"Marketing Cloud: 2024 Special Research on Cross-border E-commerce of Beauty and Personal Care" is written by ATLAS Cross-border Trade Research Institute of Guangdong 56 Digital Technology. It mainly explores the trends of China's beauty and personal care industry and its development in the field of cross-border e-commerce. The specific content is as follows:

1. Overall Trends of China's Beauty and Personal Care Industry

- In 2023, China's cosmetics industry performed well, with domestic retail sales increasing by 5.1% year-on-year, while the total import and export trade volume declined by 12.2% year-on-year. Export growth contrasted with a decrease in imports.

- China's cosmetics industry has formed multiple industrial clusters, such as Shanghai's "Oriental Beauty Valley" and Guangzhou's "Baiyun Beauty Bay". Among them, Guangzhou's cosmetics industrial output value exceeds 100 billion yuan, accounting for about 55% of the national industry scale, with production enterprises mainly concentrated in Baiyun District.

2. Special Topic on China's Beauty and Personal Care Foreign Trade Trends

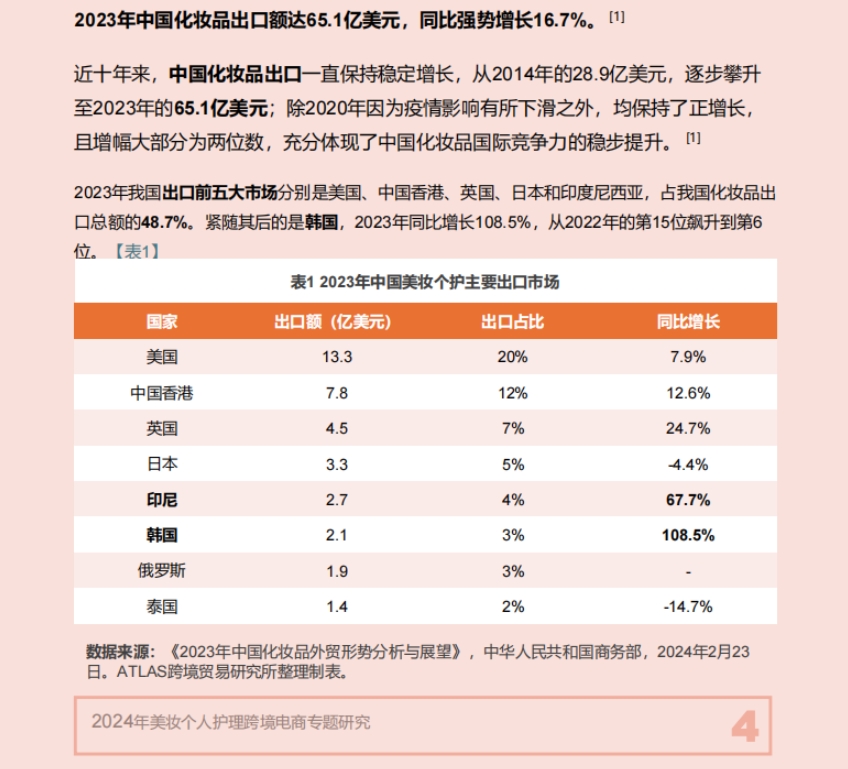

- Trade Volume: In 2023, China's cosmetics export value reached USD 6.51 billion, a year-on-year increase of 16.7%, maintaining stable growth over the past decade.

- Target Markets: The top five export markets are the United States, Hong Kong (China), the United Kingdom, Japan, and Indonesia, accounting for 48.7% of total exports, with South Korea growing rapidly.

- Key Categories: Basic skincare and color cosmetics are the main export products, accounting for 54% of category export value in 2023. Among export provinces, Guangdong ranks first.

3. Amazon Trends for Beauty and Personal Care Categories

- Price Trends: In Q1 2024, Amazon's overall category pricing increased, but beauty/personal care category pricing remained flat or even slightly declined compared to 2023, due to the decline of influencer-driven categories after inflated pricing.

- Category Trends: In Q1, Amazon's color cosmetics and body care products quickly dominated the rankings, squeezing the share of basic skincare categories.

- Practical Suggestions: Merchants should focus on branding and channel control, and can use TikTok promotion, offline event promotion, and other methods.