tank Center, mainly focusing on the overseas expansion of the pharmaceutical industry chain. The specific contents are as follows:

- Global Economy and Pharmaceutical Market Analysis:

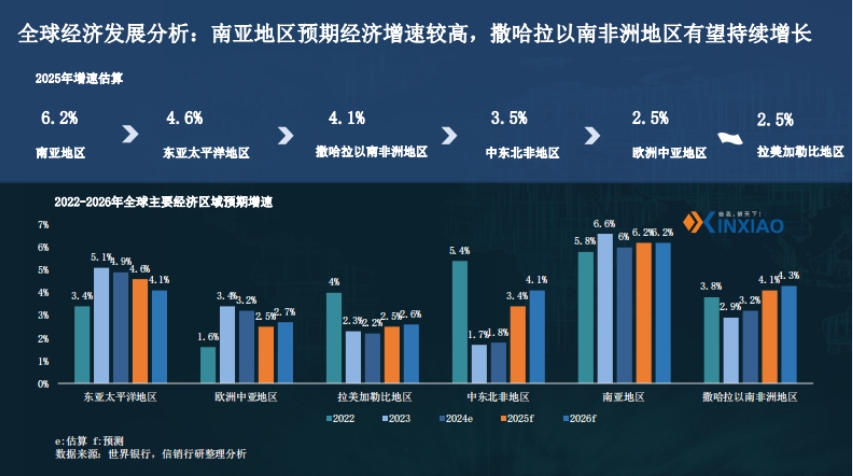

- Economic Growth: In 2025, the economic growth rate in South Asia is expected to reach 6.2%, which is relatively high among regions, and Sub-Saharan Africa is expected to continue growing. Countries such as India, Indonesia, and Argentina may lead in economic growth in 2025.

- Health Expenditure: High-income regions have a higher proportion of per capita health expenditure. In 2022, per capita health expenditure in high-income regions reached $2,741, accounting for 14.4%; in low-income regions, per capita health expenditure was only $5.3, accounting for 5.3%.

- Market Size: By 2030, the global pharmaceutical market size is expected to reach $2,069.4 billion, with overseas market size more than four times that of China. The US, EU, etc., are the main markets, while emerging markets such as the Middle East & Africa and Latin America also have great potential. By 2027, pharmaceutical sales in the Middle East & Africa are expected to reach $64 billion, and by 2028, the Latin American pharmaceutical market size is expected to reach $54.4 billion.

- Analysis of Opportunities for Overseas Expansion of the Pharmaceutical Industry:

- Pricing Differences and Tariffs: There are significant pricing differences for some drugs between China and the US. For example, Bevacizumab is priced about four times higher in the US than in China, Adalimumab 19 times higher, and Toripalimab 33 times higher. In April 2025, the US imposed additional tariffs on pharmaceuticals, so companies going overseas need to consider the impact of the country of origin on tariffs.

- Drug Shortages: The US has long faced drug shortage issues. In 2023, the number of shortage drugs reported by CDER and CBER was 33 and 48, respectively. Among the production sites for shortage drug formulations, the US accounts for 49%, and for API production sites, the US accounts for 28%, while China accounts for 4% of API production sites.

- Population and Demand: Some underdeveloped regions have demographic dividends. Regions such as the Middle East & North Africa, Latin America & the Caribbean are experiencing rapid population growth, driving rigid demand for pharmaceuticals; some developed regions are facing aging populations, which also sustain demand for pharmaceutical products.

- Current Status of Overseas Expansion of Pharmaceutical and Equipment Industries:

- Product Export: In 2024, China's pharmaceutical export value increased by 9.8% year-on-year. API exports take the EU as one of the main markets, with Zhejiang Province accounting for 17.45% of enterprises exporting APIs to the EU. The export value of traditional Chinese medicine continues to grow, with the export value of proprietary Chinese medicines reaching 2,464.11 million yuan in 2024. Achievements in overseas expansion of formulations continue, with many pharmaceutical companies having products approved for overseas marketing in Q1 2025.

- Innovation Strength: The number of innovative drugs approved in China is increasing, with 23 chemical drugs, 7 traditional Chinese medicines, and 24 biological drugs approved in 2024. China's drug R&D pipeline accounts for 26.7%, second only to the US.

- Internal and External Drivers: Internal drivers include compressed profits for generic drugs, the start of alliance procurement for biologics, and enhanced pharmaceutical innovation strength; external drivers include the large international market and significant regional differences.

- Overseas Expansion Strategies and Risk Prevention:

- Overseas Expansion Strategies: Including independent overseas expansion (e.g., BeiGene building its own commercialization team and localized production, with global sales of Zanubrutinib reaching 18.859 billion yuan in 2024), international licensing ("license-out" transaction amounts repeatedly hitting new highs, with 33 outbound licensing events in Q1 2025), NewCo model (combining BD and equity transaction features, with four such transactions by Kangnuoya within half a year), overseas mergers and acquisitions (e.g., Nano Micro Technology holding a controlling stake in US RILAS), etc.

- Risk Prevention: Attention must be paid to differences in policy regulation, geopolitical and cultural differences, human resources issues, market competition, supply chain risks, and cost pressures. For example, drug registration requirements vary by country; in Southeast Asia, the pharmaceutical market for original drugs is dominated by European and American companies, while the generic drug market is largely occupied by Indian pharmaceutical companies.

- Industry Chain Synergy in Overseas Expansion and New Business Opportunities:

- Synergistic Overseas Expansion: Pharmaceuticals, supply chains, and platforms join hands to go overseas. For example, the China Pharmaceutical Industry Overseas Alliance can control costs, reduce risks, and improve efficiency. Junshi Biosciences and Excellmab are cooperating to develop Toripalimab, and Baicheng Pharma and Kexing Pharma have reached strategic cooperation for overseas expansion.

- New Business Opportunities: With improved quality of generic drugs and intensified domestic competition, the overseas market has the strength to compete with India, driving the collaborative overseas expansion of formulation, API, and packaging. Options include product transfer, technology transfer, and semi-finished product transfer for overseas expansion.