In recent years, the number of newborns in China has been declining year after year, and the industry consensus has shifted from the previous "incremental sharing" to "stock competition." As the domestic mother and baby track space continues to be squeezed, major brands have turned their attention to overseas markets.

Amid this wave,mother and baby brand MAKUKUhas emerged with a precise Southeast Asian strategy. Established for only four years, it has become the third largest diaper brand in Indonesia, with TikTok sales in a single country exceeding 65.5 million yuan, and global monthly sales surpassing 100 million yuan, making it a phenomenal dark horse in the mid-to-high-end mother and baby market in Southeast Asia.

Image source: MAKUKU official website

Cross-industry entrepreneurship, seizing market dividends

According to information, the MAKUKU brand was established in November 2020 and belongs to Shanghai Makuku E-commerce Co., Ltd.

Its founder, Mr. Jiang, once served as the head of OPPO's overseas marketing department and has certain experience and understanding in expanding into the Southeast Asian market.

Before venturing overseas, the team conducted solid research and found that Indonesia has 4-4.5 million newborns every year, with mother and baby consumption continuing to grow and huge market potential. For this reason, MAKUKU chose Indonesia as its first stop for going abroad.

Image source: MAKUKU official website

However, the initial direct sales model was not ideal. Faced with the low return rate of offline stores, the team decisively switched to the "distribution + vertical blockbuster" strategy, focusing resources on the core category of diapers.

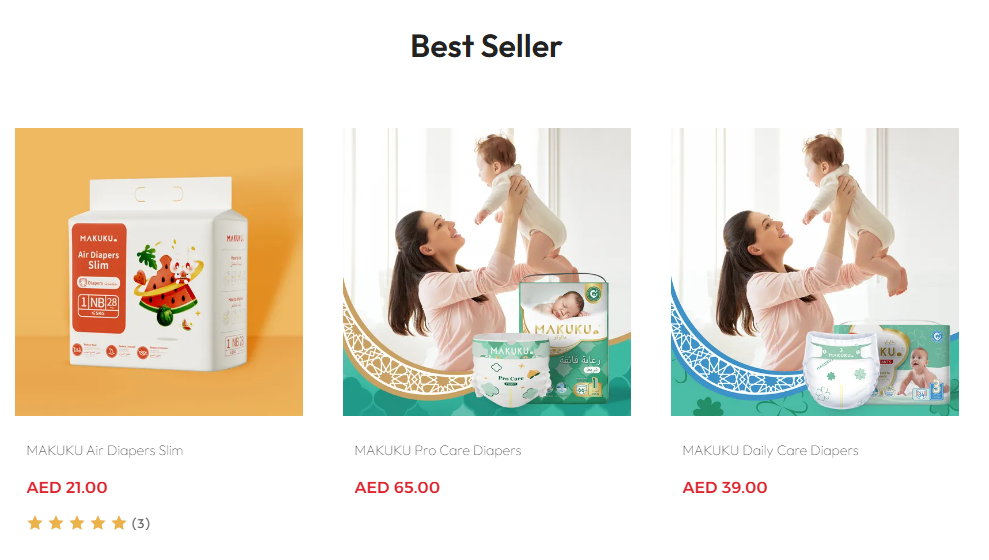

They successively launched three series to cover different consumer groups.

Slim series: Opened up reputation with ultra-thin and breathable features, priced at 0.8 yuan/piece (average level in Indonesia);

Comfort series: Focused on cost performance to seize market share;

Pro Care series: Positioned in the high-end market, priced higher than products of the same level from Japan's Oji Group.

This layered product matrix allowed MAKUKU to rise to third place in the Indonesian market within half a year after the launch of its first diaper at the end of 2021, and its offline channels quickly covered more than 10,000 stores.

Image source: MAKUKU official website

Subsequently, capital quickly followed. In 2021, the brand completed an angel round financing of 185 million yuan (the highest first round record for a Chinese mother and baby brand), and received another 30 million US dollars in Pre-A round funding the following year.

Now, the brand's product line has expanded from diapers to milk powder, cleaning and care products, children's clothing, and other full categories, forming a "family consumption brand" matrix covering the mother and baby ecosystem.

Image source: MAKUKU official website

The "Population Code" of the Trillion-level Blue Ocean

The rapid explosion of the MAKUKU brand in the Southeast Asian market is not only due to the founding team's grasp of consumer demand, but also the structural dividends of emerging markets. According to Statista, the global mother and baby market size will reach 823 billion US dollars in 2024, with a compound annual growth rate of 6.8%. Southeast Asia has become the growth engine, and the market situation is still very promising.

