There are only a few days left until the end of 2025. Cross-border sellers have just experienced the fierce battle of "Black Friday and Cyber Monday" and are gearing up for the Christmas year-end sales, hoping to end the year on a high note.

However, at this critical sales juncture, a new regulation from the Japanese market has cast a sense of urgency over the hot year-end promotions.

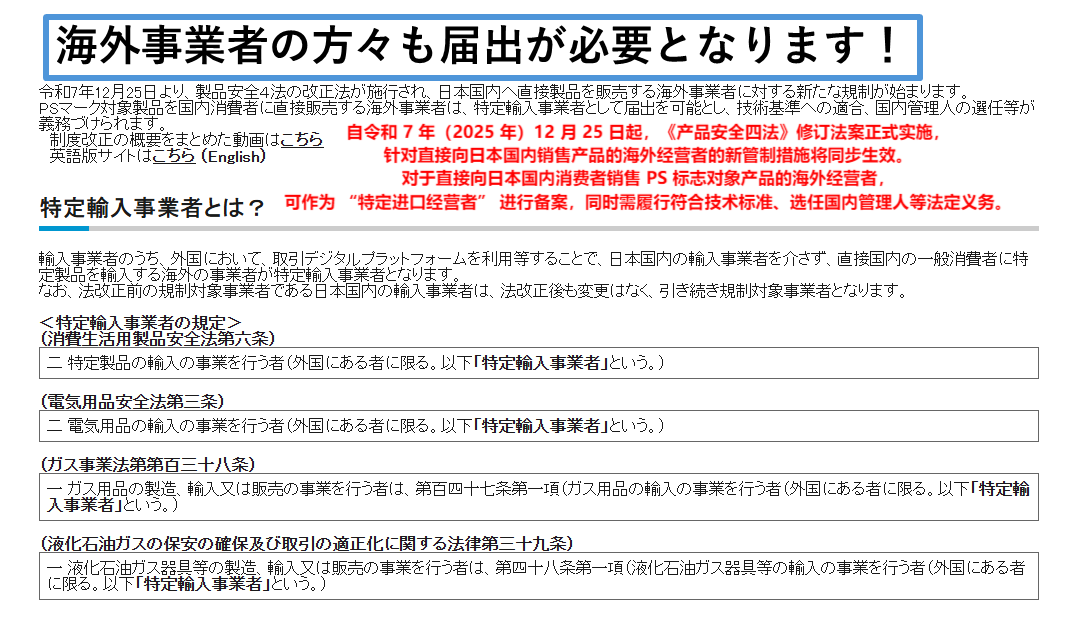

The four product safety regulations revised by Japan's Ministry of Economy, Trade and Industry (METI) will officially take effect onDecember 25. This revision is targeted directly at overseas companies selling goods in Japan, affectingmother and baby toys, home appliances, gas appliances and other popular categories. The core requirement of the new regulation is: cross-border sellers selling products with Japan'sPS mandatory mark must designate a "domestic manager" in Japan and complete the registration and filing of a "designated importer".

Image source: Ministry of Economy, Trade and Industry (METI)

What is a"domestic manager"? Why is it necessary?

Simply put, the"domestic manager" is like the "legal representative" of overseas sellers in the Japanese market.

He can be an individual or a company, but must meet several hard requirements:have a physical office address in Japan and be proficient in Japanese.

If the seller cannot provide a qualified"domestic manager", the filing application will not be approved, and the corresponding products will be forcibly removed from the e-commerce platform.

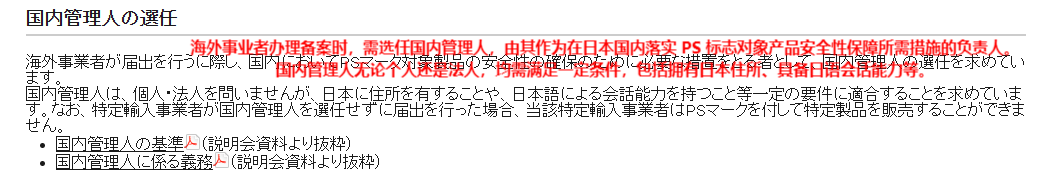

Image source: Ministry of Economy, Trade and Industry (METI)

Japan's intention is very clear: to achieve"responsibility anchoring". In the past, since sellers were far overseas, once there was a safety issue with goods circulating in Japan, accountability and communication were often complicated and difficult.

