This document mainly focuses on the overview of overseas markets, the development of cross-border e-commerce, the Chinese e-commerce market, Chinese enterprises' overseas strategies, the overseas health food industry, and relevant information about Magic Mirror Insight company. The specific content is as follows:

1. Overview of Overseas Markets

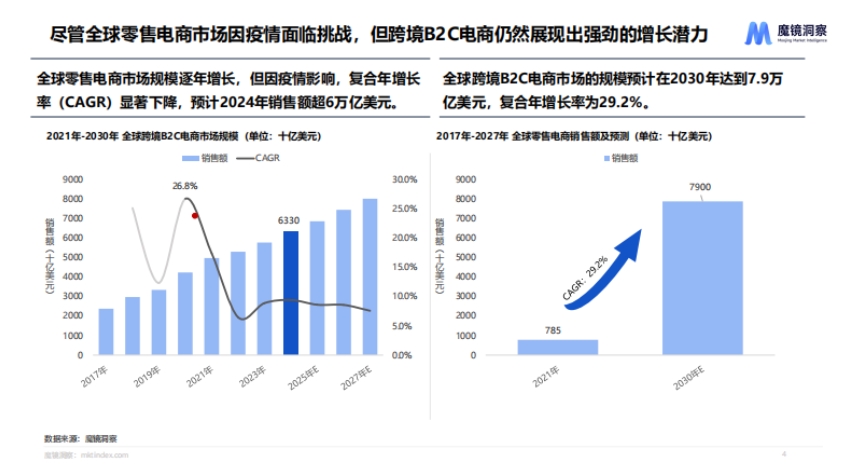

- E-commerce Market Size: The global retail e-commerce market size has grown year by year, but the CAGR has significantly declined due to the pandemic. It is expected that sales will exceed $6 trillion in 2024; the global cross-border B2C e-commerce market size is projected to reach $7.9 trillion by 2030, with a CAGR of 29.2%. The Chinese e-commerce market is mature but its growth rate is slowing down, the US e-commerce market is also in a mature stage, while Indonesia's e-commerce market is developing rapidly.

- Drivers of E-commerce Development: Technological advances have led to widespread internet access and the development of mobile devices, changes in consumer shopping habits, logistics optimization reducing costs and improving delivery efficiency, and policy support lowering trade barriers, all of which have promoted the development of cross-border e-commerce.

- Constraints on E-commerce Development: These include policy differences, cybersecurity risks, logistics costs and delivery efficiency issues, cultural differences, and lack of market localization. For example, logistics costs are high and efficiency is low outside major cities, cybersecurity issues affect consumer trust, and differences in policies and regulations across countries increase the operational burden for enterprises.

2. Overseas Strategies of Chinese Enterprises

- Reasons for Going Overseas: Chinese enterprises are driven by internal factors (slow growth in the local market, fierce competition, seeking new profit points and market opportunities) and external factors (rapid development and potential of emerging overseas markets).

- Types of Strategies: These include globalization, multinational, internationalization, and multi-country local strategies. Enterprises tend to adopt multinational or multi-country local strategies for better localization. Overseas brands mostly use an "online + offline" sales model, with online e-commerce sales types including third-party platforms, self-built e-commerce platforms, and social media sales.

- Case Study: Taking Anker Innovations as an example, 70.3% of its revenue comes from overseas online channels. Success factors include deep cultivation in the e-commerce field, professional teams meeting the needs of different channels and consumers, and continuous expansion of online channels to enhance brand reputation. In 2023, Anker Innovations achieved significant annual revenue growth and performed well in multiple markets and channels.

3. Overseas Health Food Industry

- Market Size and Growth: With increasing public health awareness, demand for health supplements is growing. The global market size is expected to reach $201.1 billion by 2026, with North America being the largest market and maintaining good growth momentum. From January to June 2024, the overseas online health supplement market sales reached 93.35 billion yuan, a year-on-year increase of 20.2%, higher than the domestic growth rate.

- Platform and Regional Distribution: Amazon is the largest platform, with sales of 87.71 billion yuan from January to June 2024, a year-on-year increase of 19.7%; the US site has the largest sales scale at 75.05 billion yuan. Shopee and Lazada are smaller in scale but show good growth trends, with Indonesia, Thailand, and the Philippines performing well in the Southeast Asian market.

- Consumer Behavior: The proportion of adults using health supplements in the US continues to grow, with offline channels still being the main purchasing method, and online retailers accounting for 25%. On the US Amazon platform, demand for health supplements focuses on sports energy, immune enhancement, and protein supplementation, with joint/bone health, brain health, and cardiovascular health showing high growth rates.

- Brand Competition Landscape: The US Amazon health supplement market is fragmented, with leading brands holding less than 2% market share, while the domestic market is relatively more concentrated. Nutritional supplements, probiotics, and protein powders are the core products of leading brands, and the NOW brand performs well both domestically and overseas.

- Price Range and Efficacy Analysis: On the US Amazon platform, 65% of consumer demand is concentrated in the 50 - 200 yuan price range, with the proportion of mid-to-high-end products increasing; domestic market demand is concentrated below 100 yuan. The domestic weight loss market is more mature than the US Amazon market, while the US Amazon market for hair, skin, and nails is more mature than the domestic market, with more diverse product forms and ingredients.

4. Introduction to Magic Mirror Insight Company

- Company Overview: Magic Mirror Insight is operated by Beijing Taomi Technology Co., Ltd., with a scale of 140+ people and offices in Beijing, Shanghai, Wuhan, Chongqing, Guangzhou, etc., serving global clients.

- Data Products and Services: Provides data products such as Magic Mirror Oversea Growth Radar, covering multiple countries, regions, and sites, offering market research, brand landscape positioning, and segmented track mining services. Service models include data products and data services, covering report services, trend ingredient discovery, and omni-channel consumer experience management, solving product development, market monitoring, consumer research, and other issues.

- Data Capabilities: Covers all industries and categories on mainstream e-commerce and social media platforms, with data traceable for over 6 years, supporting customized collection from multiple platforms. Core platforms include domestic and overseas e-commerce platforms and domestic mainstream social media platforms.

- Client Situation: Has served 500+ enterprises, covering 60% of the Top 30 consumer goods brands. Clients include brand owners, consulting firms, financial institutions, government clients, logistics companies, etc., with many leading clients across industries.