This report is the TikTok Shop 2024 market analysis report for the health category across Southeast Asian sites. The main contents are as follows:

1. Thailand Site

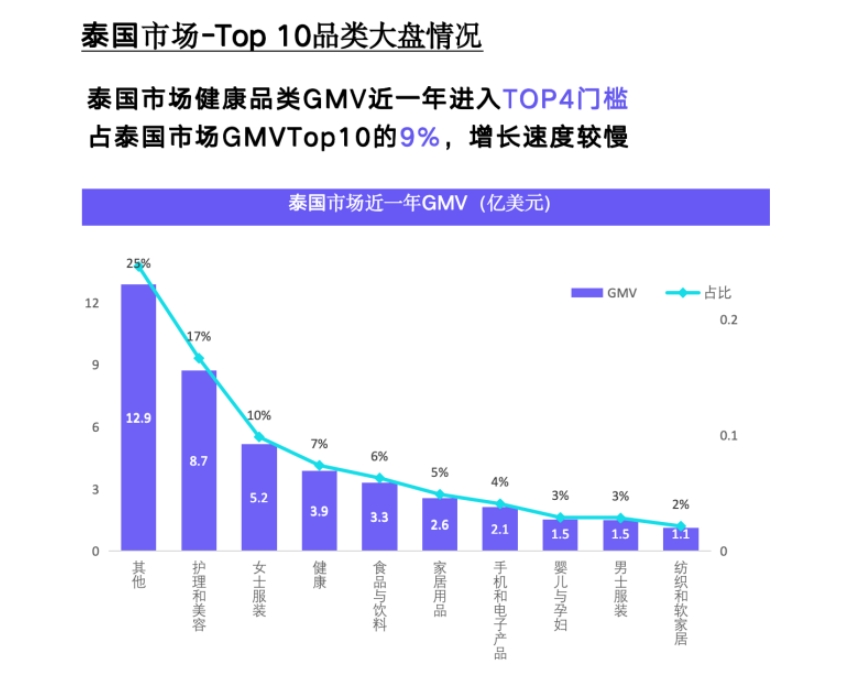

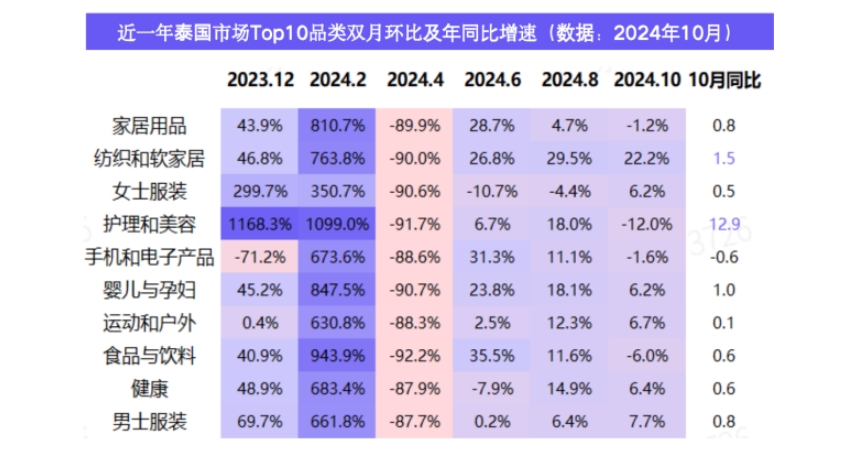

- Market Overview: The health category GMV has entered the TOP4 threshold in the past year, accounting for 9% of Thailand's market GMV Top10, with relatively slow growth.

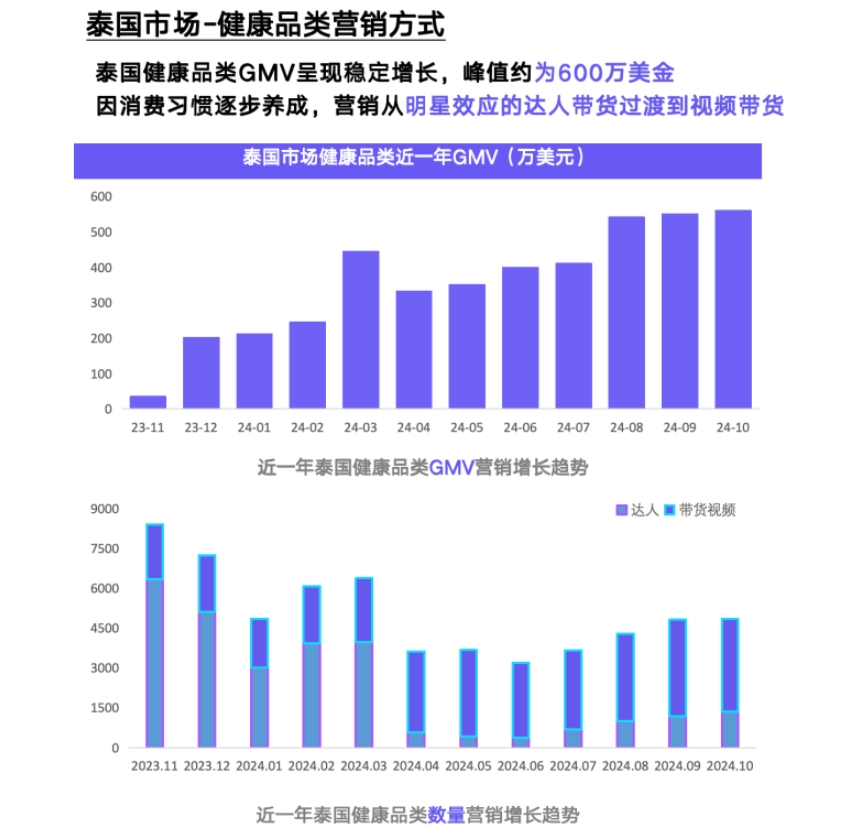

- Marketing Methods: GMV shows stable growth, with a peak of about USD 6 million. Marketing has transitioned from celebrity influencer sales to video-based sales.