After the implementation of the new regulation, the"domestic manager" will become the direct bridge between regulatory authorities and overseas sellers, not only making policy communication and implementation more efficient, but more importantly, fundamentally clarifying responsibility—if there is a problem with the product, the responsible party can be quickly and accurately identified through the "domestic manager".

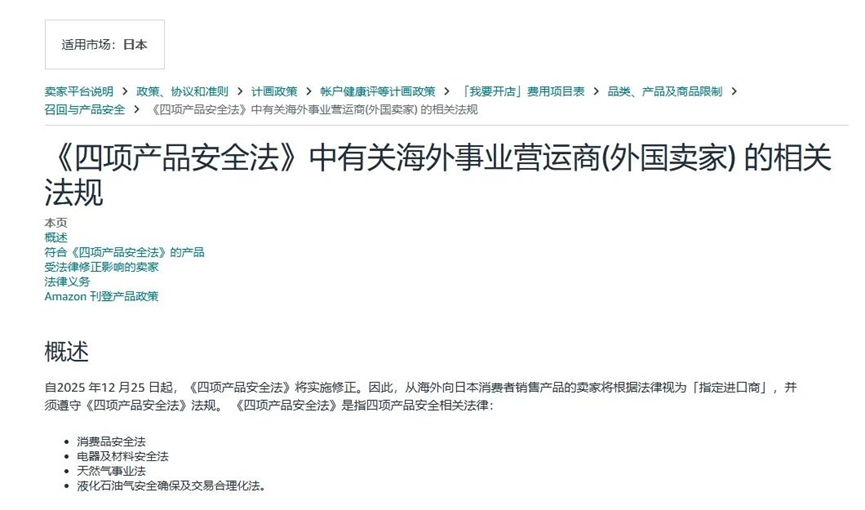

Currently, major e-commerce platforms including Amazon, AliExpress, and Rakuten have issued compliance reminders to sellers on their Japan sites, requiring sellers of specific products to complete the Ministry of Economy, Trade and Industry's filing within the deadline, otherwise their products will be removed and banned from sale.

