The "2024 Overseas Beauty White Paper" provides an in-depth analysis of the overseas beauty market landscape, helping companies accurately seize opportunities for going global. It covers key topics such as market environment, regional characteristics, brand strategies, and Magic Mirror Insights advantages, offering comprehensive guidance for beauty companies' international development.

1. Panorama Insights into Overseas Markets

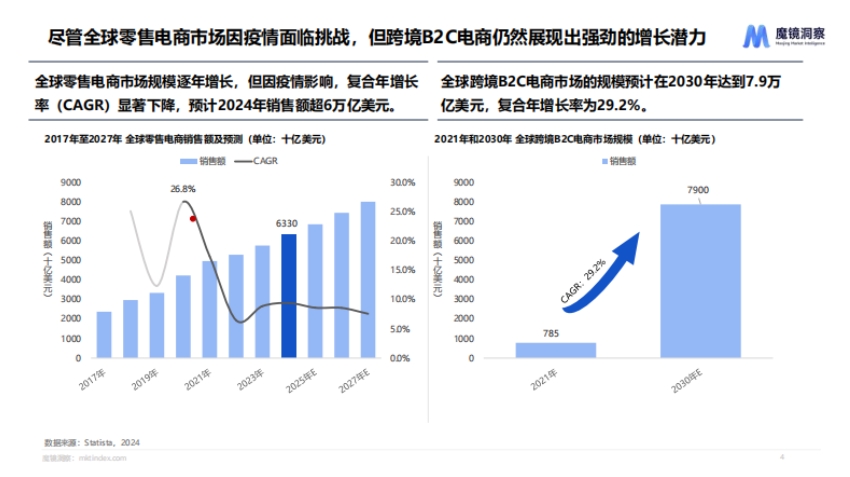

- E-commerce Market Dynamics: The global retail e-commerce market continues to grow, with the scale expected to exceed $6 trillion in 2024. Cross-border B2C e-commerce is surging, and is projected to reach $7.9 trillion by 2030. Although the compound annual growth rate has declined due to the pandemic, overall development remains robust. Technological advancements, changing consumer habits, logistics optimization, and policy support jointly drive growth. Internet penetration and mobile device development provide convenience, changing consumer behavior boosts online shopping demand, logistics upgrades reduce costs and improve efficiency, and policy support lowers trade barriers. However, challenges such as policy differences, cybersecurity, logistics and delivery, and cultural differences persist, including complex tax policies, high logistics costs and low efficiency, insufficient localization due to cultural differences, cybersecurity threats, and data privacy issues.

- Regional Market Landscape: China's e-commerce market is mature and growth is slowing, the US is stable but awaits breakthroughs, and emerging markets such as Indonesia have huge potential. China has high e-commerce penetration and market saturation with slow growth, the US is highly mature but still has room for increased penetration, and emerging markets like Indonesia, though small in scale, have impressive penetration and growth rates, attracting many companies to invest.

2. In-depth Analysis of the Beauty Industry

- Global Market Overview: The global beauty market exceeds $300 billion, and is expected to rise to $404.7 billion by 2026. Skincare is growing steadily, fragrance and color cosmetics are recovering, and sun protection is becoming a hot trend. Domestic online beauty growth is sluggish and relies on major promotions, while overseas markets are stable. Amazon accounts for 77% of beauty sales on overseas e-commerce platforms, with Shopee and Lazada dominating the Southeast Asian market.

- Regional Market Highlights

- Southeast Asia Opportunities: In the first half of 2024, beauty sales grew by 63%, with Vietnam leading at 125% growth. Shopee is the main channel, Indonesia and Vietnam account for 60% of the Southeast Asian market share and show strong growth. Consumers pursue high cost-performance, facial care is the top demand, sun protection has great potential, and many Chinese domestic brands perform well.

- US Amazon Market Interpretation: The market is mature and stable, with average monthly sales of $7.5 billion and high average product prices. Skincare dominates and grew by 17% in the first half of the year, while some small color cosmetics declined. Brand competition is fragmented, Korean and Chinese brands are gaining share, and consumer preferences differ from those in China, such as significant differences in demand for facial serums, whitening, and repair.

- Japan Amazon Market Scan: The market is expected to reach $32 billion in 2024, with offline consumption still holding an important position and a high proportion of online perfume purchases. International big brands dominate color cosmetics and fragrances, while local and Korean brands are favored in skincare. Consumers are keen on stocking up on skincare products online, beauty preferences are shifting towards natural and transparent looks, and perfume consumption is polarized.

3. Practical Guide for Brands Going Global

- Drivers and Strategies for Going Global: Fierce domestic competition and overseas market potential drive companies to expand abroad, often adopting multinational or multi-local strategies, integrating "online + offline" models, and leveraging third-party platforms, self-built platforms, and social media for sales. For example, Anker Innovations has expanded through deep cultivation of e-commerce, a professional team, and diversified channels, with 70.3% of its revenue coming from overseas online sales, achieving a global brand presence.

- Beauty Industry Paths to Going Global: Chinese beauty brands have significant advantages in going overseas, with affordable prices matching Southeast Asian purchasing power, cultural and demand similarities reducing promotion difficulties, and the "Belt and Road" initiative creating a favorable business environment. The number of brands is increasing, product lines are rich, brand image is improving, and high cost-performance is recognized by the market. Many brands perform excellently in the Southeast Asian market, such as Skintific.