- Subcategories: GMV prices are concentrated in the USD 30 - 50 range, with quantities showing a more differentiated distribution at USD 0 - 5 and USD 30 - 50. Transactions are mainly focused on dietary supplements, medical supplies, and alternative medicines.

- Store Situation: The GMV Top10 store threshold is USD 800,000, with significant differentiation in average product prices, mainly concentrated below USD 20 and USD 30 - 50.

- Best-selling Stores and Products: For example, cozy.shop is a deeply cultivated small store, leading the sales rankings with explosive products; the TOP5 best-selling health products in October 2024 include black grain dietary supplements, etc.

2. Indonesia Site

- Market Overview: Not yet ranked in the TOP10, still a blue ocean market, but the total GMV of the Top10 has continued to grow in the past year, reaching about USD 3 billion.

- Marketing Methods: GMV growth is rapid, with a compound growth rate of 51%, relying on video-based sales. The GMV contribution has shifted from influencers to videos.

- Subcategories: Secondary subcategory prices are concentrated in the USD 5 - 10 range, with transaction quantities mainly in USD 5 - 10. Mainly dietary supplements, beverage subcategories, and others.

- Store Situation: The GMV Top10 store threshold is only USD 200,000, with significant product price differentiation, mainly concentrated in USD 20 - 30.

- Best-selling Stores and Products: For example, Klik.Apotek is a female vertical integrated supply chain store; the TOP5 best-selling health products in October 2024 include whitening and spot-removing supplements, etc.

3. Philippines Site

- Market Overview: Ranked within the Top10, with moderate growth. The concentration of the TOP10 category market is relatively low, with personal care and beauty accounting for only 16%.

- Marketing Methods: Recent GMV growth has slowed, with a peak of about USD 2.8 million. The main recent marketing method is video-based sales, accounting for over 80% of transactions.

- Subcategories: Secondary subcategory prices are concentrated in the USD 5 - 10 range, with transaction quantities mainly below USD 10. Mainly dietary supplements, OTC drugs, and other subcategories.

- Store Situation: The GMV Top10 store threshold is only USD 300,000, with average product prices concentrated around USD 10.

- Best-selling Stores and Products: For example, DailyPlus is a focused and deeply cultivated store; the TOP5 best-selling health products in October 2024 include collagen oral liquids, etc.

4. Malaysia Site

- Market Overview: Although ranked Top6, the share is relatively low and growth is slow. Personal care and beauty account for 17% of Malaysia's GMV in the past year.

- Marketing Methods: Recent GMV growth has slowed, with a peak of about USD 3.6 million. The main recent marketing method is video-based sales, but the proportion of influencer sales is increasing.

- Subcategories: Secondary subcategory prices are concentrated in the USD 5 - 20 range, with transaction quantities mainly in USD 5 - 10. Mainly dietary supplements, alternative medicines, and other subcategories.

- Store Situation: The GMV Top10 store threshold is USD 500,000, with differentiated product prices mainly concentrated in USD 5 - 10 and USD 20 - 30.

- Best-selling Stores and Products: For example, Pentavite Store is a vertically focused small store; the TOP5 best-selling health products in October 2024 include dietary supplements, etc.

5. Vietnam Site

- Market Overview: Just entered the Top10, with slow growth. Personal care and beauty account for 22% of Vietnam's GMV in the past year.

- Marketing Methods: GMV is relatively stable, with monthly transactions around USD 1.5 million. Early sales relied on influencer celebrity effects, later mainly on video-based sales.

- Subcategories: Secondary subcategory GMV prices are concentrated in USD 10 - 20, with transaction quantities mainly in USD 5 - 10. Mainly other subcategories, dietary supplements, and medical supplies.

- Store Situation: The GMV Top10 store threshold for health small stores is only USD 200,000, with product price tiers concentrated around USD 10 and USD 30 - 50.

- Best-selling Stores and Products: For example, Muscle Nutrition and other stores; the TOP5 best-selling health products in October 2024 include calcium tablets, etc.

6. Singapore Site

- Market Overview: Ranked TOP3, it is the highest-ranked site in Southeast Asia but with slow growth. Personal care and beauty account for 28% of Singapore's GMV in the past year.

- Marketing Methods: GMV is relatively stable, with monthly transactions around USD 660,000. The mainstream sales method is video-based sales, accounting for over 80% of total transactions.

- Subcategories: Secondary subcategory prices are concentrated >USD 100, belonging to a high premium market, with transaction quantities relatively dispersed but mainly in USD 10 - 30. Mainly dietary supplements, alternative medicines, and other subcategories.

- Store Situation: The GMV Top10 store threshold is only USD 100,000, with average product prices highly concentrated at >USD 100.

- Best-selling Stores and Products: For example, UNICHI WELLNESS and other stores; the TOP5 best-selling health products in October 2024 include Her Yaneng, etc.

In addition, the report also introduces the EchoTik platform, a third-party TikTok overseas short video and live e-commerce data analysis platform and AI tool. It provides precise positioning and effective recommendations for e-commerce sellers and traffic influencers in product selection, featuring professional and comprehensive data and metrics, exclusive browser plugins, real-time live room traffic monitoring, rapid response consulting, and other core capabilities.