Image source: Amazon

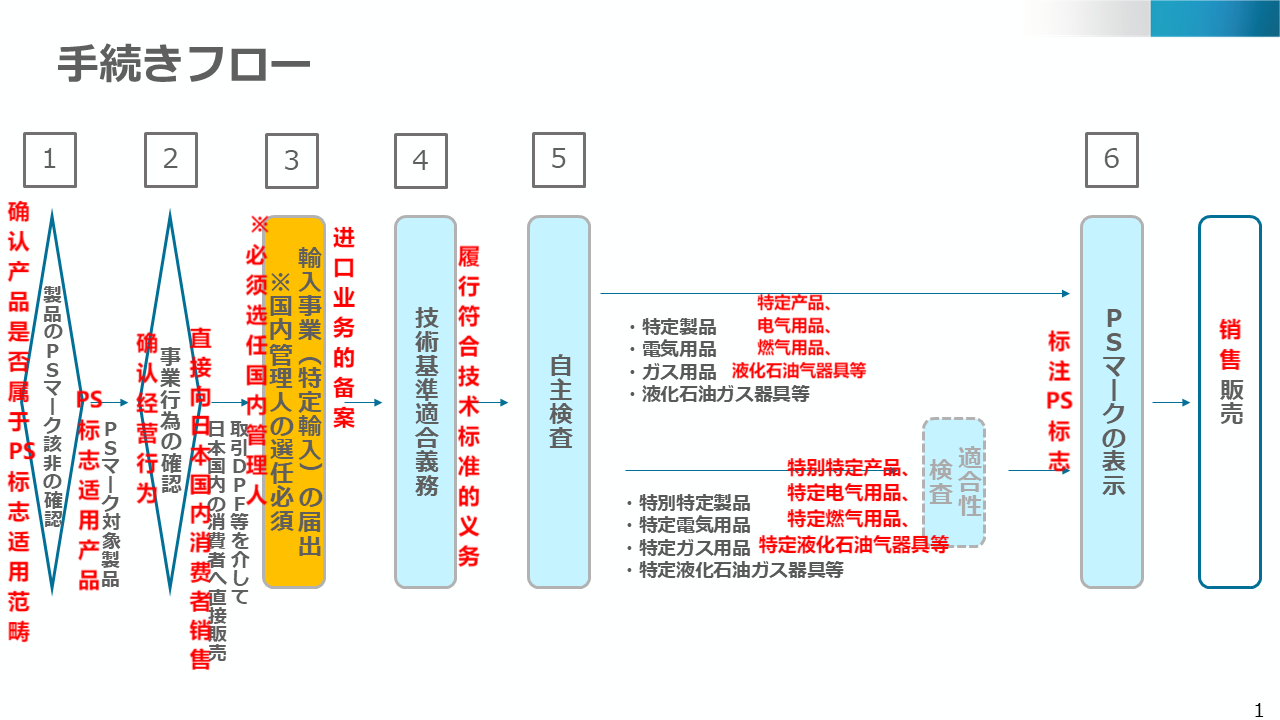

Sellers' urgent self-check: Does your product need aPS mark?

For the majority of sellers, the most urgent task now is to immediately check whether their products fall under the category requiring thePS mark. This mainly falls into two categories:

PSE mark (Electrical Appliance and Material Safety Law): This covers almost all products with electricity. For example, AC adapters, home appliances, lithium batteries, and all products containing lithium batteries (such as smart devices, electric toys, etc.), sellers in these categories need to pay special attention.

PSC mark (Consumer Product Safety Law): These products are highly relevant to home and mother & baby category sellers, mainly including baby cribs, pacifiers, lighters, pressure cookers, helmets and 13 other specific consumer products.

Image source: Ministry of Economy, Trade and Industry (METI)

The market is still growing, but the"rules of the game" are tightening

In recent years, thanks to a very high internet penetration rate, a mature financial payment system, and consumers' increasing online shopping habits, the Japanese e-commerce market has maintained steady growth. Data shows that theJapanese e-commerce market size is expected to exceed$200 billionin 2025, firmly ranking as the world's third largest e-commerce market.

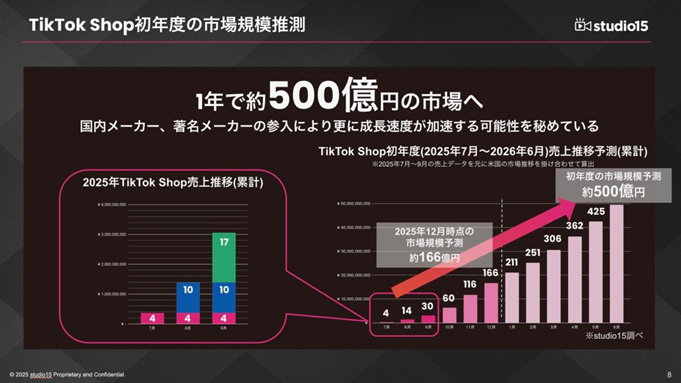

The huge market potential has attracted global giants and countless sellers. For example, Tuke Shop, which officially entered Japan in the middle of this year, exceeded 100 million yen in daily sales in just a few months, showing amazing explosive power. Industry forecasts that its market size is expected to reach about50 billion yennext year.

Image source:Studio15

However, as the number of participants surges, problems such as counterfeiting and evasion of supervision have begun to emerge in the market.

To this end, Japanese authorities are strengthening market supervision from multiple aspects and building a solid compliance defense line. In addition to the above-mentioned new product safety regulations, Japan also plans to tighten policies in the field of cross-border taxation.

It is reported that the Japanese Ministry of Finance is considering adjusting the tariff exemption policy for small-value imported goods, and is expected to introduce new regulations in2026. In the future, imported goods valued at less than 10,000 yen (about 495 RMB) may no longer enjoy exemption from tariffs and consumption tax.

Image source:yomiuri.co.jp

In summary, for cross-border sellers, the Japanese market is entering a stage of comprehensive regulatory strengthening. From clarifying product safety responsibility to possible new tax policies in the future, all rules are being continuously improved and tightened. This means that the previous business model of focusing only on sales and ignoring compliance is no longer viable.

If you want to continue selling and develop steadily in the Japanese market, you must now put compliant operation first. According to platform reminders, checking products and completing relevant filings is the most urgent task at present. Only by proactively adapting to the rules can you avoid the risk of removal and win long-term business space for yourself.

Time is running out, please be sure to take action immediately.