This document is the "2025 China Automobile Overseas Insights (Hong Kong Edition)" released by the Autohome Research Institute, focusing on the relevant situation of Chinese automobiles going overseas to the Hong Kong market. The specific content is as follows:

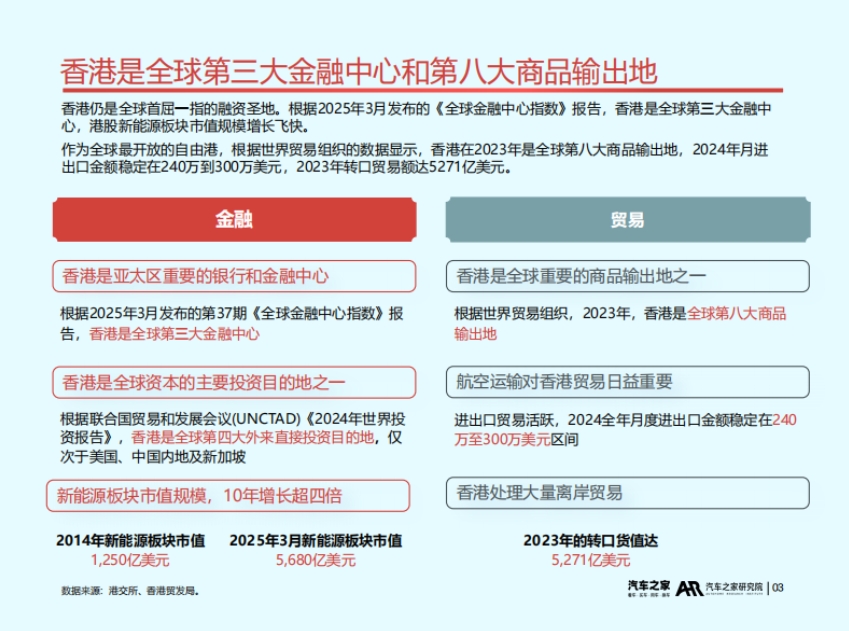

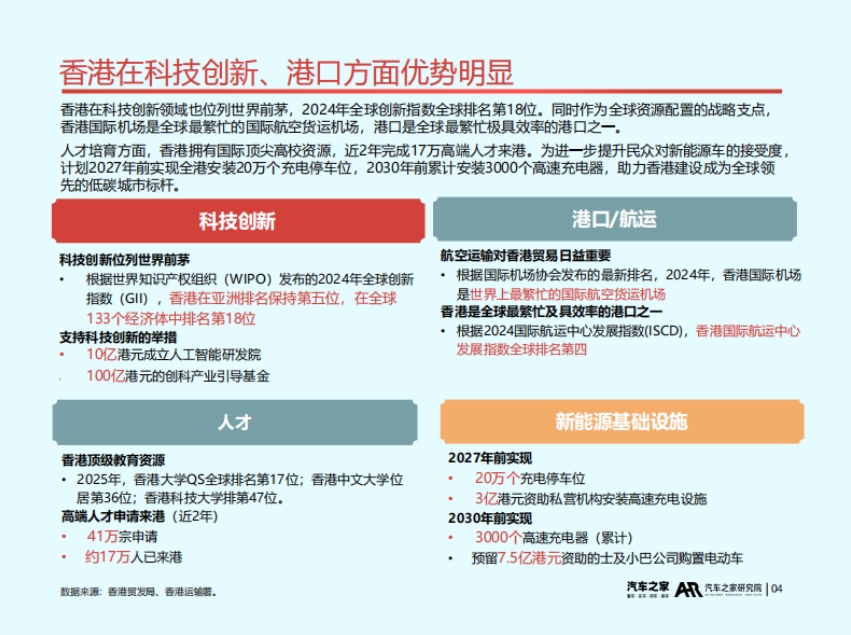

- Hong Kong Development Status: Hong Kong is the world's third largest financial center and the eighth largest commodity exporter. The market value of the new energy sector has increased more than fourfold in 10 years, and the re-export trade volume reached $527.1 billion (2023). In the field of technological innovation, Hong Kong ranked 18th in the 2024 Global Innovation Index and also possesses top university resources, attracting 170,000 high-end talents to Hong Kong in the past two years. Its port and shipping advantages are significant: Hong Kong International Airport is the busiest international air cargo airport in the world, and its port ranks fourth globally. At the same time, Hong Kong also has plans for new energy infrastructure construction, aiming to install 200,000 charging parking spaces citywide by 2027 and a cumulative total of 3,000 fast chargers by 2030.

- Hong Kong Automobile Market Trends: The private car ownership per thousand people in Hong Kong is only 84 vehicles, and the total car market fluctuates between 40,000 and 50,000 units, greatly influenced by policies. However, the penetration rate of new energy vehicles has grown rapidly, jumping from 1% in 2015 to 68% in January-April 2025, ranking among the top in the world. This is mainly due to policy support (such as the "One-for-One Scheme" and "First Registration Tax Reduction"), low purchase and usage costs, and the increase in models brought by the layout of mainland car companies. Chinese brands have quickly risen by leveraging the momentum of new energy, accounting for 40% of the Hong Kong market in January-April 2025. BYD topped the sales chart, and several Chinese brands such as Zeekr and MG entered the top ten in sales, occupying seven spots among the Top 10 most popular models.

- Chinese Car Companies' Layout in Hong Kong: Many car companies value Hong Kong's advantages and have set up R&D centers or headquarters in Hong Kong, such as Li Auto establishing an overseas headquarters and chip R&D center, and CATL setting up a global R&D center. Chinese car company stores are concentrated in Wan Chai and Kowloon Bay, with brands like BYD and MG having a larger number of stores and actively expanding into new areas. BYD, Zeekr, MG, and other car companies have performed outstandingly in the Hong Kong market, each with popular models.

- Challenges and Prospects: The Hong Kong automobile market faces challenges such as unreasonable distribution of charging piles, difficulty in installation in residential areas, and subsidy reduction. In response, strategies have been proposed, such as reasonable matching of charging piles, developing a unified charging APP, and car companies can utilize Hong Kong's advantages in finance and free trade zones to optimize capital operations, lay out the global market, strengthen technological R&D, and radiate to the right-hand drive car market.