In addition, a more critical point is the supply-demand mismatch in the mother and baby market. In the Indonesian market, European and American brands occupy the market share, but high-premium products are difficult to penetrate, and consumers in third- and fourth-tier cities have long faced the dilemma of "unable to afford international big brands and unable to trust local miscellaneous brands."

MAKUKU, using the Chinese supply chain as a fulcrum, controls the price of SAP diapers at 60% of that of European and American brands, shaping the image of a "local brand" and quickly opening up the incremental market.

Image source: MAKUKU official website

Multi-channel reach, from TikTok to independent site word-of-mouth fission

To leverage the fragmented Southeast Asian market, a single channel is certainly not enough. In this regard, MAKUKU's "omni-channel conquest" strategy has become the key.

1. TikTok

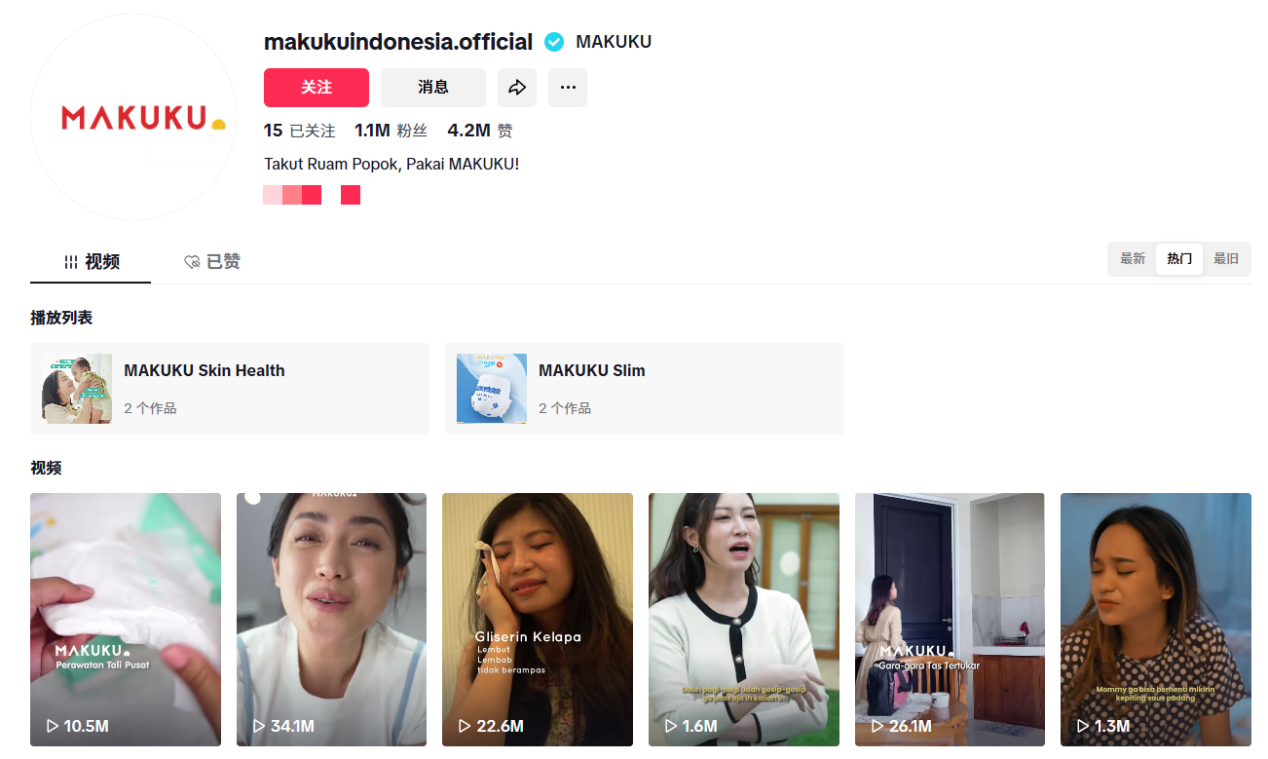

In terms of social media layout, MAKUKU mainly relies on TikTok traffic and has built a clearly positioned and functionally complementary account matrix, with different accounts planned according to their functions.

For example, the brand's main TikTok account @makukuindonesia.official focuses on products, building brand image and conveying product value through videos such as family sitcoms, product reviews, and core technology analysis.

