This document mainly focuses on the practical layout of Chinese pharmaceutical companies going global in 2024, providing a comprehensive analysis of the relevant macro background, data overview, transaction cases, and future development trends. The specific content is as follows:

1. Macro Background of Chinese Pharmaceutical Companies Going Global

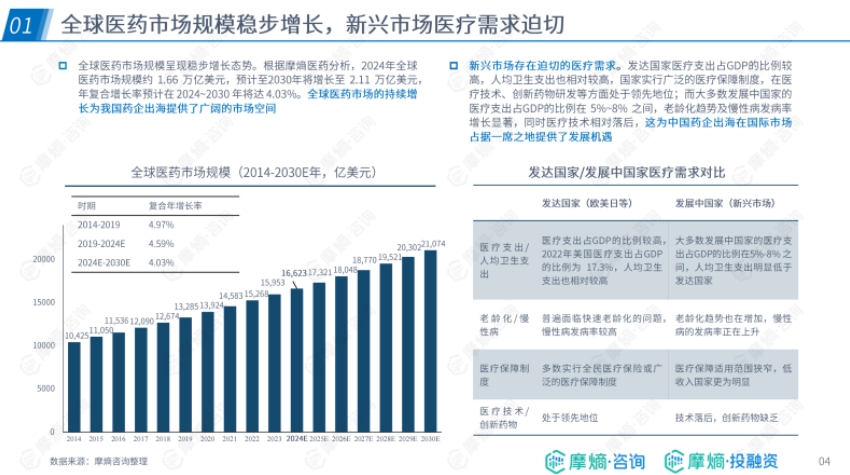

- Growth of Global Market Size and Emerging Market Demand: The global pharmaceutical market size is steadily increasing, with a projected compound annual growth rate of 4.03% from 2024 to 2030. The urgent medical needs in emerging markets, along with differences from developed countries in medical expenditure, aging population, healthcare systems, and medical technology, provide opportunities for Chinese pharmaceutical companies to expand overseas.

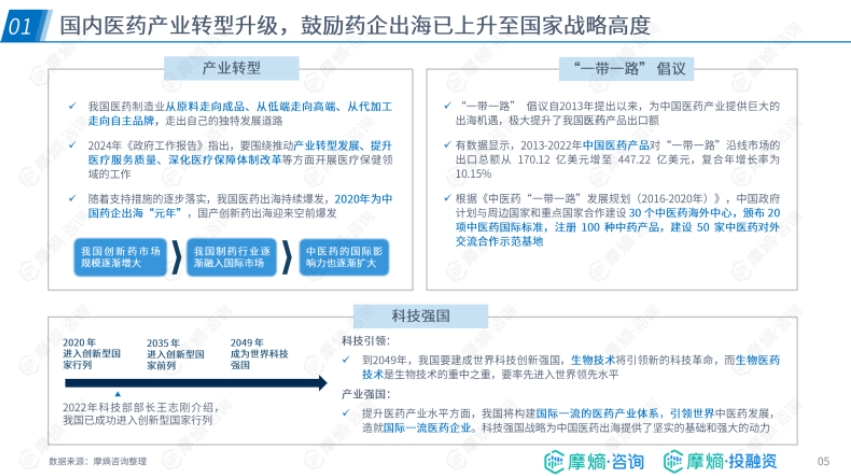

- Domestic Industry Transformation and Strategic Support: China's pharmaceutical manufacturing industry continues to develop, the innovative drug market is expanding, the pharmaceutical industry is integrating into the international market, and the influence of traditional Chinese medicine is growing. The "Belt and Road" initiative has boosted pharmaceutical product exports, the strategy of strengthening the country through science and technology provides a foundation and momentum for pharmaceutical companies to go global, and the government encourages pharmaceutical companies to expand overseas.

- Improvement of Local Pharmaceutical Companies' Innovation Capability and Profit Considerations: The innovation capability of domestic pharmaceutical companies is maturing, with an increasing number of approved innovative drugs, some reaching international standards. Domestic medical insurance price reductions have limited profit margins, while overseas markets offer higher pricing potential, making globalization an inevitable choice.

- Modes of Going Global and Industry Review: The main modes for Chinese pharmaceutical companies going global are "borrowing a ship to go overseas", "cooperative expansion", and "independent expansion". The overseas development of China's pharmaceutical industry has evolved from bulk APIs to the overseas listing of innovative drugs, with representative companies and businesses at each stage.

2. Overview of Cross-border Pharmaceutical Transactions and Trend Insights

- Global Pharmaceutical Industry Transaction Volume Trends: The global pharmaceutical transaction volume peaked in 2021, then slightly declined. In the first half of 2024, there were 2,674 transactions, with the annual total expected to continue growing. Transaction volume fluctuations are influenced by various factors.

- Distribution of Transaction Themes: Collaboration agreements are the most important transaction theme, along with proprietary technology, fundraising, licensing, and other themes. The diversity of transaction themes reflects the complexity of the industry.

- Analysis of Cross-border Transaction Proportion: Cross-border transactions maintain a stable and significant proportion in the industry, remaining around 40% from 2019 to the first half of 2024. Despite fluctuations, their necessity is evident.

- Status of China's Cross-border Pharmaceutical Transactions: The United States is China's primary trading partner, with prominent and diversified transactions between China and the US, though China's trading partner concentration is higher. The themes of China's cross-border pharmaceutical transactions are diverse and closely related to pharmaceutical companies' "going global" strategies.

- Licensing Transaction Related Situation: Licensing is highly significant for Biotech companies. China's pharmaceutical licensing transactions are in sync with global market trends, and Chinese pharmaceutical companies' "going global" strategies effectively balance market fluctuations, with increased activity in early-stage project licensing.

3. Transaction Case Analysis and Tracking

- HUTCHMED/Takeda - Fruquintinib Case: In January 2023, Takeda obtained exclusive development rights for Fruquintinib in certain global regions from HUTCHMED, paying upfront and milestone payments. After Fruquintinib was approved by the US FDA in November 2023, HUTCHMED received milestone payments.

- Jacobio/AbbVie - JAB-3068 and JAB-3312 Case: In May 2020, AbbVie obtained global exclusive development rights for related drugs from Jacobio, with Jacobio receiving upfront and milestone payments. The transaction was terminated in July 2023, and Jacobio retained exclusive development options for certain regions in China.

4. Future Development Trends of Chinese Pharmaceutical Companies' Internationalization

- Market Demand and Regulatory Internationalization: The intensifying global aging population is expanding pharmaceutical market demand, and the internationalization of China's drug regulatory process is accelerating, which will promote industry internationalization.

- Overseas Markets and Pharmaceutical Companies' Capability Enhancement: Overseas markets are diversifying, with emerging markets attracting attention; R&D innovation capabilities are improving, international layout of production bases is being optimized, and sales channels and business models are being innovated.