As of July 2025, the account has accumulated 1.1 million followers, with an average video view count of 2.1 million, and viral videos reaching over 20 million views.

Image source: TikTok

On the basis of successfully building brand awareness and user interest with the main account, MAKUKU has also set up a live streaming account @makukuoffcialstore.id dedicated to sales conversion. The daily video content of this account mainly includes live broadcast previews, promotional activity introductions, and highlights from live broadcasts, aiming to warm up and attract traffic for upcoming live broadcasts.

According to statistics, this account has held 453 live broadcasts, with an average of over 9,000 viewers per session, contributing $496,700 in sales to the brand.

Live broadcast screen of the account Image source: TikTok

Of course, relying solely on the brand's self-operated accounts, the reach and influence are ultimately limited. To maximize coverage and trust endorsement, MAKUKU has simultaneously launched a large-scale influencer cooperation program.

According to information, the brand demonstrated strong execution in the early days of entering TikTok, cooperating with more than 500 Indonesian local influencers on average every month, including but not limited to beauty bloggers, full-time mothers, parenting experts, etc.

So far, MAKUKU has cooperated with more than 2,500 TikTok influencers in the TikTok Indonesia shop alone, with a total of over 10,300 videos published, creating a total sales of 7.31 million US dollars.

Image source: echotik

2. Independent site

When social media traffic is converted into initial users, MAKUKU has built its independent site as a "anchor point" of brand trust. Its core strategy focuses on localized experience, such as creating the "Hear What Our Customers Say" section, using real feedback from local consumers as endorsements to lower consumers' decision-making threshold and strengthen sales conversion.

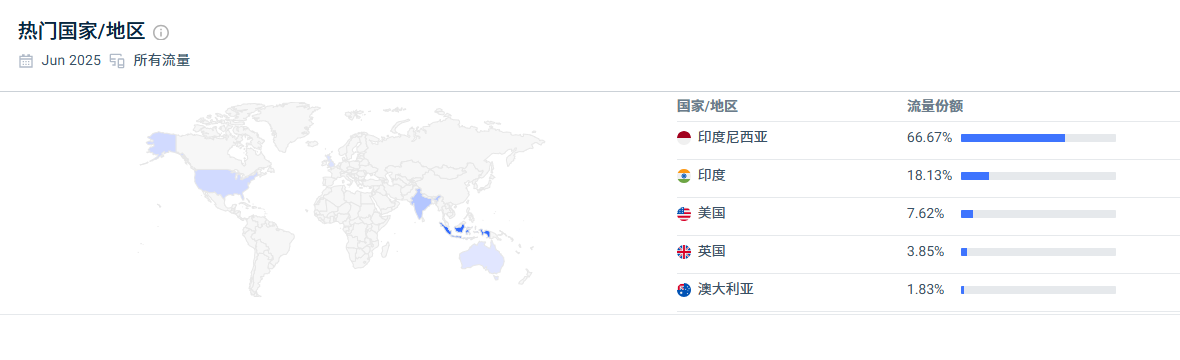

Data shows that MAKUKU's independent site has an average monthly visit of about 59,000, of which 66.67% of the traffic comes from Indonesia, confirming the effectiveness of product localization adaptation.

Image source: similarweb

3. Online and offline synergy

Faced with the unique safety sensitivity of mother and baby products, MAKUKU has built a trust closed loop with "online exposure and traffic + offline experience conversion."

The traffic from platforms such as TikTok not only drives online sales, but also feeds back to offline channels. Research shows that more than 20% of offline consumers' first awareness of the brand comes from TikTok content.

And more than 10,000 offline distribution outlets (mother and baby stores, supermarket counters) have become physical touchpoints for product experience, especially covering third- and fourth-tier cities with low e-commerce penetration, solving consumers' trust concerns about "invisible and intangible" online goods.

Image source: MAKUKU official website

Conclusion

The growth of the MAKUKU brand in Southeast Asia confirms a simple truth: there is no shortcut to going global. Behind success is a deep insight into local needs and a consistent commitment to product strength.

For many Chinese companies seeking overseas opportunities, the current overseas market, especially the vibrant emerging markets, still offers broad opportunities. The key is whether you can let go of the illusion of "making quick money," truly settle down, understand the real life and pain points of consumers on that land, and serve them with solid products and innovative methods.

This road may not be smooth, but when a brand chooses to stand with users and cultivate with heart, the world of the overseas market will naturally be broad.